ICICI Bank 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F69

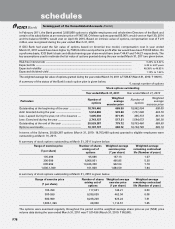

Superannuation fund

ICICI Bank contributes 15.00% of the total annual basic salary of certain employees to a superannuation fund for ICICI Bank

employees. The employee gets an option on retirement or resignation to commute one-third of the total credit balance in his/

her account and receive a monthly pension based on the remaining balance. In the event of death of an employee, his or her

beneficiary receives the remaining accumulated balance. ICICI Bank also gives cash option to its employees, allowing them to

receive the amount contributed by ICICI Bank in their monthly salary during their employment. In that event, the employee does

not receive any superannuation benefit on retirement/resignation from services of the Bank.

Upto March 31, 2005, the superannuation fund was administered solely by Life Insurance Corporation of India. Subsequent to

March 31, 2005, both Life Insurance Corporation of India and ICICI Prudential Life Insurance Company Limited are administering

separate funds. Employees have the option to decide on an annual basis, the insurance company for management of that

year’s contribution towards superannuation fund.

ICICI Prudential Life Insurance Company, ICICI Prudential Asset Management Company and ICICI Venture Funds Management

Company have accrued for superannuation liability based on a percentage of basic salary payable to eligible employees for the

period of service.

Pension

The Bank provides for pension, a deferred retirement plan covering certain employees of erstwhile Bank of Madura, erstwhile

Sangli Bank and erstwhile Bank of Rajasthan. The plan provides for a pension payment on a monthly basis to these employees

on their retirement based on the respective employee’s years of service with the Bank and applicable salary. For erstwhile Bank

of Madura, erstwhile Sangli Bank and erstwhile Bank of Rajasthan employees in service, separate pension funds are managed

in-house and the liability is funded as per actuarial valuation. The pension payments to retired employees of erstwhile Bank

of Madura and erstwhile Sangli Bank are being administered by ICICI Prudential Life Insurance Company Limited and pension

payments to retired employees of erstwhile Bank of Rajasthan are being administered by LIC and ICICI Prudential Life Insurance

Company Limited for whom the Bank has purchased master annuity policies. Employees covered by the pension plan are not

eligible for benefits under the provident fund plan.

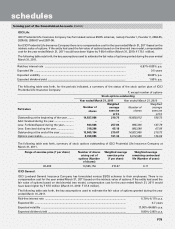

Provident fund

The Group is statutorily required to maintain a provident fund as a part of retirement benefits to its employees. There are

separate provident funds for employees inducted from erstwhile Bank of Madura, erstwhile Sangli Bank, erstwhile Bank of

Rajasthan and for other employees of ICICI Bank. In-house trustees manage these funds. Each employee contributes a specified

portion of the basic salary and the Group contributes an equal amount. The funds are invested according to the rules prescribed

by the Government of India.

Leave encashment

The Group provides for leave encashment benefit, which is a defined benefit scheme, based on actuarial valuation conducted

by an independent actuary.

11. Provisions, contingent liabilities and contingent assets

The Group estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of information

available upto the date on which the consolidated financial statements are prepared. A provision is recognised when an

enterprise has a present obligation as a result of a past event and it is probable that an outflow of resources will be required

to settle the obligation, in respect of which a reliable estimate can be made. Provisions are determined based on management

estimate required to settle the obligation at the balance sheet date, supplemented by experience of similar transactions.

These are reviewed at each balance sheet date and adjusted to reflect the current management estimates. In cases where

the available information indicates that the loss on the contingency is reasonably possible but the amount of loss cannot be

reasonably estimated, a disclosure to this effect is made in the consolidated financial statements. In case of remote possibility,

neither provision nor disclosure is made in the consolidated financial statements. The Group does not account for or disclose

contingent assets, if any.

12. Cash and cash equivalents

Cash and cash equivalents include cash in hand, balances with RBI, balances with other banks and money at call and short notice.

13. Investments

i) Investments of the Bank are accounted for in accordance with the extant RBI guidelines on investment classification and

valuation as given below.

a) All investments are classified into ‘Held to Maturity’, ‘Available for Sale’ and ‘Held for Trading’. Reclassifications, if

any, in any category are accounted for as per the RBI guidelines.

Under each classification, the investments are further classified as (a) government securities, (b) other approved

securities, (c) shares, (d) bonds and debentures and (e) others.

b) ‘Held to Maturity’ securities are carried at their acquisition cost or at amortised cost, if acquired at a premium over

the face value. Any premium over the face value of fixed rate and floating rate securities acquired is amortised over

the remaining period to maturity on a constant yield basis and straight line basis respectively.

c) ‘Available for Sale’ and ‘Held for Trading’ securities are valued periodically as per RBI guidelines.

Any premium over the face value of fixed rate and floating rate investments in government securities,

classified as ‘Available for Sale’, is amortised over the remaining period to maturity on constant yield basis

and straight line basis respectively. Quoted investments are valued based on the trades/quotes on the recognised

stock exchanges, subsidiary general ledger account transactions, price list of RBI or prices declared

forming part of the Consolidated Accounts (Contd.)

schedules