ICICI Bank 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F38

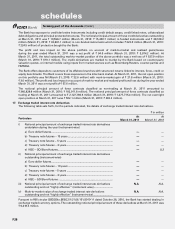

37. Transfer of merchant acquiring operations

During the year ended March 31, 2010, the Bank and First Data, a global company engaged in electronic commerce and

payment services, formed a merchant acquiring alliance and a new entity, 81.0% owned by First Data, was formed, which

has acquired ICICI Bank’s merchant acquiring operations through transfer of assets, primarily comprising fixed assets

and receivables, and assumption of liabilities, for a total consideration of ` 3,744.0 million. This transfer of assets and

liabilities to the new entity would be considered a ‘slump sale’ for tax purposes. The Bank realised a profit of ` 2,029.0

million from this transaction, which is included in Schedule 14 - “Other income” for the year ended March 31, 2010.

38. Staff retirement benefits

Pension

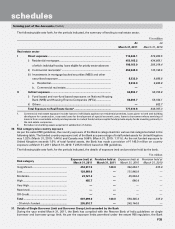

The following tables set forth, for the periods indicated, reconciliation of opening and closing balance of the present

value of the defined benefit obligation for pension benefits.

` in million

Particulars Year ended

March 31, 2011

Year ended

March 31, 2010

Opening obligations ............................................................................................ 1,748.7 1,932.2

Service cost .......................................................................................................... 170.8 51.8

Interest cost .......................................................................................................... 457.8 134.5

Actuarial (gain)/loss .............................................................................................. 607.0 (32.1)

Liabilities extinguished on settlement ................................................................. (460.0) (287.7)

Addition due to amalgamation ............................................................................ 6,479.0 —

Benefits paid ......................................................................................................... (160.4) (50.0)

Obligations at the end of year ............................................................................ 8,842.9 1,748.7

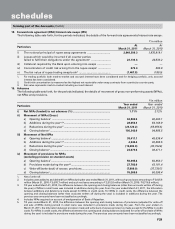

Opening plan assets, at fair value ...................................................................... 1,839.9 2,145.3

Expected return on plan assets ........................................................................... 156.5 169.9

Actuarial gain/(loss) .............................................................................................. 69.1 (130.7)

Assets distributed on settlement ......................................................................... (511.1) (322.6)

Contributions ........................................................................................................ 6,094.6 28.0

Addition due to amalgamation ............................................................................ 978.8 —

Benefits paid ......................................................................................................... (160.4) (50.0)

Closing plan assets, at fair value ........................................................................ 8,467.4 1,839.9

Fair value of plan assets at the end of the year .................................................. 8,467.4 1,839.9

Present value of the defined benefit obligations at the end of the year ............ 8,842.9 1,748.7

Amount not recognised as an asset (limit in Para 59(b)) .................................... —7.7

Asset/(liability)..................................................................................................... (375.5) 83.5

Cost for the year

Service cost .......................................................................................................... 170.8 51.8

Interest cost .......................................................................................................... 457.8 134.5

Expected return on plan assets ........................................................................... (156.5) (169.9)

Actuarial (gain)/loss .............................................................................................. 537.9 98.6

Curtailments & settlements (gain)/loss ................................................................ 51.1 34.9

Effect of the limit in para 59(b) ............................................................................. (7.7) (43.5)

Net cost ................................................................................................................ 1,053.4 106.4

Investment details of plan assets

Majority of the plan assets are invested in Government securities and corporate bonds

Assumptions

Interest rate ........................................................................................................... 8.10% 7.75%

Salary escalation rate: ..........................................................................................

On Basic Pay ......................................................................................................... 1.50% 7.00%

On Dearness Relief ............................................................................................... 7.00% 7.00%

Estimated rate of return on plan assets .............................................................. 8.00% 8.00%

forming part of the Accounts (Contd.)

schedules