ICICI Bank 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Non-interest expense

The following chart depicts the trends in cost to average assets over the last three years.

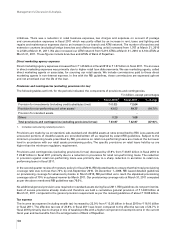

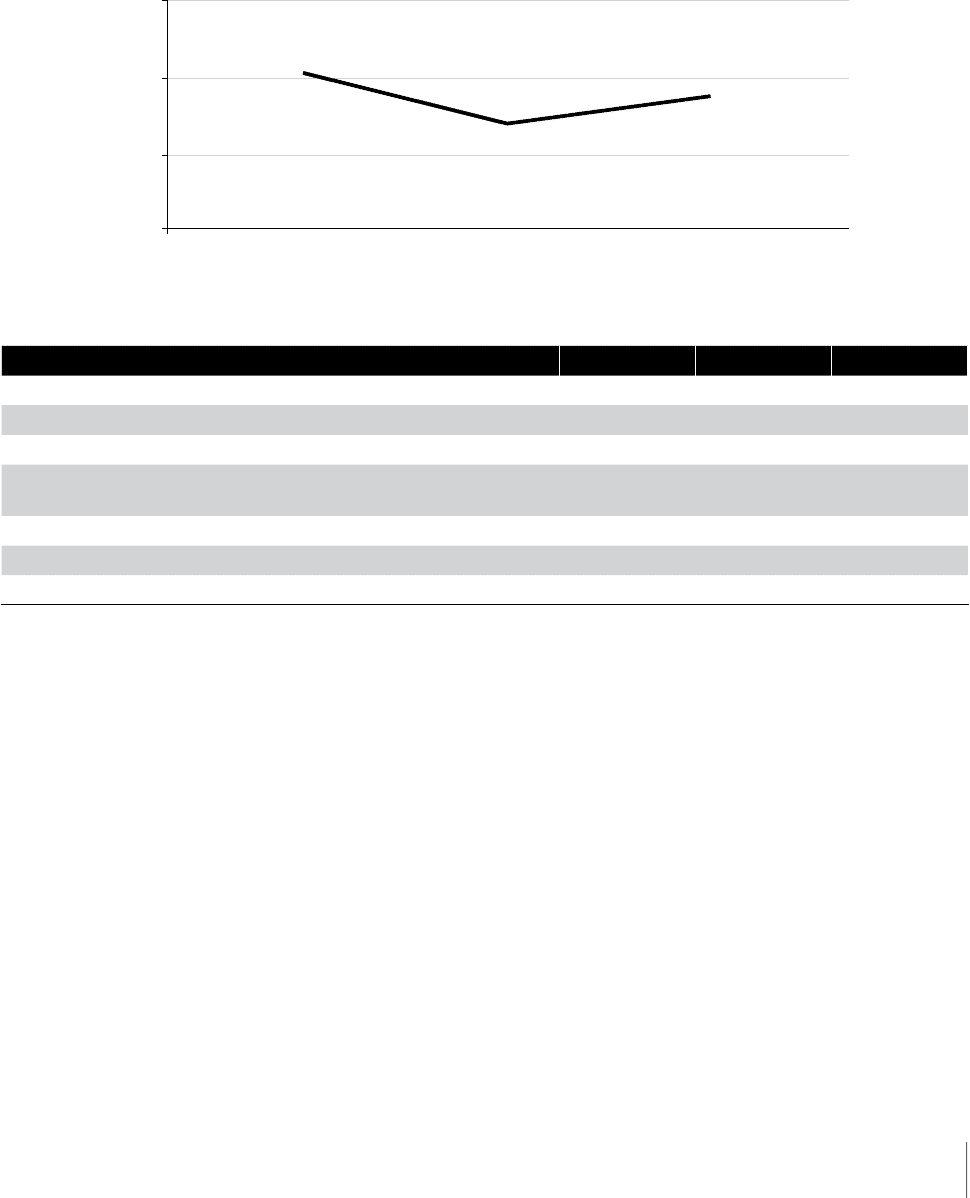

The following table sets forth, for the periods indicated, the principal components of non-interest expense.

` in billion, except percentages

Fiscal 2010 Fiscal 2011 % change

Payments to and provisions for employees ` 19.26 ` 28.17 46.3%

Depreciation on own property (including non banking assets) 4.78 4.84 1.3

Other administrative expenses 31.89 30.80 (3.4)

Total non-interest expense (excluding lease depreciation and

direct marketing agency expenses)

55.93 63.81 14.1

Depreciation (net of lease equalisation) on leased assets 1.42 0.79 (44.4)

Direct marketing agency expenses 1.25 1.57 25.6

Total non-interest expense ` 58.60 ` 66.17 12.9%

Non-interest expenses primarily include employee expenses, depreciation on assets, direct marketing agency

expenses and other administrative expenses. In fiscal 2011, non-interest expenses increased by 12.9% from ` 58.60

billion in fiscal 2010 to ` 66.17 billion in fiscal 2011 primarily due to an increase in employee expenses partly offset by

a decrease in other administrative expenses and a decrease in depreciation on leased assets.

Payments to and provisions for employees

Employee expenses increased by 46.3% from ` 19.26 billion in fiscal 2010 to ` 28.17 billion in fiscal 2011. Employee

expenses increased primarily due to addition of employees of Bank of Rajasthan, annual increase in salaries and

provision for payment of performance bonus and performance-linked retention pay during the period and increase in

the employee base, including sales executives, employees on fixed term contracts and interns, from 41,068 employees

at March 31, 2010 to 56,969 employees at March 31, 2011 (including employees of Bank of Rajasthan).

Depreciation

Depreciation on owned property increased by 1.3% from ` 4.78 billion in fiscal 2010 to ` 4.84 billion in fiscal 2011

primarily due to increase in the branch and ATM network and capitalisation of the Bank’s new building in Hyderabad,

offset, in part, by sale of assets of merchant acquiring operations and other properties. Depreciation on leased assets

decreased from ` 1.42 billion in fiscal 2010 to ` 0.79 billion in fiscal 2011 due to a reduction in leased assets.

Other administrative expenses

Other administrative expenses primarily include rent, taxes and lighting, advertisement and publicity, repairs and

maintenance and other expenditure. Other operating expenses decreased by 3.4% from ` 31.89 billion in fiscal 2010 to

` 30.80 billion in fiscal 2011. The decrease in other operating expenses was primarily due to our overall cost reduction

Fiscal 2009 Fiscal 2010 Fiscal 2011

Cost / average assets

2.0%

1.8%

1.5%

1.3%

Annual Report 2010-2011 57