ICICI Bank 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated assets of the Bank and its subsidiaries and other consolidating entities increased from ` 4,893.47 billion

at year-end fiscal 2010 to ` 5,337.68 billion at March 31, 2011. Consolidated advances of the Bank and its subsidiaries

increased from ` 2,257.78 billion at March 31, 2010 to ` 2,560.19 billion at March 31, 2011.

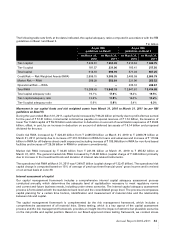

The following table sets forth, for the periods indicated, the profit/(loss) of our principal subsidiaries.

` in billion

Company Fiscal 2010 Fiscal 2011

ICICI Bank UK PLC ` 1.76 ` 1.67

ICICI Bank Canada 1.54 1.45

ICICI Bank Eurasia Limited Liability Company 0.53 0.21

ICICI Prudential Life Insurance Company Limited 2.58 8.08

ICICI Lombard General Insurance Company Limited 1.44 (0.80)

ICICI Securities Limited 1.23 1.13

ICICI Securities Primary Dealership Limited 0.85 0.53

ICICI Home Finance Company Limited 1.61 2.33

ICICI Prudential Asset Management Company Limited 1.28 0.72

ICICI Venture Funds Management Company Limited ` 0.51 ` 0.74

INTERNATIONAL FINANCIAL REPORTING STANDARDS

Convergence with International Financial Reporting Standards (IFRS), issued by the International Accounting Standards

Board (IASB) is gaining the attention of companies, regulators and investing communities across the world.

Based on the recommendations of a Core Group set up to facilitate IFRS convergence in India, the Ministry of Corporate

Affairs (MCA), in consultation with RBI, has announced the approach and timelines for achieving convergence by

financial institutions including banks, insurance companies and NBFCs. As per the roadmap, all scheduled commercial

banks will need to convert their opening balance sheet as at April 1, 2013 in compliance with the IFRS converged

Indian Accounting Standards. MCA has recently placed 35 Indian Accounting Standards (IND AS), converged with

IFRS, on its website.

Currently, IASB has undertaken a project which will replace the current standards on financial instruments, particularly

IAS 39, in a phased manner. As a part of this project, IASB has issued IFRS 9 – “Financial Instruments” which introduces

a new classification and measurement regime for financial assets within its scope. Additionally, the IASB has released

exposure drafts on various aspects related to financial instruments which include ‘amortised cost and impairment

of financial assets’, ‘derecognition’, ‘fair value option for financial liabilities’, ‘hedge accounting’, ‘asset and liability

offsetting’ and ‘fair value measurement’. These revisions are expected to be significantly different from existing IAS

39 as issued by IASB and AS 30 as issued by ICAI. To enable the Indian banks to transition to IFRS converged Indian

Accounting Standards, RBI is working actively with the banks in such areas as identifying the major impact areas for

banking industry, impact on existing regulatory guidelines and arriving at an industry-wide common approach to

transition issues to the extent possible.

Currently, we report our financials under Indian GAAP and also report a reconciliation of shareholders’ equity and net

profit under Indian GAAP to US GAAP. We are awaiting further clarity on the final transition to IFRS in order to assess

the impact on our accounting systems and processes and financial reporting.

Annual Report 2010-2011 71