ICICI Bank 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F29

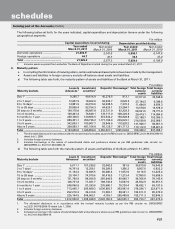

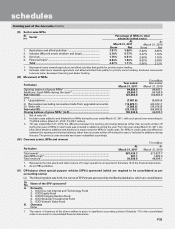

18. Forward rate agreement (FRA)/Interest rate swaps (IRS)

The following table sets forth, for the periods indicated, the details of the forward rate agreements/interest rate swaps.

` in million

Particulars At

March 31, 2011

At

March 31, 2010

i) The notional principal of rupee swap agreements ............................. 2,649,306.3 1,870,819.1

ii) Losses which would be incurred if all counter parties

failed to fulfil their obligations under the agreement1 ........................ 23,133.4 20,533.2

iii) Collateral required by the Bank upon entering into swaps ................. ——

iv) Concentration of credit risk arising from the rupee swaps2 ................ 673.4 500.0

v) The fair value of rupee trading swap book3 ........................................ (1,467.8) (180.5)

1. For trading portfolio both mark-to-market and accrued interest have been considered and for hedging portfolio, only accrued

interest has been considered.

2. Credit risk concentration is measured as the highest net receivable under swap contracts from a particular counter party.

3. Fair value represents mark-to-market including accrued interest.

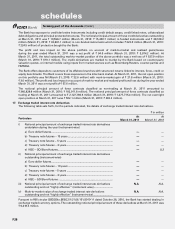

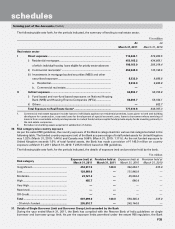

19. Advances

The following table sets forth, for the periods indicated, the details of movement of gross non-performing assets (NPAs),

net NPAs and provisions.

` in million

Particulars Year ended

March 31, 2011

Year ended

March 31, 2010

i) Net NPAs (funded) to net advances (%) ................................................... 1.11% 2.12%

ii) Movement of NPAs (Gross)

a) Opening balance1 ............................................................................... 94,806.5 96,493.1

b) Additions during the year2,3,4 ............................................................... 28,656.3 64,168.9

c) Reductions during the year2 ............................................................... (23,120.2) (65,855.5)

d) Closing balance1 .................................................................................. 100,342.6 94,806.5

iii) Movement of Net NPAs

a) Opening balance1 ................................................................................ 38,411.1 45,539.4

b) Additions during the year2,3,4 ............................................................... 4,946.4 36,666.5

c) Reductions during the year2 ............................................................... (19,283.9) (43,794.8)

d) Closing balance1 .................................................................................. 24,073.6 38,411.1

iv) Movement of provisions for NPAs

(excluding provision on standard assets)

a) Opening balance1 ................................................................................ 56,395.4 50,953.7

b) Provisions made during the year4,5 ..................................................... 27,782.6 43,181.4

c) Write-off/(write-back) of excess provisions ...................................... (7,909.0) (37,739.7)

d) Closing balance1 .................................................................................. 76,269.0 56,395.4

1. Net of write-off.

2. Includes cases added to and deleted from NPAs during the year ended March 31, 2011, with such gross loans amounting to ` 5,025.8

million (March 31, 2010: ` 9,970.7 million) and such net loans amounting to ` 3,512.0 million (March 31, 2010: ` 8,716.8 million).

3. Till year ended March 31, 2010, the difference between the opening and closing balances (other than accounts written off during

the year) of NPAs in retail loans was included in additions during the year. From the year ended March 31, 2011, the bifurcation

between additions and deletions is made except for NPAs in credit cards. For NPAs in credit cards, the difference between the

opening and closing balances (other than accounts written off during the year) is included in additions during the year. The

previous year amounts have been reclassified accordingly.

4. Includes NPAs acquired on account of amalgamation of Bank of Rajasthan.

5. Till year ended March 31, 2010, the difference between the opening and closing balances of provisions (adjusted for write-off

and sale of NPAs during period) in retail loans was included in provisions made during the year. From the year ended on

March 31, 2011, the bifurcation between provision made and write back of excess provision is made except for the NPAs in credit

cards. For NPAs in credit cards, the difference between the opening and closing balances (adjusted for write-off and sale of NPAs

during the year) is included in provisions made during the year. The previous year amounts have been reclassified accordingly.

forming part of the Accounts (Contd.)

schedules