ICICI Bank 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

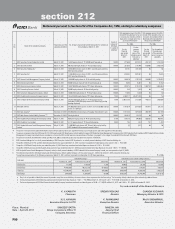

F44

Income on custodial services

During the year ended March 31, 2011, the Bank recovered custodial charges from its subsidiaries amounting to ` 1.6

million (March 31, 2010: ` 1.6 million) and from its associates/joint ventures/other related entities amounting to ` 2.6 million

(March 31, 2010: ` 3.3 million). The material transactions for the year ended March 31, 2011 were with ICICI Securities

Primary Dealership Limited amounting to ` 1.6 million (March 31, 2010: ` 1.5 million), ICICI Strategic Investments Fund

amounting to ` 0.9 million (March 31, 2010: ` 1.1 million), ICICI Equity Fund amounting to ` 0.5 million (March 31, 2010:

` 0.8 million) and with ICICI Emerging Sectors Fund amounting to ` 0.9 million (March 31, 2010: ` 1.3 million).

Interest expenses

During the year ended March 31, 2011, the Bank paid interest to its subsidiaries amounting to ` 560.7 million

(March 31, 2010: ` 902.2 million), to its associates/joint ventures/other related entities amounting to ` 79.7 million

(March 31, 2010: ` 3.3 million), to its key management personnel amounting to ` 1.5 million (March 31, 2010: ` 2.5

million) and to relatives of key management personnel amounting to ` 0.7 million (March 31, 2010: ` 1.2 million).

The material transactions for the year ended March 31, 2011 were with ICICI Prudential Life Insurance Company

Limited amounting to ` 272.5 million (March 31, 2010: ` 420.4 million), ICICI Securities Limited amounting to ` 157.2

million (March 31, 2010: ` 159.3 million), ICICI Bank Eurasia Limited Liability Company amounting to ` 11.3 million

(March 31, 2010: ` 146.8 million) and to Mewar Aanchalik Gramin Bank amounting to ` 69.7 million.

Interest income

During the year ended March 31, 2011, the Bank received interest from its subsidiaries amounting to ` 1,579.1 million

(March 31, 2010: ` 1,588.0 million), from its associates/joint ventures/other related entities amounting to ` 4.8 million

(March 31, 2010: ` 2.9 million), from its key management personnel amounting to ` 0.4 million (March 31, 2010: ` 0.5

million) and from relatives of key management personnel amounting to ` 0.7 million (March 31, 2010: ` 1.0 million). The

material transactions for the year ended March 31, 2011 were with ICICI Home Finance Company Limited amounting to

` 1,127.7 million (March 31, 2010: ` 913.7 million) and with ICICI Bank Eurasia Limited Liability Company amounting to

` 166.4 million (March 31, 2010: ` 351.0 million).

Other income

The Bank undertakes derivative transactions with its subsidiaries, associates, joint ventures and other related entities.

The Bank manages its foreign exchange and interest rate risks arising from these transactions by covering them in the

market. During the year ended March 31, 2011, the net loss of the Bank on forex and derivative transactions entered

into with subsidiaries was ` 121.9 million (March 31, 2010: loss of ` 17,346.2 million) and the net gain/loss was Nil

(March 31, 2010: loss of ` 220.9 million) with its associates/joint ventures/other related entities. The material transactions

for the year ended March 31, 2011 were loss of ` 13.9 million (March 31, 2010: loss of ` 17,913.1 million) with ICICI

Bank Canada, loss of ` 167.5 million (March 31, 2010: gain of ` 495.2 million) with ICICI Bank UK PLC, loss of ` 64.1

million (March 31, 2010: gain of ` 215.8 million) with ICICI Home Finance Company Limited, gain of ` 371.7 million

(March 31, 2010: loss of ` 50.7 million) with ICICI Securities Primary Dealership Limited and loss of ` 248.1 million

(March 31, 2010: loss of ` 93.4 million) with ICICI Bank Eurasia Limited Liability Company. While the Bank within its

overall position limits covers these transactions in the market, the above amounts represent only the transactions with

its subsidiaries, associates, joint ventures and other related entities and not the offsetting/covering transactions.

Dividend income

During the year ended March 31, 2011, the Bank received dividend from its subsidiaries amounting to ` 4,113.5 million

(March 31, 2010: ` 3,692.7 million). The material transactions for the year ended March 31, 2011 were with ICICI Home

Finance Company Limited amounting to ` 1,499.8 million (March 31, 2010: ` 934.0 million), ICICI Securities Limited

amounting to ` 810.0 million (March 31, 2010: ` 920.0 million), ICICI Securities Primary Dealership Limited amounting

to ` 250.1 million (March 31, 2010: ` 422.1 million), ICICI Lombard General Insurance Company Limited amounting to

` 416.6 million (March 31, 2010: ` 476.1 million), ICICI Venture Funds Management Company Limited amounting to

` 450.0 million (March 31, 2010: ` 260.0 million) and with ICICI Prudential Asset Management Company Limited amounting

to ` 229.6 million (March 31, 2010: ` 409.6 million).

Dividend paid

During the year ended March 31, 2011, the Bank paid dividend to its key management personnel amounting to

` 4.2 million (March 31, 2010: ` 4.5 million). The dividend paid during the year ended March 31, 2011 to Ms. Chanda

Kochhar was ` 3.2 million (March 31, 2010: ` 3.0 million), to Mr. Sandeep Bakhshi was ` 0.04 million (March 31, 2010:

` 0.03 million), to Mr. N. S. Kannan was ` 1.0 million (March 31, 2010: ` 0.9 million), to Mr. K. Ramkumar was Nil

(March 31, 2010: ` 0.2 million) and to Mr. Sonjoy Chatterjee was Nil (March 31, 2010: ` 0.3 million).

Remuneration to whole-time directors

Remuneration paid to the whole-time directors of the Bank during the year ended March 31, 2011 was ` 79.6 million

(March 31, 2010: ` 119.4 million). The remuneration paid for the year ended March 31, 2010 to Mr. K. V. Kamath was

forming part of the Accounts (Contd.)

schedules