ICICI Bank 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F73

schedules

forming part of the Consolidated Accounts (Contd.)

SCHEDULE 18

NOTES FORMING PART OF THE ACCOUNTS

The following additional disclosures have been made taking into account the requirements of Accounting Standards

(ASs) and Reserve Bank of India (RBI) guidelines in this regard.

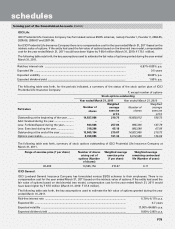

1. Amalgamation of The Bank of Rajasthan Limited

The Bank of Rajasthan Limited (Bank of Rajasthan), a banking company incorporated under the Companies Act, 1956

and licensed by RBI under the Banking Regulation Act, 1949 was amalgamated with the Bank with effect from close of

business of August 12, 2010 in terms of the Scheme of Amalgamation (the Scheme) approved by the RBI vide its order

DBOD No. PSBD 2603/16.01.128/2010-11 dated August 12, 2010 under sub section (4) of section 44A of the Banking

Regulation Act, 1949. The consideration for the amalgamation was 25 equity shares of ICICI Bank of the face value of

` 10 each fully paid-up for every 118 equity shares of ` 10 each of Bank of Rajasthan. Accordingly, ICICI Bank allotted

31,323,951 equity shares to the shareholders of Bank of Rajasthan on August 26, 2010 and 2,860,170 equity shares which

were earlier kept in abeyance pending civil appeal, on November 25, 2010.

ICICI Bank is also a banking company incorporated under the Companies Act, 1956 and licensed by RBI under the

Banking Regulation Act, 1949.

As per the Scheme, the undertaking of Bank of Rajasthan including all its assets and liabilities stood transferred/

deemed to be transferred to and vested in ICICI Bank as a going concern.

The amalgamation has been accounted for as per the Scheme. Accordingly, the assets and liabilities of Bank of Rajasthan

have been accounted at the values at which they were appearing in the books of Bank of Rajasthan at August 12, 2010 and

provisions were made for the difference between the book values appearing in the books of Bank of Rajasthan and the fair

value as determined by ICICI Bank. In the books of ICICI Bank, an amalgamation expenses provision account was credited

by an amount determined for the expenses and costs of the Scheme arising as a direct consequence on account of any

changes in the business or operations of Bank of Rajasthan proposed or considered necessary by the Board of Directors

of ICICI Bank (including but not limited to rationalisation, upgradation and enhancement of human resources and expenses

relating to modifying signage, modifying stationery, branding, changing systems and network, communication including

media costs, impairment of technology and fixed assets, conducting general meetings, payment of listing fees and other

statutory and regulatory charges, travel in relation to the consolidation contemplated in the Scheme, valuation, due diligence,

investment banking expenses and charges relating to preparation of the Scheme, consultations in relation to the consolidation

contemplated in the Scheme and training), and other extraordinary expenses on integration and consolidation under the

Scheme, to be incurred by ICICI Bank and the balance in such account has been debited to the securities premium account.

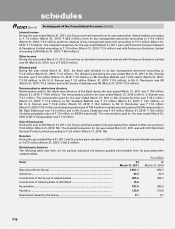

Accordingly, the excess of the paid up value of shares issued over the fair value of the net asset acquired (including Statutory

Reserves) of ` 1,440.1 million and amalgamation expenses of ` 657.8 million have been debited to the securities premium

account. The computation of this amount is detailed in the table below separately.

1. Includes ` 50.8 million received subsequent to August 12, 2010 against shares kept in abeyance pending civil appeal.

2. Net of provision for amalgamation expenses amounting to ` 32.2 million no longer required.

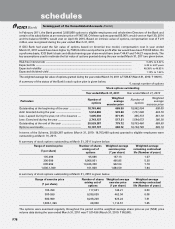

Particulars Amount Amount

34,184,121 equity shares of face value of ` 10 each issued to the

shareholders of Bank of Rajasthan ..................................................................... 341.8

Less:

Net assets of Bank of Rajasthan at August 12, 20101 ......................................... 3,608.0

Fair value adjustments ........................................................................................ (2,703.6)

Reserves taken over on amalgamation .............................................................. (2,002.7)

Total fair value of the net assets acquired (including Statutory Reserves) of

Bank of Rajasthan at August 12, 2010 ................................................................ (1,098.3)

Excess of paid-up value of equity shares issued over the fair value of the net

assets acquired .................................................................................................... 1,440.1

Amalgamation expenses2 .................................................................................... 657.8

` in million

As per the accounting done for amalgamation in terms of the Scheme, the identity of reserves of Bank of Rajasthan is not required

to be preserved in the books of ICICI Bank. However, the balance in Statutory Reserve Account of Bank of Rajasthan at August 12,

2010 has been added to the Statutory Reserves of ICICI Bank. As a result, the balance in Statutory Reserves is higher to the extent of

` 2,002.7 million. The excess of the paid up value of shares issued over the fair value of the net asset acquired (including Statutory

Reserves) and amalgamation expenses has been debited to the securities premium account of ICICI Bank. As a result, the balance

in the securities premium account is lower to the extent of ` 2,097.9 million.