ICICI Bank 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Condition

Assets

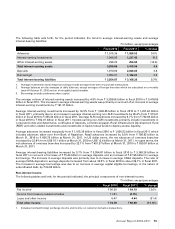

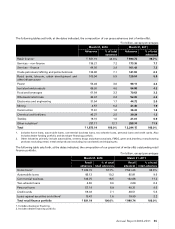

The following table sets forth, at the dates indicated, the principal components of assets.

` in billion, except percentages

Assets At March 31, 2010 At March 31, 2011 % change

Cash and bank balances ` 388.73 ` 340.90 (12.3)%

Investments 1,208.93 1,346.86 11.4

- SLR investments1684.04 641.61 (6.2)

- RIDF and other related investments2101.10 150.80 49.2

- Equity investment in subsidiaries 122.00 124.53 2.1

- Other investments 301.79 429.92 42.5

Advances 1,812.06 2,163.66 19.4

- Domestic 1,360.69 1,612.69 18.5

- Overseas 451.37 550.97 22.1

Fixed assets (including leased assets) 32.13 47.44 47.7

Other assets 192.15 163.48 (14.9)

Total Assets ` 3,634.00 ` 4,062.34 11.8%

1. Government and other approved securities qualifying for SLR. Banks in India are required to maintain a specified percentage,

currently 24.0%, of their net demand and time liabilities by way of liquid assets like cash, gold or approved unencumbered

securities.

2. Investments made in RIDF and other such entities in lieu of shortfall in the amount required to be lent to certain specified sectors

called priority sector as per RBI guidelines.

3. All amounts have been rounded off to the nearest ` 10.0 million.

The total assets increased by 11.8% from ` 3,634.00 billion at March 31, 2010 to ` 4,062.34 billion at March 31,

2011 (including ` 155.96 billion of Bank of Rajasthan at August 12, 2010), primarily due to increase in investments

and advances. Investments increased by 11.4% from ` 1,208.93 billion at March 31, 2010 to ` 1,346.86 billion at

March 31, 2011. The net advances increased by 19.4% from ` 1,812.06 billion at March 31, 2010 to ` 2,163.66 billion

at March 31, 2011.

Cash and cash equivalents

Cash and cash equivalents include cash in hand and balances with RBI and other banks, including money at call

and short notice. Cash and cash equivalents decreased from ` 388.73 billion at March 31, 2010 to ` 340.90 billion at

March 31, 2011. The decrease was primarily due to a decrease in balances with RBI from ` 241.73 billion at March 31,

2010 to ` 171.23 billion at March 31, 2011 due to higher than stipulated CRR balance maintained at March 31, 2010.

Investments

Total investments increased by 11.4% from ` 1,208.93 billion at March 31, 2010 to ` 1,346.86 billion at March 31,

2011 (including ` 70.96 billion of Bank of Rajasthan at August 12, 2010), primarily due to an increase in investment

in corporate bonds and debentures by ` 125.1 1 billion, RIDF and other related investments in lieu of shortfall in

directed lending requirements by ` 49.70 billion (including ` 21.34 billion of Bank of Rajasthan at August 12, 2010)

and investments in commercial paper and certificate of deposits by ` 31.21 billion. The investment in pass-through

certificates decreased by ` 15.93 billion at March 31, 2011 compared to March 31, 2010. At March 31, 2011, we had

an outstanding net investment of ` 28.31 billion in security receipts issued by asset reconstruction companies in

relation to sale of non-performing assets compared to ` 33.94 billion at March 31, 2010. At March 31, 2011, we had a

gross portfolio of funded credit derivatives of ` 10.60 billion and non-funded credit derivatives of ` 28.17 billion, which

includes ` 0.22 billion as protection bought by us.

Advances

Net advances increased by 19.4% from ` 1,812.06 billion at March 31, 2010 to ` 2,163.66 billion at March 31, 2011

primarily due to increase in domestic corporate loans, overseas corporate loans and loans taken over from Bank of

Rajasthan amounting to ` 65.28 billion at August 12, 2010. Net retail advances increased by 5.8% from ` 790.62 billion

at March 31, 2010 to ` 836.75 billion at March 31, 2011. In rupee terms, net advances of overseas branches (including

offshore banking unit) increased by 22.1% from ` 451.37 billion at March 31, 2010 to ` 550.97 billion at March 31, 2011.

Annual Report 2010-2011 59