ICICI Bank 2011 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F88

forming part of the Consolidated Accounts (Contd.)

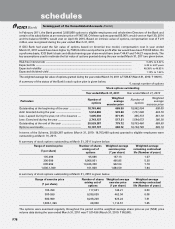

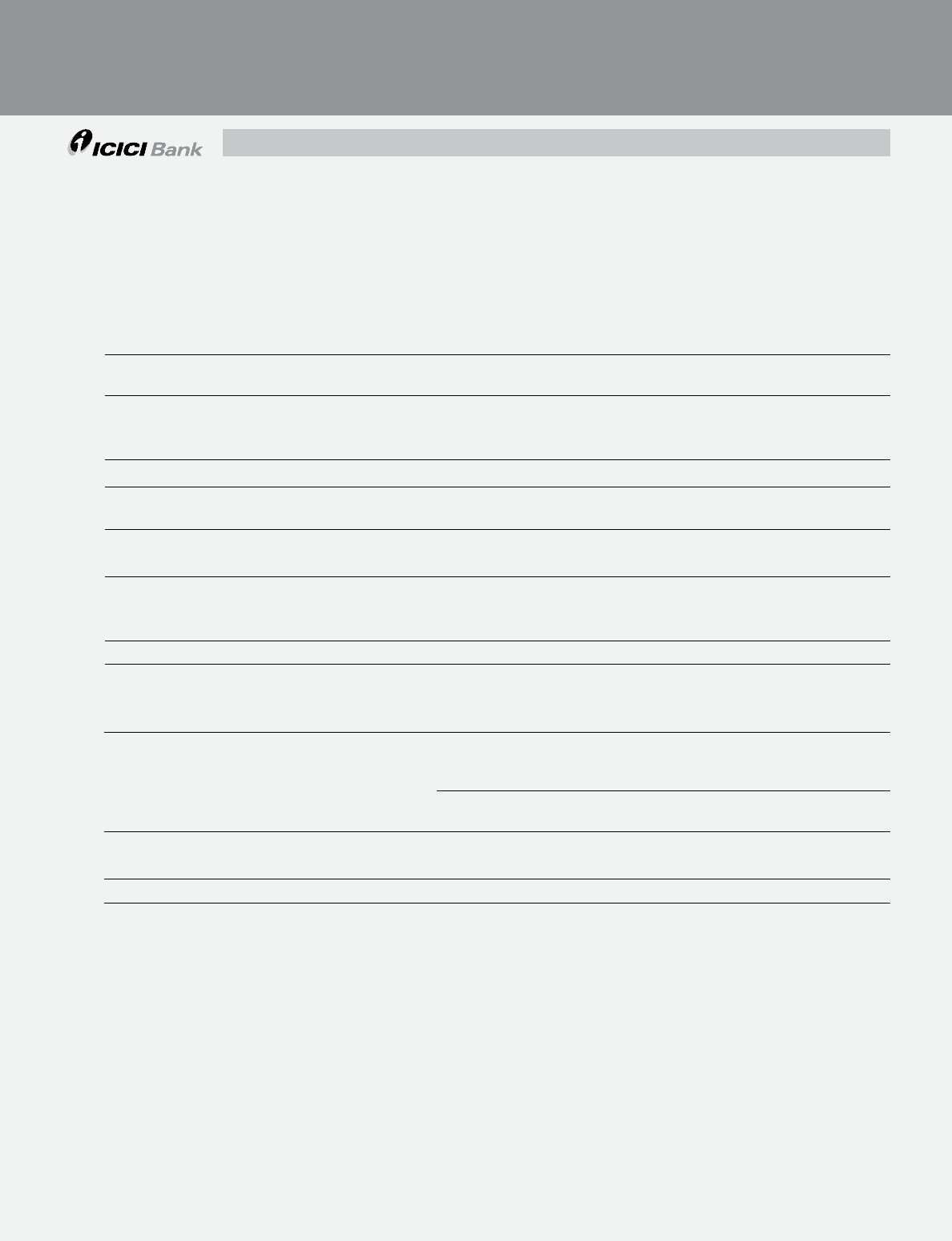

B. Geographical segments

The Group has reported its operations under the following geographical segments.

• Domestic operations comprise branches and subsidiaries/joint ventures in India.

• Foreign operations comprise branches and subsidiaries/joint ventures outside India and offshore banking unit in India.

The Group conducts transactions with its customers on a global basis in accordance with their business requirements,

which may span across various geographies.

The following tables set forth, for the periods indicated, the geographical segment results.

Revenue For the year ended

March 31, 2011

For the year ended

March 31, 2010

Domestic operations ...................................................................................... 553,305.3 532,972.3

Foreign operations ......................................................................................... 62,641.7 63,025.4

Total ................................................................................................................ 615,947.0 595,997.7

` in million

` in million

Capital expenditure incurred

during the year ended

Depreciation provided on

capital expenditure during the

year ended

March 31,

2011

March 31,

2010

March 31,

2011

March 31,

2010

Domestic operations ........................................... 25,008.7 3,545.3 7,188.6 7,390.1

Foreign operations .............................................. 94.6 121.4 208.2 238.6

Total ..................................................................... 25,103.3 3,666.7 7,396.8 7,628.7

Assets At

March 31, 2011

At

March 31, 2010

Domestic operations ...................................................................................... 4,128,281.6 3,694,052.1

Foreign operations ......................................................................................... 1,142,335.5 1,134,927.3

Total ................................................................................................................ 5,270,617.1 4,828,979.4

` in million

Note: Segment assets do not include tax paid in advance/tax deducted at source (net) and deferred tax asset (net).

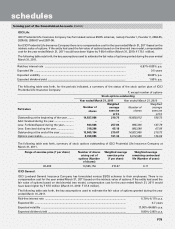

13. Penalties/fines imposed by RBI and other banking regulatory bodies

The penalty imposed by RBI and other banking regulatory bodies during the year ended March 31, 2011 was ` 510,000

(March 31, 2010: Nil).

During the year ended March 31, 2011, RBI vide letter dated June 22, 2010 had issued an order under section 11(3) of

FEMA, 1999 directing the Bank to pay a penalty of ` 10,000 for violation of FEMA regulations. The Bank has paid the

penalty to RBI on July 2, 2010.

During the year ended March 31, 2011, RBI has levied a penalty of ` 500,000 on the Bank for having opened an account

only on the basis of driving licence as an identity proof while relying on the introduction from existing customer as an

address proof. The Bank has paid the penalty of ` 500,000 on August 5, 2010.

In April 2011, RBI has imposed a penalty of ` 1.5 million on the Bank towards non-compliance of certain instructions

issued by RBI in respect of derivative business.

schedules