ICICI Bank 2011 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F106

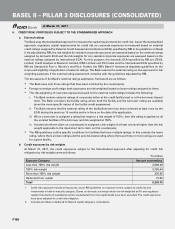

6. CREDIT RISK: PORTFOLIOS SUBJECT TO THE STANDARDISED APPROACH

a. External ratings

The Bank uses the standardised approach to measure the capital requirements for credit risk. As per the standardised

approach, regulatory capital requirements for credit risk on corporate exposures is measured based on external

credit ratings assigned by External Credit Assessment Institutions (ECAI) specified by RBI in its guidelines on Basel

II. As stipulated by RBI, the risk weights for resident corporate exposures are assessed based on the external ratings

assigned by domestic ECAI and the risk weights for non-resident corporate exposures are assessed based on the

external ratings assigned by international ECAI. For this purpose, the domestic ECAI specified by RBI are CRISIL

Limited, Credit Analysis & Research Limited, ICRA Limited and Fitch India and the international ECAI specified by

RBI are Standard & Poor’s, Moody’s and Fitch. Further, the RBI’s Basel II framework stipulates guidelines on the

scope and eligibility of application of external ratings. The Bank reckons the external rating on the exposure for risk

weighting purposes, if the external rating assessment complies with the guidelines stipulated by RBI.

The key aspects of the Bank’s external ratings application framework are as follows:

• The Bank uses only those ratings that have been solicited by the counterparty.

• Foreign sovereign and foreign bank exposures are risk-weighted based on issuer ratings assigned to them.

• The risk-weighting of corporate exposures based on the external credit ratings includes the following:

i. The Bank reckons external ratings of corporates either at the credit facility level or at the borrower (issuer)

level. The Bank considers the facility rating where both the facility and the borrower rating are available

given the more specific nature of the facility credit assessment.

ii. The Bank ensures that the external rating of the facility/borrower has been reviewed at least once by the

ECAI during the previous 15 months and is in force on the date of its application.

iii. When a borrower is assigned a rating that maps to a risk weight of 150%, then this rating is applied on all

the unrated facilities of the borrower and risk weighted at 150%.

iv. Unrated short-term claim on counterparty is assigned a risk weight of at least one level higher than the risk

weight applicable to the rated short term claim on that counterparty.

• The RBI guidelines outline specific conditions for facilities that have multiple ratings. In this context, the lower

rating, where there are two ratings and the second-lowest rating where there are three or more ratings are used

for a given facility.

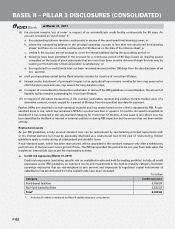

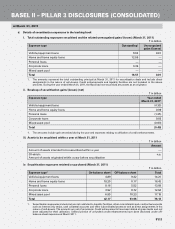

b. Credit exposures by risk weights

At March 31, 2011, the credit exposures subject to the Standardised approach after adjusting for credit risk

mitigation by risk weights were as follows:

` in billion

Exposure Category Amount outstanding1

Less than 100% risk weight 2,089.30

100% risk weight 3,756.44

More than 100% risk weight 326.95

Deducted from capital 37.06

Total2 6,209.75

1. Credit risk exposures include all exposures, as per RBI guidelines on exposure norms, subject to credit risk and

investments in held-to-maturity category. Claims on domestic sovereign which are risk-weighted at 0% and regulatory

capital instruments of subsidiaries which are deducted from the capital funds have been excluded. The credit exposures

have been adjusted for credit risk mitigation.

2. Includes all entities considered for Basel II capital adequacy computation.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2011