ICICI Bank 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

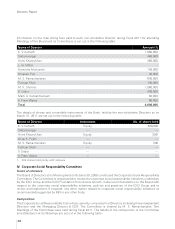

Shareholders of ICICI Bank with more than one per cent holding at March 31, 2011

Name of the Shareholder No. of shares % to total no.

of shares

Deutsche Bank Trust Company Americas (Depositary for ADS holders) 310,840,032 26.99

Life Insurance Corporation of India 107,847,146 9.36

Allamanda Investments Pte. Limited 57,586,922 5.00

Government of Singapore 17,152,264 1.49

Aberdeen Asset Managers Limited A/c Aberdeen International India

Opportunities Fund (Mauritius) Limited

17,080,000 1.48

New Perspective Fund.INC. 17,072,207 1.48

Europacific Growth Fund 16,981,777 1.47

Carmignac Geston A/c Carmignac Patrimone 13,900,000 1.21

Bajaj Allianz Life Insurance Company Limited 13,831,757 1.20

Abu Dhabi Investment Authority - Gulab 13,018,858 1.13

IVY Funds Inc Asset Strategy Fund 12,667,088 1.10

Bajaj Holdings and Investments Limited 12,176,817 1.06

Total 610,154,868 52.97

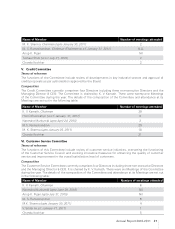

Distribution of shareholders of ICICI Bank at March 31, 2011

Range - Shares No. of Folios % No. of Shares %

Upto 1,000 663,805 99.07 47,657,274 4.14

1,001 to 5,000 4,271 0.64 8,563,592 0.74

5,001 – 10,000 502 0.07 3,523,231 0.31

10,001 – 50,000 650 0.10 15,904,277 1.38

50,001 & above 782 0.12 1,076,123,998 93.43

Total 670,010 100.00 1,151,772,372 100.00

Disclosure with respect to shares lying in suspense account

Particulars Shareholders Shares

Aggregate number of shareholders and the outstanding shares in the

suspense account lying at the beginning of the year 701 38,251

Number of shareholders who approached ICICI Bank for transfer of shares

from suspense account during the year 65 3,958

Number of shareholders to whom shares were transferred from suspense

account during the year 63 3,910

Aggregate number of shareholders and the outstanding shares in the

suspense account lying at the end of the year 638 34,341

The voting rights on the shares lying in suspense account are frozen till the rightful owner of such shares

claims the shares.

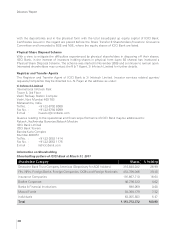

Outstanding GDRs/ADSs/Warrants or any Convertible Debentures, conversion date and likely impact

on equity

ICICI Bank has 155.42 million ADS (equivalent to 310.84 million equity shares) outstanding, which constituted

26.99% of ICICI Bank’s total equity capital at March 31, 2011. Currently, there are no convertible debentures

outstanding.

Annual Report 2010-2011 29