ICICI Bank 2011 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F114

Risk management objectives

The Bank manages its market risk with the broad objectives of:

1. Management of market risk such as interest rate risk, currency risk, equity risk and credit spread risk arising

from the investments and derivatives portfolio.

2. Proper classification, valuation and accounting of investments and derivatives portfolio.

3. Adequate and proper reporting of investments and derivative products.

4. Compliance with regulatory requirements.

5. Effective control over the operation and execution of market related transactions.

Structure and organisation of the market risk management function

The Market Risk Management Group (MRMG), which is an independent function, reports to the Head - RMG. MRMG

exercises independent control over the process of market risk management and recommends changes in policies

and methodologies for measuring market risk.

To comply with the home and host country regulatory guidelines and to have independent control groups there is

clear functional separation of:

• Trading i.e. front office;

• Monitoring, control, settlements and accounting i.e. Treasury Middle Office Group.

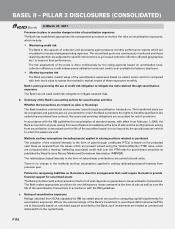

Strategies and processes

Internal control system

Treasury operations warrant elaborate control procedures. Keeping this in view, the following guidelines are

followed for effective control of the treasury operations:

1. Delegation

Appropriate delegation of administrative powers has been put in place for treasury operations. Keeping in view

the size of the investment portfolio and the variety of securities that the Bank has been dealing in, authority for

investment decisions has been delegated to various dealers depending on exigencies of business.

Treasury Middle Office Group (TMOG) is responsible for an independent check of the transactions entered into

by the front office. It also monitors the various limits, which have been laid down in the Investment Policy.

2. System controls

The system used for recording, processing, monitoring and accounting of treasury transactions have adequate

data integrity controls. The process for enabling/disabling role-based access is also documented.

3. Exception handling processes

The Investment Policy sets out deal-size limits for various products. Various coherence checks have been

inserted in the system for ensuring that the appropriate deal size limits are enforced to minimise exceptions.

Additionally, the Investment Policy lists the value-at-risk (VaR) limits and stop loss limits for different groups. It

also defines the approval mechanism in case of breach of these limits.

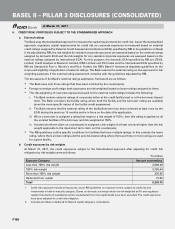

Scope and nature of risk reporting and/or measurement systems

Reporting

The Bank periodically reports on the various investments and their related risk measures to the senior management

and the committees of the Board. The Bank also periodically reports to its various regulators as per the reporting

requirements of the respective regulators.

Measurement

The Bank has devised various risk metrics for different products and investments. These risk metrics are measured

and reported to the senior management independently by TMOG. Some of the risk metrics adopted by the Bank

for monitoring its risks are VaR, duration of equity (DoE), price value of basis point (PV01) and stop loss amongst

others. Limits are placed on various risk metrics which are monitored on a periodic basis.

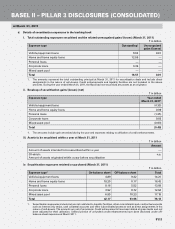

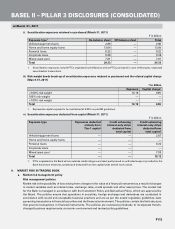

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2011