ICICI Bank 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F81

forming part of the Consolidated Accounts (Contd.)

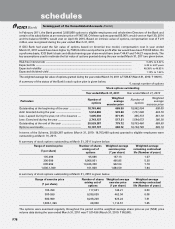

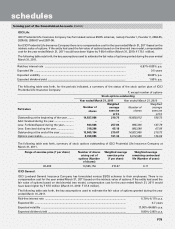

6.2 Assets under finance lease

The following table sets forth, for the periods indicated, the details of finance leases.

Particulars At

March 31, 2011

At

March 31, 2010

Future minimum lease receipts ......................................................................... 1,437.1 1,651.9

Present value of lease receipts .......................................................................... 6.8 17.4

Unmatured finance charges ............................................................................... 0.6 0.2

Total .................................................................................................................. 7.4 17.6

Maturity profile of future minimum lease receipts

- Not later than one year .................................................................................. 2.7 17.6

- Later than one year and not later than five years ......................................... 4.7 –

- Later than five years ....................................................................................... ––

Total .................................................................................................................. 7.4 17.6

` in million

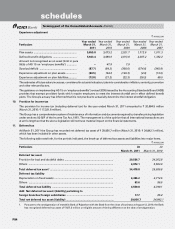

6.3 Maturity profile of present value of lease rentals

The following table sets forth, for the periods indicated, the details of maturity profile of present value of finance lease receipts.

Particulars At

March 31, 2011

At

March 31, 2010

Not later than one year ............................................................................................... 2.4 17.4

Later than one year and not later than five years ...................................................... 4.4 –

Later than five years .................................................................................................... – –

Total ............................................................................................................................. 6.8 17.4

` in million

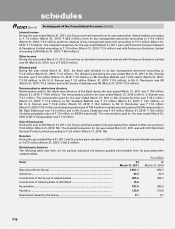

7. Preference shares

Certain government securities amounting to ` 2,563.8 million at March 31, 2011 (March 31, 2010: ` 2,405.2 million) have

been earmarked against redemption of preference share issued by the Bank, which fall due for redemption on April 20,

2018, as per the original issue terms.

8. Provisions and contingencies

The following table sets forth, for the periods indicated, the break-up of provisions and contingencies included in profit

and loss account.

Particulars Year ended

March 31, 2011

Year ended

March 31, 2010

Provision for depreciation of investments ................................................................. 3,162.7 328.2

Provision towards non-performing and other assets ................................................ 20,555.3 44,745.4

Provision towards income tax1 ................................................................................... 20,684.9 17,321.8

Provision towards wealth tax ...................................................................................... 30.2 30.5

Other provision and contingencies ............................................................................ 1,881.8 513.4

Total provisions and contingencies ........................................................................... 46,314.9 62,939.3

` in million

1. Net of creation of net deferred tax asset amounting to ` 4,441.6 million for the year ended March 31, 2011 (March 31, 2010: ` 2,349.8 million).

schedules