ICICI Bank 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F32

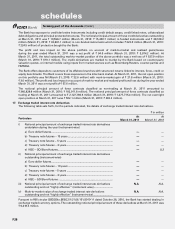

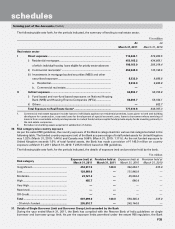

26. Details of non-performing assets purchased/sold, excluding those sold to SC/RC

The Bank has not purchased any non-performing assets in terms of the guidelines issued by the RBI circular no.

DBOD.No.BP.BC.16/21.04.048/2005-06 dated July 13, 2005. The Bank has sold certain non-performing assets in terms of

these RBI guidelines.

The following table sets forth, for the periods indicated, details of non-performing assets sold, excluding those sold to SC/RC.

` in million, except no. of accounts

Particulars Year ended

March 31, 2011

Year ended

March 31, 2010

No. of accounts1 ........................................................................................................... —7,428

Aggregate value (net of provisions) of accounts sold,

excluding those sold to SC/RC .................................................................................... —479.0

Aggregate consideration ............................................................................................. —463.6

Aggregate gain/(loss) over net book value ................................................................ —(15.4)

1. Excludes accounts previously written-off.

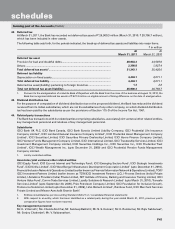

27. Floating provision

The Bank holds floating provision of ` 1.9 million at March 31, 2011 which was taken over from erstwhile Bank of

Rajasthan on amalgamation.

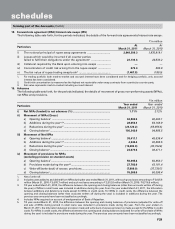

28. Concentration of Deposits, Advances, Exposures and NPAs

(I) Concentration of deposits, advances, exposures and NPAs

` in million

Concentration of deposits

At

March 31, 2011

At

March 31, 2010

Total deposits of twenty largest depositors ............................................... 219,063.0 304,189.2

Deposits of twenty largest depositors as a percentage

of total deposits of the Bank ....................................................................... 9.71% 15.06%

` in million

Concentration of advances1

At

March 31, 2011

At

March 31, 2010

Total advances to twenty largest borrowers (including banks) ................ 968,797.3 912,696.2

Advances to twenty largest borrowers as a

percentage of total advances of the Bank ................................................. 16.93% 18.74%

1. Represents credit exposure as per RBI guidelines on exposure norms. Total advances do not include the exposure to

consolidated entities which are deducted from capital funds of the Bank and exposure to NABARD.

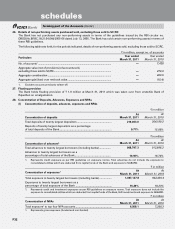

` in million

Concentration of exposures1At

March 31, 2011

At

March 31, 2010

Total exposure to twenty largest borrowers (including banks) ................. 1,007,127.8 942,409.4

Exposures to twenty largest borrowers as a

percentage of total exposure of the Bank ................................................. 16.29% 18.23%

1. Represents credit and investment exposures as per RBI guidelines on exposure norms. Total exposure does not include the

exposure to consolidated entities which are deducted from capital funds of the Bank, SLR investments and exposure to NABARD.

` in million

Concentration of NPAs At

March 31, 2011

At

March 31, 2010

Total exposure1 to top four NPA accounts ................................................. 6,508.1 7,200.3

1. Represents gross exposure (funded and non-funded)

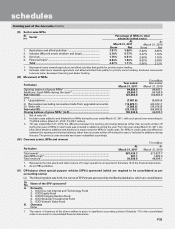

forming part of the Accounts (Contd.)

schedules