ICICI Bank 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

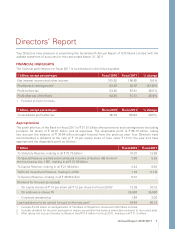

the previous year. The return on assets, or RoA,

improved substantially to 1.34% in fiscal 2011

from 1.13% in the previous year.

•The strong results achieved by the Bank

are reflected in the higher level of proposed

dividend of ` 14 per equity share compared to

` 12 per equity share in the previous year.

•The above growth and profitability was

achieved on the back of sustaining and

enhancing the improvements achieved in

key operating metrics. The proportion of

current and savings account deposits in

total deposits, which had already increased

from 28.7% at March 31, 2009 to 41.7% at

March 31, 2010, was further improved to 45.1% at

March 31, 2011. The net non-performing asset

ratio was reduced substantially from 1.87% at

March 31, 2010 to 0.94% at March 31, 2011.

The cost-to-asset ratio was contained at 1.7%

despite the expansion in the branch network

and increase in business volumes. The Bank’s

capital adequacy position continued to be very

strong, with total capital adequacy of 19.5% and

Tier-1 capital adequacy of 13.2%.

While executing our organic growth strategy, we

continued to focus on opportunities to further

strengthen our franchise and our platform for

capitalising on the growth opportunities in the

Indian economy. To this end, we undertook the

major strategic initiative of the merger of Bank of

Rajasthan with ICICI Bank during fiscal 2011. With

this merger, we created a combined network of

over 2,500 branches, substantially expanding our

presence not only in Rajasthan but also in other

major banking centres in the country. Following

receipt of regulatory approvals for the merger in

August 2010, we moved quickly to integrate the

Bank of Rajasthan franchise with ICICI Bank. We

have been able to achieve integration of human

resources and various aspects of operations

seamlessly in a short span of time. We believe

this provides us a powerful platform for pursuing

our objective of sustained profitable growth in the

coming years.

The ICICI Group has a unique diversified financial

services franchise in India, with leadership positions

across many segments of financial services. Our

non-banking businesses – insurance, securities,

asset management and private equity - continue

to build on their strong positions in their respective

businesses and realign their strategies to the

emerging market environment wherever required.

In fiscal 2011, we achieved a 30.5% increase in the

consolidated profit after tax, despite the impact

of regulatory changes and volatility in financial

markets on several businesses.

As the second-largest bank in India, we are also

conscious of our larger role in the growth and

development of the Indian economy. Our vision

encompasses not only participating in all aspects

of the Indian economy and its international

linkages, but also catalysing India’s growth.

We are executing a focused financial inclusion

plan-leveraging information & communications

technology and the enabling regulatory framework

to provide basic banking services to the unbanked.

Through the ICICI Foundation for Inclusive Growth,

we are seeking to improve the quality of school

education and primary healthcare in a number of

states, thereby playing our role in the strengthening

of the soft infrastructure that is critical to long-

term sustainable growth of our country. Through

our specialised technology finance practice, we

continue to support research & development in the

area of clean technology and energy efficiency to

mitigate climate change.

Looking ahead, we see strong fundamentals

driving sustained high growth in India for several

years to come. There would continue to be periodic

challenges on account of global developments,

volatility in capital flows, inflation and other

factors. However, the underlying momentum

of our demographic dividend and investment

potential will support robust growth over the long-

term. The ICICI Group therefore has a range of

growth opportunities across its businesses and

a strong platform to leverage these opportunities

and create value for its stakeholders. We are

committed to playing a proactive role in India’s

growth and also helping to achieve the national

goal of social & economic inclusion of the less

advantaged sections of our society.

We look forward to your continued support and

goodwill as we move forward.

With best wishes,

Chanda Kochhar

Annual Report 2010-2011 5