ICICI Bank 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

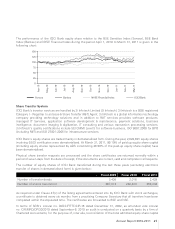

The performance of the ICICI Bank equity share relative to the BSE Sensitive Index (Sensex), BSE Bank

Index (Bankex) and NYSE Financial Index during the period April 1, 2010 to March 31, 2011 is given in the

following chart:

Share Transfer System

ICICI Bank’s investor services are handled by 3i Infotech Limited (3i Infotech). 3i Infotech is a SEBI registered

Category I – Registrar to an Issue & Share Transfer (R&T) Agent. 3i Infotech is a global information technology

company providing technology solutions and in addition to R&T services provides software products,

managed IT Services, application software development & maintenance, payment solutions, business

intelligence, document imaging & digitization, IT consulting and various transaction processing services.

3i Infotech’s quality certifications include SEI CMMI Level 5 for software business, ISO 9001:2000 for BPO

(including R&T) and ISO 27001:2005 for infrastructure services.

ICICI Bank’s equity shares are traded mainly in dematerialised form. During the year, 2,822,691 equity shares

involving 9,533 certificates were dematerialised. At March 31, 2011, 99.19% of paid-up equity share capital

(including equity shares represented by ADS constituting 26.99% of the paid-up equity share capital) have

been dematerialised.

Physical share transfer requests are processed and the share certificates are returned normally within a

period of seven days from the date of receipt, if the documents are correct, valid and complete in all respects.

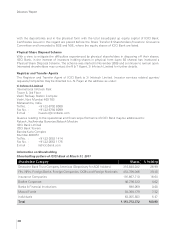

The number of equity shares of ICICI Bank transferred during the last three years (excluding electronic

transfer of shares in dematerialised form) is given below:

Fiscal 2009 Fiscal 2010 Fiscal 2011

Number of transfer deeds 3,408 2,018 2,429

Number of shares transferred 367,813 282,433 368,234

As required under Clause 47(c) of the listing agreements entered into by ICICI Bank with stock exchanges,

a certificate is obtained every six months from a practising Company Secretary that all transfers have been

completed within the stipulated time. The certificates are forwarded to BSE and NSE.

In terms of SEBI’s circular no. D&CC/FITTC/CIR-16 dated December 31, 2002, as amended vide circular

no. CIR/MRD/DP/30/2010 dated September 6, 2010 an audit is conducted on a quarterly basis by a firm of

Chartered Accountants, for the purpose of, inter alia, reconciliation of the total admitted equity share capital

Annual Report 2010-2011 27