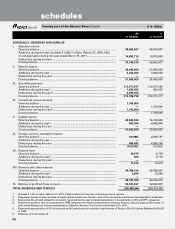

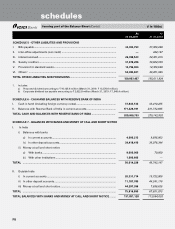

ICICI Bank 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

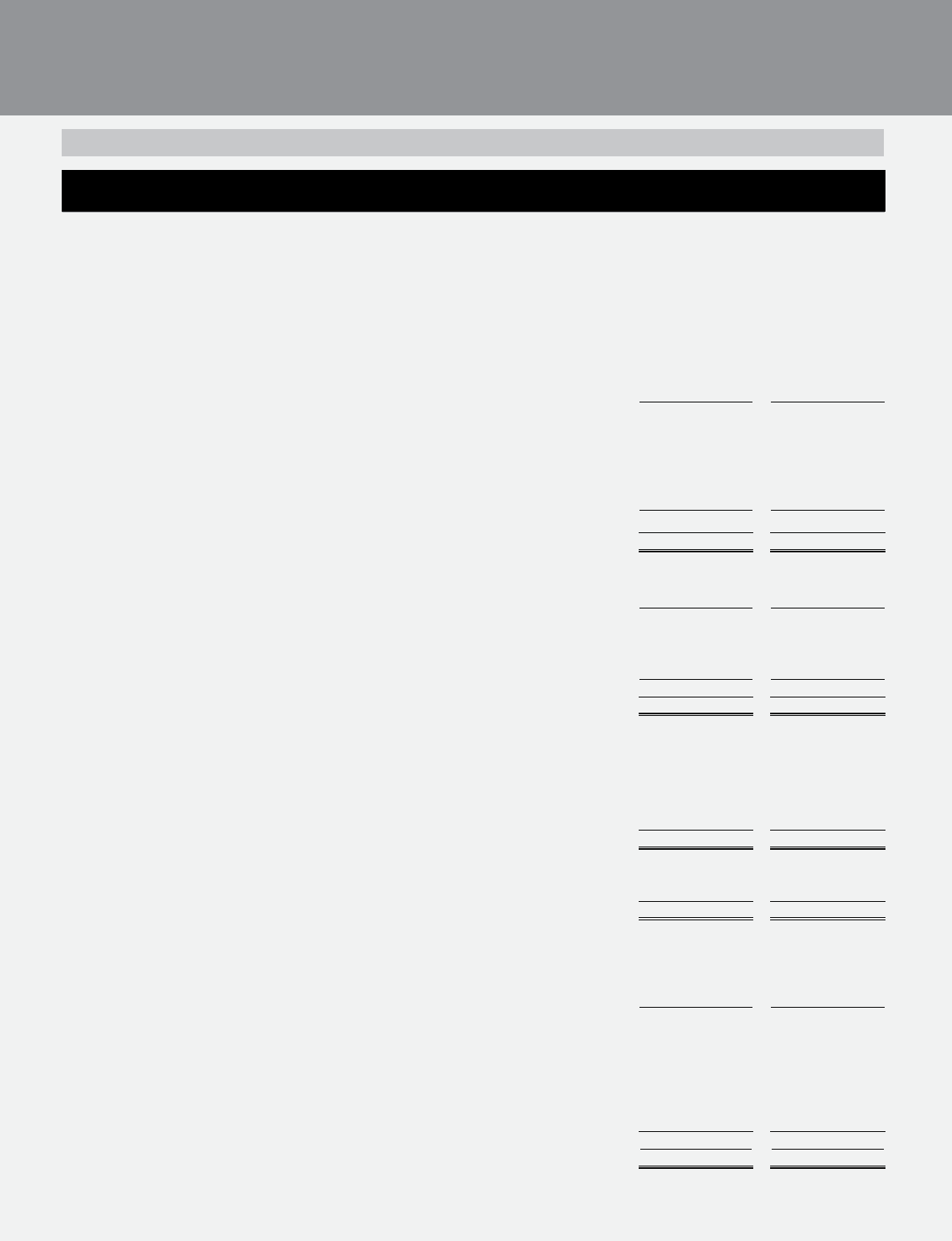

F9

At

31.03.2011

At

31.03.2010

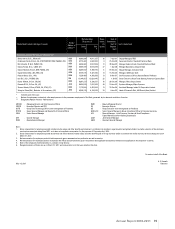

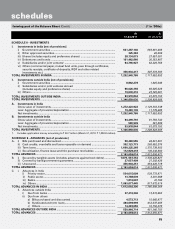

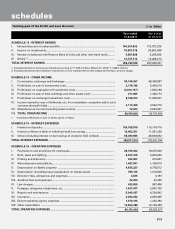

SCHEDULE 8 - INVESTMENTS

I. Investments in India [net of provisions]

i) Government securities ........................................................................................ 641,287,140 683,991,406

ii) Other approved securities ................................................................................... 325,363 45,009

iii) Shares (includes equity and preference shares) ............................................... 28,134,073 27,557,381

iv) Debentures and bonds ....................................................................................... 161,462,866 36,353,907

v) Subsidiaries and/or joint ventures1 ..................................................................... 64,796,927 62,226,766

vi) Others (commercial paper, mutual fund units, pass through certificates,

security receipts, certificate of deposits, RIDF and other related

investments etc.) ................................................................................................. 356,934,417 307,378,383

TOTAL INVESTMENTS IN INDIA ...................................................................................... 1,252,940,786 1,117,552,852

II. Investments outside India [net of provisions]

i) Government securities ........................................................................................ 8,862,278 1,645,046

ii) Subsidiaries and/or joint ventures abroad

(includes equity and preference shares) ............................................................ 66,026,356 66,005,026

iii) Others ................................................................................................................... 19,030,210 23,725,081

TOTAL INVESTMENTS OUTSIDE INDIA .......................................................................... 93,918,844 91,375,153

TOTAL INVESTMENTS ...................................................................................................... 1,346,859,630 1,208,928,005

A. Investments in India

Gross value of investments ....................................................................................... 1,272,423,922 1,129,332,338

Less: Aggregate of provision/depreciation ............................................................... 19,483,136 11,779,486

Net investments.......................................................................................................... 1,252,940,786 1,117,552,852

B. Investments outside India

Gross value of investments ....................................................................................... 94,499,793 91,756,742

Less: Aggregate of provision/depreciation ............................................................... 580,949 381,589

Net investments.......................................................................................................... 93,918,844 91,375,153

TOTAL INVESTMENTS ...................................................................................................... 1,346,859,630 1,208,928,005

1. Includes application money amounting to ` 50.7 million (March 31, 2010: ` 1,000.0 million).

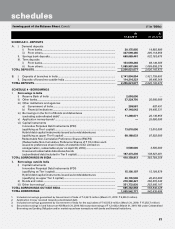

SCHEDULE 9 - ADVANCES [net of provisions]

A. i) Bills purchased and discounted .......................................................................... 58,480,555 44,531,591

ii) Cash credits, overdrafts and loans repayable on demand ................................ 302,123,773 255,552,276

iii) Term loans ............................................................................................................ 1,690,225,268 1,375,739,502

iv) Securitisation, finance lease and hire purchase receivables ............................ 112,829,418 136,232,602

TOTAL ADVANCES ............................................................................................................ 2,163,659,014 1,812,055,971

B. i) Secured by tangible assets (includes advances against book debts) ............... 1,679, 661,354 1,336,426,827

ii) Covered by bank/government guarantees ......................................................... 27,057,409 21,202,426

iii) Unsecured ............................................................................................................ 456,940,251 454,426,718

TOTAL ADVANCES ............................................................................................................ 2,163,659,014 1,812,055,971

C. I. Advances in India

i) Priority sector ................................................................................................ 534,015,609 539,773,871

ii) Public sector .................................................................................................. 13,788,639 3,201,088

iii) Banks ............................................................................................................. 1,810,607 41,790

iv) Others ............................................................................................................ 1,063,077,445 817,672,519

TOTAL ADVANCES IN INDIA ............................................................................................ 1,612,692,300 1,360,689,268

II. Advances outside India

i) Due from banks ............................................................................................ 37,410,346 13,515,963

ii) Due from others

a) Bills purchased and discounted ............................................................. 4,572,713 15,060,877

b) Syndicated and term loans ..................................................................... 494,699,999 412,037,485

c) Others ...................................................................................................... 14,283,656 10,752,378

TOTAL ADVANCES OUTSIDE INDIA ................................................................................ 550,966,714 451,366,703

TOTAL ADVANCES ............................................................................................................ 2,163,659,014 1,812,055,971

(` in ‘000s)

forming part of the Balance Sheet (Contd.)

schedules