ICICI Bank 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

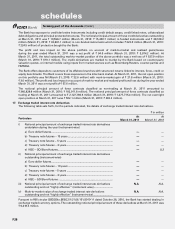

F36

with the approval of the Board of Directors can enhance exposure to a single borrower or borrower group by a further

5 percent of capital funds. During the year ended March 31, 2011, with the prior approval of the Board of Directors, the

Bank exceeded the single borrower limit of 15% of capital funds to Reliance Industries Limited. At March 31, 2011, the

exposure to Reliance Industries Limited as a percentage of capital funds was 12.4%.

32. Unsecured advances against intangible assets

The Bank has made advances against intangible collaterals of the borrowers which are classified as ‘unsecured’ in its

financial statements. At March 31, 2011, the amount of such advances was Nil (March 31, 2010: Nil) and the estimated

value of the intangible collaterals was Nil (March 31, 2010: Nil).

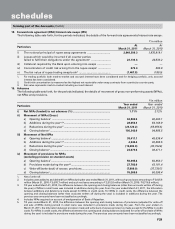

33. Fixed Assets

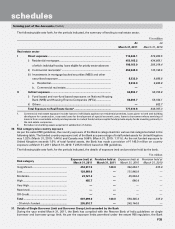

The following table sets forth, for the periods indicated, the movement in software acquired by the Bank, as included in fixed assets.

` in million

Particulars At

March 31, 2011

At

March 31, 2010

At cost at March 31st of preceding year .............................................................. 5,852.6 5,267.4

Additions during the year1 .................................................................................... 737.6 824.9

Deductions during the year .................................................................................. (0.6) (239.7)

Depreciation to date .............................................................................................. (4,830.8) (4,043.3)

Net block ................................................................................................................ 1,758.8 1,809.3

1. Includes impact of acquisition of erstwhile Bank of Rajasthan.

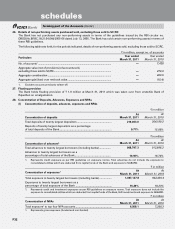

34. Assets given on lease

Assets under finance lease

The following table sets forth, for the periods indicated, the details of finance leases.

` in million

Particulars At

March 31, 2011

At

March 31, 2010

Future minimum lease receipts

Present value of lease receipts ............................................................................. 6.8 17.4

Unmatured finance charges .................................................................................. 0.6 0.2

Total ....................................................................................................................... 7.4 17.6

Maturity profile of future minimum lease receipts

- Not later than one year ....................................................................................... 2.7 17.6

- Later than one year and not later than five years .............................................. 4.7 —

- Later than five years ............................................................................................ ——

Total ....................................................................................................................... 7.4 17.6

Maturity profile of present value of lease rentals

The following table sets forth, for the periods indicated, the details of maturity profile of present value of finance lease

receipts.

` in million

Particulars At

March 31, 2011

At

March 31, 2010

Not later than one year ........................................................................................ 2.4 17.4

Later than one year and not later than five years ............................................... 4.4 —

Later than five years ............................................................................................. ——

Total ...................................................................................................................... 6.8 17.4

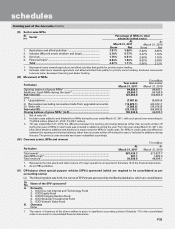

forming part of the Accounts (Contd.)

schedules