ICICI Bank 2011 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F84

forming part of the Consolidated Accounts (Contd.)

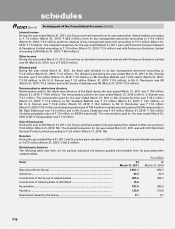

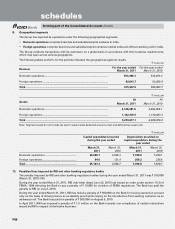

Experience adjustment

Particulars

Year ended

March 31,

2011

Year ended

March 31,

2010

Year ended

March 31,

2009

Year ended

March 31,

2008

Year ended

March 31,

2007

Plan assets .......................................................... 5,855.8 3,073.2 2,521.7 1,712.6 1,011.3

Defined benefit obligations ................................ 5,943.4 3,089.6 2,813.8 2,287.2 1,352.2

Amount not recognised as an asset (limit in para

59(b) of AS 15 on ‘employee benefits’) ............. –47.9 7.9 – –

Surplus/(deficit) .................................................. (87.7) (64.3) (300.0) (574.6) (340.9)

Experience adjustment on plan assets ............... (90.5) 194.8 (149.3) (4.0) (13.6)

Experience adjustment on plan liabilities ........... (72.8) (21.2) (22.3) (29.2) 69.5

The estimates of future salary increases, considered in actuarial valuation, take into consideration inflation, seniority, promotion

and other relevant factors.

The guidance on implementing AS 15 on ‘employee benefits’ (revised 2005) issued by the Accounting Standards Board (ASB)

provides that exempt provident funds which require employers to meet the interest shortfall are in effect defined benefit

plans. The Group’s actuary has informed that it is not practical to actuarially determine the interest shortfall obligation.

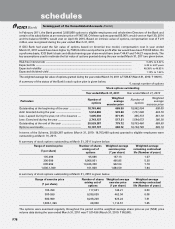

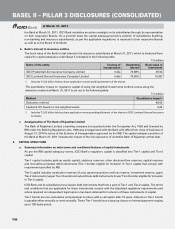

10. Provision for income tax

The provision for income tax (including deferred tax) for the year ended March 31, 2011 amounted to ` 20,684.9 million

(March 31, 2010: ` 17,321.8 million).

The Group has a comprehensive system of maintenance of information and documents required by transfer pricing legislation

under sections 92-92F of the Income Tax Act, 1961. The management is of the opinion that all international transactions are

at arm’s length so that the above legislation will not have material impact on the financial statements.

11. Deferred tax

At March 31, 2011 the Group has recorded net deferred tax asset of ` 29,936.7 million (March 31, 2010: ` 24,842.1 million),

which has been included in other assets.

The following table sets forth, for the periods indicated, the break-up of deferred tax assets and liabilities into major items.

Particulars At

March 31, 2011

At

March 31, 2010

Deferred tax asset

Provision for bad and doubtful debts .................................................................. 29,506.7 24,052.8

Others ................................................................................................................... 4,972.1 5,503.0

Total deferred tax asset1 ...................................................................................... 34,478.8 29,555.8

Deferred tax liability

Depreciation on fixed assets ................................................................................ 4,496.2 4,712.6

Others ................................................................................................................... 63.6 86.5

Total deferred tax liability ................................................................................... 4,559.8 4,799.1

Add: Net deferred tax asset/(liability) pertaining to

foreign branches/foreign subsidiaries ................................................................ 17.7 85.4

Total net deferred tax asset/(liability) ................................................................. 29,936.7 24,842.1

` in million

1. Pursuant to the amalgamation of erstwhile Bank of Rajasthan with the Bank from the close of business at August 12, 2010, the Bank

has recognised deferred tax asset of ` 827.3 million on eligible amount of timing difference on the date of amalgamation.

` in million

schedules