ICICI Bank 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

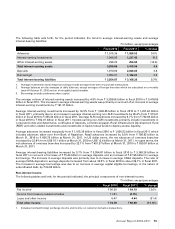

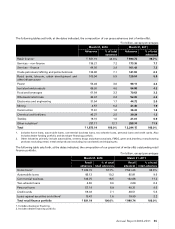

Non-interest income primarily includes fee and commission income, income from treasury-related activities and lease

and other income. During fiscal 2011, the decrease in non-interest income was primarily on account of a decrease in

income from treasury-related activities. During fiscal 2011, there was an increase in fee income and income by way of

dividends included in lease and other income. Overall there was a net decrease in non-interest income by 11.1% from

` 74.78 billion in fiscal 2010 to ` 66.48 billion in fiscal 2011.

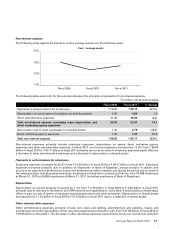

Fee income

Fee income primarily includes fees from corporate clients such as loan processing fees, transaction banking fees and

structuring fees and fees from retail customers such as loan processing fees, fees from credit cards business, account

service charges and third party referral fees. Fee income increased from ` 56.50 billion in fiscal 2010 to ` 64.19 billion

in fiscal 2011 primarily due to an increase in corporate fees, offset, in part, by decline in retail fees. Higher credit

demand and increased business activity in the corporate sector due to economic recovery resulted in an increase in

loan processing fees and transaction banking related fees from corporate clients.

Income from foreign exchange transactions with clients and from margins on derivatives transactions with clients

increased by 17.3% from ` 6.78 billion in fiscal 2010 to ` 7.95 billion in fiscal 2011.

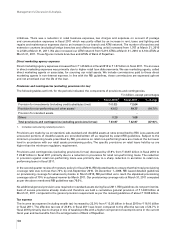

Profit/(loss) on treasury-related activities (net)

Income from treasury-related activities includes income from sale of investments and revaluation of investments

on account of changes in unrealised profit/(loss) in the fixed income, equity and preference share portfolio, units of

venture funds and security receipts.

Profit on treasury-related activities decreased from a gain of ` 11.81 billion in fiscal 2010 to a loss of ` 2.15 billion in

fiscal 2011. Treasury income for fiscal 2011 primarily includes loss on investments in government of India securities

and loss on security receipts, offset, in part, by gains on equity investments. The higher income from treasury-related

activities in fiscal 2010 included reversal of provision against credit derivatives due to softening of credit spreads,

higher profit on government of India securities and other fixed income instruments and in equity investments offset,

in part, by a loss on mark-to-market/realised loss on security receipts.

During fiscal 2010, we had capitalised on certain market opportunities to realise gains from sale of our government

and other domestic fixed income positions. During fiscal 2011, the government securities portfolio was impacted by

increase in interest rates which resulted in a loss for fiscal 2011 as compared to gains in fiscal 2010.

The equity markets remained volatile due to global and domestic developments including the political unrest in the

Middle East and concerns on global recovery due to possible impact on crude oil prices, and continued high levels of

inflation in India and resultant monetary tightening. These factors impacted market sentiment resulting in decline in

realised/unrealised profit on equity investments for fiscal 2011 as compared to fiscal 2010.

During fiscal 2010, softening of credit spreads had resulted in reversal of provision held against the credit derivatives

portfolio amounting to ` 3.97 billion. During fiscal 2011, there was a profit on credit derivatives portfolio amounting

to ` 0.15 billion.

At March 31, 2011, we had an outstanding net investment of ` 28.31 billion in security receipts issued by asset

reconstruction companies in relation to sale of non-performing assets. At the end of each reporting period, security

receipts issued by asset reconstruction companies are valued as per net asset value obtained from the asset

reconstruction company from time to time. During fiscal 2011, the impact of these security receipts on the income

from treasury-related activities was a loss of ` 2.31 billion compared to a loss of ` 2.12 billion in fiscal 2010.

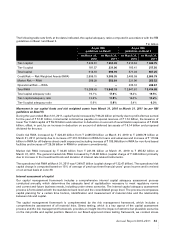

Lease and other income

Lease and other income primarily includes dividend from subsidiaries, lease rentals and profit on sale of fixed assets.

Lease and other income decreased from ` 6.47 billion in fiscal 2010 to ` 4.44 billion in fiscal 2011. During fiscal 2010, the

Bank and First Data, a global leader in electronic commerce and payment services, formed a merchant acquiring alliance

and a new entity, 81.0% owned by First Data. This entity acquired ICICI Bank’s merchant acquiring operations through

transfer of assets, primarily comprising fixed assets, receivables and payables, and assumption of liabilities, for a total

consideration of ` 3.74 billion. We realised a profit of ` 2.03 billion from this transaction in fiscal 2010.

Management’s Discussion & Analysis

56