ICICI Bank 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F33

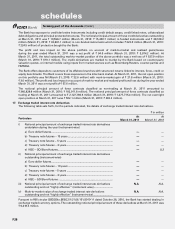

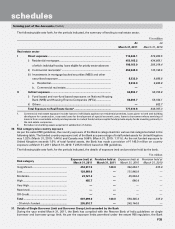

(II) Sector-wise NPAs

Sr.

no. Sector Percentage of NPAs to total

advances in that sector

At

March 31, 2011 At

March 31, 2010

Gross Net Gross Net

1. Agriculture and allied activities1 ........................................... 7.61% 3.00% 5.62% 3.05%

2. Industry (Micro & small, medium and large) ........................ 2.10% 0.77% 2.37% 1.19%

3. Services ................................................................................. 1.76% 0.51% 2.60% 1.16%

4. Personal loans2 ...................................................................... 9.84% 1.83% 9.02% 3.34%

Total ....................................................................................... 4.47% 1.11% 5.06% 2.12%

1. Represents loans towards agriculture and allied activities that qualify for priority sector lending.

2. Excludes retail loans towards agriculture and allied activities that qualify for priority sector lending. Excludes commercial

business loans, developer financing and dealer funding.

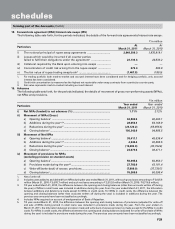

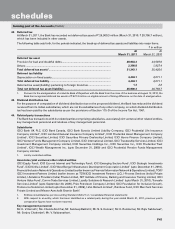

(III) Movement of NPAs

` in million

Particulars Year ended

March 31, 2011

Year ended

March 31, 2010

Opening balance of gross NPAs1 .............................................................. 94,806.5 96,493.1

Additions: fresh NPAs during the year2,3 ................................................... 28,656.3 64,168.9

Sub-total (A) ............................................................................................... 123,462.8 160,662.0

Less: ...........................................................................................................

i) Upgradations ....................................................................................... (7,581.6) (6,655.9)

ii) Recoveries (excluding recoveries made from upgraded accounts) . (13,670.1) (24,183.1)

iii) Write-offs ............................................................................................. (1,868.5) (35,016.5)

Sub-total (B) .............................................................................................. (23,120.2) (65,855.5)

Closing balance of gross NPAs1 (A-B) ..................................................... 100,342.6 94,806.5

1. Net of write-off.

2. Includes cases added to and deleted from NPAs during the year ended March 31, 2011, with such gross loans amounting to

` 5,025.8 million (March 31, 2010: ` 9,970.7 million).

3. Till year ended March 31, 2010, the difference between the opening and closing balances (other than accounts written off

during the year) of NPAs in retail loans was included in additions during the year. From the year ended March 31, 2011, the

bifurcation between additions and deletions is made except for NPAs in credit cards. For NPAs in credit cards, the difference

between the opening and closing balances (other than accounts written off during the year) is included in additions during

the year. The previous year amounts have been reclassified accordingly.

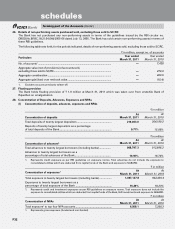

(IV) Overseas assets, NPAs and revenue

` in million

Particulars At

March 31, 2011

At

March 31, 2010

Total assets1 ............................................................................................... 697,435.3 611,827.7

Total NPAs (net)2 ........................................................................................ 981.1 1,593.3

Total revenue1 ............................................................................................ 39,309.8 44,598.1

1. Represents the total assets and total revenue of foreign operations as reported in Schedule 18 of the financial statements.

2. As per RBI guidelines.

(V) Off-balance sheet special purpose vehicles (SPVs) sponsored (which are required to be consolidated as per

accounting norms)

(a) The following table sets forth, the names of SPVs/trusts sponsored by the Bank/subsidiaries which are consolidated:

Sr.

No. Name of the SPV sponsored1

A. Domestic

1. ICICI Eco-net Internet and Technology Fund

2. ICICI Equity Fund

3. ICICI Emerging Sectors Fund

4. ICICI Strategic Investments Fund

5. ICICI Venture Value Fund

B. Overseas

None

1. The nature of business of the above entities is given in significant accounting policies (Schedule 17) in the consolidated

notes to accounts to consolidated financial statements.

forming part of the Accounts (Contd.)

schedules