ICICI Bank 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17th Annual Report and Accounts 2010-2011

solutions to enhance

Innovative customer experience

Table of contents

-

Page 1

17th Annual Report and Accounts 2010-2011 Innovative solutions to enhance customer experience -

Page 2

... innovations across banking touch points such as ATMs, Internet, Mobile and Call Centre, we have made financial transactions faster, simpler and more secure. Our adoption of innovative technology is a manifestation of our philosophy of 'Khayaal Aapka'. Offering convenience through technology-led... -

Page 3

...Business Overview...Promoting Inclusive Growth...Management's Discussion and Analysis ...Key Financial Indicators...Particulars of Employees under Section 217 (2A) of the Companies Act, 1956 ...02 04 06 06 07 33 34 44 49 72 73 FINANCIALS Auditors' Report ...Balance Sheet ...Profit and Loss Account... -

Page 4

... that forms the backbone of an economy: power, communications, transport, water resources management and so on. An investment of this magnitude will have significant positive implications for the economy, in terms of improvement in productivity, demand for various input goods and services, job... -

Page 5

... access to basic financial services, both in terms of initial enrolment and ongoing servicing. Banks are already working on business models to serve the un-banked segment through deployment of innovative solutions, and this will gain momentum in the coming years. Investment in social infrastructure... -

Page 6

...loan portfolio; improved profitability; and continued focus on key operating parameters. • ICICI Bank's total advances grew by 19.4% in fiscal 2011. This was driven mainly by strong growth in domestic corporate advances, as well as in the lending to Indian companies from our international branches... -

Page 7

... profitable growth in the coming years. The ICICI Group has a unique diversified financial services franchise in India, with leadership positions across many segments of financial services. Our non-banking businesses - insurance, securities, asset management and private equity - continue to build... -

Page 8

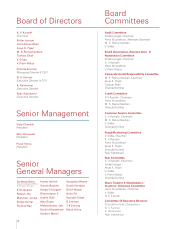

...V. Prem Watsa Chanda Kochhar Share Transfer & Shareholders'/ Investors' Grievance Committee Homi Khusrokhan, Chairman V. Sridar N. S. Kannan Committee Of Executive Directors Chanda Kochhar, Chairperson N. S. Kannan K. Ramkumar Rajiv Sabharwal Senior Management Vijay Chandok President Zarin Daruwala... -

Page 9

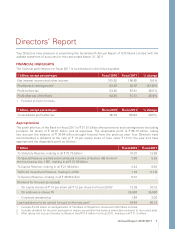

... The Bank of Rajasthan Limited with ICICI Bank Limited. Includes dividend for the prior year paid on shares issued after the balance sheet date and prior to the record date. After taking into account transfer to Reserve Fund ` 0.4 million for fiscal 2011, making in all ` 11.3 million. Annual Report... -

Page 10

...new account, opening a fixed deposit and the Money Manager, help our customers to manage almost all their financial needs online. Further, our Internet Banking service goes beyond fulfilling the routine banking needs of customers by enabling them to buy mutual funds, insurance, forex and gold online... -

Page 11

... ICICI Lombard General Insurance Company Limited ICICI Prudential Asset Management Company Limited ICICI Prudential Trust Limited ICICI Securities Limited ICICI Securities Primary Dealership Limited ICICI Venture Funds Management Company Limited ICICI Home Finance Company Limited ICICI Investment... -

Page 12

... Office and Corporate Office and also at the registered offices of the concerned subsidiaries. As required by Accounting Standard-21 (AS-21) issued by the Institute of Chartered Accountants of India, the Bank's consolidated financial statements included in this Annual Report incorporate the accounts... -

Page 13

... phones not only to check account balances and transfer funds but also to apply for a loan. Our innovative Mobile Banking service takes convenience to a different level by enabling customers to buy flight and movie tickets and also shop for apparels, books and flowers. Annual Report 2010-2011 11 -

Page 14

... our ATMs offer services such as opening fixed deposits, payment of credit card & utility bills, payment of insurance premium, mobile re-charges and 'Ultra Fast Cash' which facilitates withdrawal of ` 5,000 in a single click. We have used technology to transform our vast network of ATMs to provide... -

Page 15

...asset-liability position of the Bank. • • • A summary of reviews conducted by these committees are reported to the Board on a regular basis. Policies approved from time to time by the Board of Directors/Committees of the Board form the governing framework for each type of risk. The business... -

Page 16

...in the 'Corporate Governance Voluntary Guidelines 2009' issued by the Ministry of Corporate Affairs, Government of India. Whistle Blower Policy ICICI Bank has formulated a Whistle Blower Policy. In terms of this policy, employees of ICICI Bank and its group companies are free to raise issues, if any... -

Page 17

... Banking At ICICI Bank we have created one of Asia's largest in-house Phone Banking services that is available to our customers at any time of the day. To take convenience to a new level, we have harnessed technology to offer evolved services, which not only enable our customers to register banking... -

Page 18

... excludes foreign companies not for profit. Comprises only Audit Committee and Share Transfer & Shareholders'/Investors' Grievance Committee of all public limited companies whether listed or not but excludes committees of private limited companies, foreign companies and companies incorporated under... -

Page 19

...central and branch statutory auditors and chief internal auditor and fixation of their remuneration, approval of payment to statutory auditors for other permitted services rendered by them, review of functioning of Whistle Blower Policy, review of the quarterly and annual financial statements before... -

Page 20

... guidelines for the Employees Stock Option Scheme and recommendation of grant of ICICI Bank stock options to the employees and wholetime Directors of ICICI Bank and its subsidiary companies. Composition The Board Governance, Remuneration & Nomination Committee currently comprises three non-executive... -

Page 21

..., Executive Director shall be paid a supplementary allowance of ` 465,000 per month effective April 1, 2011, subject to approval of RBI and Members. Approval of Members for the same is being sought at the current AGM. As provided under Article 132 of the Articles of Association of the Bank, the fees... -

Page 22

... policies and practices of the ICICI Group and to review and implement, if required, any other matter related to corporate social responsibility initiatives as recommended/suggested by RBI or any other body. Composition The Corporate Social Responsibility Committee currently comprises four Directors... -

Page 23

... of the Committee include review of developments in key industrial sectors and approval of credit proposals as per authorisation approved by the Board. Composition The Credit Committee currently comprises four Directors including three non-executive Directors and the Managing Director & CEO. The... -

Page 24

... 4 VIII. Risk Committee Terms of reference The Committee is empowered to review ICICI Bank's risk management policies in relation to various risks (credit, market, liquidity, operational and reputation risks), investment policies and strategy and regulatory and compliance issues in relation thereto... -

Page 25

...General Manager is the Group Compliance Officer & Company Secretary. 111 shareholder complaints received in fiscal 2011 were processed. At March 31, 2011, no complaints were pending. X. Committee of Executive Directors Terms of reference The powers of the Committee include approval/renewal of credit... -

Page 26

..., 1949 and Reserve Bank of India's guidelines for merger/amalgamation of private sector banks dated May 11, 2005 are given below. General Body Meeting Extra-ordinary General Meeting Day, Date Monday, June 21, 2010 Resolution Merger of The Bank of Rajasthan Limited with ICICI Bank Limited (passed by... -

Page 27

... results, official news releases, analyst call transcripts and presentations are also available on the Bank's website. The Management's Discussion & Analysis forms part of the Annual Report. General Shareholder Information General Body Meeting Seventeenth AGM Day, Date & Time Venue Monday, June 27... -

Page 28

Directors' Report Market Price Information The reported high and low closing prices and volume of equity shares of ICICI Bank traded during fiscal 2011 on BSE and NSE are set out in the following table: BSE Month April 2010 May 2010 June 2010 July 2010 August 2010 September 2010 October 2010 ... -

Page 29

... to an Issue & Share Transfer (R&T) Agent. 3i Infotech is a global information technology company providing technology solutions and in addition to R&T services provides software products, managed IT Services, application software development & maintenance, payment solutions, business intelligence... -

Page 30

... of ICICI Bank at March 31, 2011 Shareholder Category Deutsche Bank Trust Company Americas (Depositary for ADS holders) FIIs, NRIs, Foreign Banks, Foreign Companies, OCBs and Foreign Nationals Insurance Companies Bodies Corporate Banks & Financial Institutions Mutual Funds Individuals Total Shares... -

Page 31

... Deutsche Bank Trust Company Americas (Depositary for ADS holders) Life Insurance Corporation of India Allamanda Investments Pte. Limited Government of Singapore Aberdeen Asset Managers Limited A/c Aberdeen International India Opportunities Fund (Mauritius) Limited New Perspective Fund.INC... -

Page 32

Directors' Report Plant Locations - Not applicable Address for Correspondence Sandeep Batra Group Compliance Officer & Company Secretary or Ranganath Athreya General Manager & Joint Company Secretary & Head Compliance - Capital Markets and Non-Banking Subsidiaries ICICI Bank Limited ICICI Bank ... -

Page 33

... to wholetime Directors being subject to RBI approval). Each option confers on the employee a right to apply for one equity share of face value of ` 10 of ICICI Bank at ` 1,106.85 which was closing price on the stock exchange which recorded the highest trading volume in ICICI Bank shares on April... -

Page 34

... ICICI Bank is grateful to the Government of India, RBI, SEBI and overseas regulators for their continued cooperation, support and guidance. ICICI Bank wishes to thank its investors, the domestic and international banking community, rating agencies and stock exchanges for their support. ICICI Bank... -

Page 35

... governance by ICICI Bank Limited ("the Bank") for the year ended on 31 March 2011, as stipulated in Clause 49 of the Listing Agreement of the said Company with stock exchanges. The compliance of conditions of corporate governance is the responsibility of the management. Our examination was limited... -

Page 36

... of the Indian economy would sustain high rates of growth over the medium to long term. For a discussion of recent economic and regulatory developments, please refer to "Management's Discussion & Analysis". BUSINESS REVIEW During fiscal 2011, the Bank focused on 5Cs strategy - Credit growth, CASA... -

Page 37

... to our corporate customers. We offer a comprehensive suite of corporate banking products including rupee and foreign currency debt, working capital credit, structured financing, loan syndication and commercial banking products and services. Our corporate and investment banking franchise is built... -

Page 38

... streams by executing our transaction banking and trade services strategy, while keeping a close watch on credit quality and further deepening our client relationships. PROJECT FINANCE With strong momentum in the Indian economy, there has been a significant increase in investment activity with... -

Page 39

... accordance with the ICICI Group's vision of combining a sustainable business model with a social and human development agenda, the Bank has undertaken several initiatives to meet the financial services needs of the rural market. These include offering credit through our branches and dedicated field... -

Page 40

... managing the balance sheet within the risk parameters laid down by the Board/Risk Committee and reviewing our asset-liability position. Policies approved from time to time by the Board of Directors/Committees of the Board form the governing framework for each type of risk. The business activities... -

Page 41

... market risks. Risk limits including position limits and stop loss limits for the trading book are monitored on a daily basis by the Treasury Middle Office Group and reviewed periodically. Foreign exchange risk is monitored through the net overnight open foreign exchange limit. Interest rate... -

Page 42

...business groups; mid-office, comprising credit and treasury mid-offices; back-office, comprising operations; and corporate and support functions. ICICI Bank's operational risk management governance and framework is defined in the Operational Risk Management Policy, approved by the Board of Directors... -

Page 43

... for customers to buy investment products, gold and foreign exchange through our online channel. Pursuant to the merger of the Bank of Rajasthan, we also enabled seamless transactions for the customers of Bank of Rajasthan in a short timeframe and combined the ATM and branch networks and technology... -

Page 44

... an overall market share of 7.3% based on retail new business weighted received premium in fiscal 2011. Effective September 1, 2010, the Insurance Regulatory and Development Authority specified changes such as cap on surrender charges, charges applicable from the sixth year of policy, an increase in... -

Page 45

...to credit, market and liquidity risks. CREDIT RATINGS ICICI Bank's credit ratings by various credit rating agencies at March 31, 2011 are given below: Agency Moody's Investor Service (Moody's) Standard & Poor's (S&P) Credit Analysis & Research Limited (CARE) Investment Information and Credit Rating... -

Page 46

... ICICI Group in early 2008 to carry forward and build upon its legacy of promoting inclusive growth. ICICI Foundation works with government authorities and specialised grassroots organisations to support developmental work in identified focus areas. It is committed to investing in long-term efforts... -

Page 47

... with ICICI Lombard General Insurance Company to design, part fund and implement the delivery of India's first outpatient healthcare product for low income households. The project will offer outpatient insurance and will complement the Government of India's national health insurance scheme for... -

Page 48

Promoting Inclusive Growth c) Access to finance: ICICI Foundation facilitates financial inclusion by supporting the development of new models for delivering financial services viz. credit, savings, remittance and insurance to low-income households. In addition to the ICICI Group's direct work in ... -

Page 49

... insurance. Biometric smart cards issued to each family capture biometric details of the family and the beneficiaries can check the balance sum insured, family details, policy details and coverage at any time during the policy period. ICICI General has also provided a unique health insurance product... -

Page 50

Promoting Inclusive Growth 5. Clean technology initiatives ICICI Bank's Technology Finance Group (TFG) implements multilateral programmes on behalf of the Government of India in the areas of collaborative research and development, energy, environment and healthcare. TFG's initiatives include ... -

Page 51

... liquidity support under the LAF window, operation of a second LAF on a daily basis, and open market operations for purchase of government securities. In response to tight systemic liquidity and the rising interest rate environment, scheduled commercial banks increased their deposit rates for... -

Page 52

... value ratio of above 75%. With respect to loans outstanding under special housing loan products with lower interest rates in initial years, the standard asset provisioning was increased from 0.4% to 2.0%. In February 2011, RBI issued guidelines declassifying loans sanctioned to non-banking finance... -

Page 53

... of savings account deposits for banks. RBI has increased the interest rate on savings account deposits to 4.00% with effect from May 3, 2011. Amalgamation of The Bank of Rajasthan On May 23, 2010, the Board of Directors of ICICI Bank and the Board of Directors of The Bank of Rajasthan Limited (Bank... -

Page 54

..., 2011. We also increased our ATM network from 5,219 ATMs at March 31, 2010 to 6,104 ATMs at March 31, 2011. These include branches and ATMs of Bank of Rajasthan. The total capital adequacy ratio of ICICI Bank on a standalone basis at March 31, 2011 in accordance with the RBI guidelines on Basel II... -

Page 55

... the net profit after tax to the quarterly average equity share capital and reserves. Return on average assets is the ratio of net profit after tax to average assets. The average balances are the averages of daily balances, except averages of foreign branches which are calculated on a monthly basis... -

Page 56

...of savings deposits increased due to RBI guidelines requiring banks to pay interest on the daily average balances in savings account deposits. Cost of borrowings increased from 5.6% in fiscal 2010 to 6.1% in fiscal 2011 primarily on account of an increase in cost of call and term borrowings and bond... -

Page 57

...include average short-term re-purchase transactions. Average balances are the averages of daily balances, except averages of foreign branches which are calculated on a monthly basis till October 31, 2010 and on a fortnightly basis thereafter. Borrowings exclude preference share capital. The average... -

Page 58

.... Fee income Fee income primarily includes fees from corporate clients such as loan processing fees, transaction banking fees and structuring fees and fees from retail customers such as loan processing fees, fees from credit cards business, account service charges and third party referral fees. Fee... -

Page 59

...Bank of Rajasthan). Depreciation Depreciation on owned property increased by 1.3% from ` 4.78 billion in fiscal 2010 to ` 4.84 billion in fiscal 2011 primarily due to increase in the branch and ATM network and capitalisation of the Bank's new building in Hyderabad, offset, in part, by sale of assets... -

Page 60

... in retail business expenses, law charges and expenses on account of postage and communication expenses in fiscal 2011 which was partly offset by an increase in rent, taxes and lighting and repairs and maintenance expenses due to an increase in our branch and ATM network. The number of branches and... -

Page 61

... (14.9) 11.8% Government and other approved securities qualifying for SLR. Banks in India are required to maintain a specified percentage, currently 24.0%, of their net demand and time liabilities by way of liquid assets like cash, gold or approved unencumbered securities. Investments made in RIDF... -

Page 62

....44 billion at March 31, 2011 (including ` 5.15 billion of Bank of Rajasthan at August 12, 2010) primarily due to part capitalisation of the Bank's new building in Hyderabad and increase in the branch network and other offices. Other assets decreased by 14.9% from ` 192.15 billion at March 31, 2010... -

Page 63

...formed 67.4% of the funding (i.e. deposits and borrowings, other than preference share capital). During fiscal 2010 and fiscal 2011, we focussed on our strategy of increasing the share of current and savings account deposits in total deposits and re-balancing our funding mix. The current and savings... -

Page 64

Management's Discussion & Analysis As a part of project financing and commercial banking activities, we have issued guarantees to support regular business activities of clients. These generally represent irrevocable assurances that we will make payments in the event that the customer fails to ... -

Page 65

... to increase in the investment book and duration of interest rate related instruments. The operational risk RWA at March 31, 2011 was ` 249.67 billion (capital charge of ` 22.47 billion). The operational risk capital charge is computed based on 15% of average of previous three financial years' gross... -

Page 66

... perception of credit rating agencies, shareholders and investors; future strategy with regard to investments or divestments in subsidiaries; and evaluation of options to raise capital from domestic and overseas markets, as permitted by RBI from time to time. We formulate our internal capital level... -

Page 67

... loans, commercial business loans, two wheeler loans, personal loans and credit cards. Also includes dealer funding portfolio and developer financing portfolio. Other industries primarily include automobiles, cement, drugs and pharmaceuticals, FMCG, gems and jewellery, manufacturing products... -

Page 68

... of bills, if the account remains overdue for more than 90 days. In compliance with regulations governing the presentation of financial information by banks, we report nonperforming assets net of cumulative write-offs in our financial statements. RBI has separate guidelines for restructured loans... -

Page 69

...- Loss assets Total customer assets 1. 2. 1 March 31, 2011 ` 2,608.30 20.64 101.14 17.92 74.00 9.22 ` 2,709.44 ` 2,057.29 55.87 96.27 50.20 40.30 5.77 ` 2,153.56 Customer assets include advances, lease receivables and credit substitutes like debentures and bonds but exclude preference shares. All... -

Page 70

... products Services - non finance Power Iron/steel and products Shipping Other Industries Total 1. 2. 3. 17.00 ` 96.27 Includes home loans, automobile loans, commercial business loans, two wheeler loans, personal loans and credit cards. Also includes NPAs in dealer funding and developer finance... -

Page 71

..., working capital and project financing requirements. During the year, there was an increase in loan processing related fees and transaction banking related fees from corporate clients. Provisions decreased from ` 10.34 billion in fiscal 2010 to ` 6.34 billion in fiscal 2011. Provisions were higher... -

Page 72

... income and reduction in overall business levels. Profit after tax of ICICI Prudential Life Insurance Company Limited increased from ` 2.58 billion in fiscal 2010 to ` 8.08 billion in fiscal 2011 due to an increase in net premium earned, fund management fees and policy fees and lower operating and... -

Page 73

...PLC ICICI Bank Canada ICICI Bank Eurasia Limited Liability Company ICICI Prudential Life Insurance Company Limited ICICI Lombard General Insurance Company Limited ICICI Securities Limited ICICI Securities Primary Dealership Limited ICICI Home Finance Company Limited ICICI Prudential Asset Management... -

Page 74

...06 7.50 19.68 19.65 Includes merchant foreign exchange income and margin on customer derivative transactions. Represents proposed dividend. ` in billion At year-end fiscal 2003 Advances Deposits Total assets Equity capital & reserves Total capital adequacy ratio 1. 2004 626.48 681.09 1,252.29 80... -

Page 75

... GE Countrywide Consumer Finance 5-Apr-99 Head Agency Business,DGP Windsor 1-Feb-05 Manager Supply Chain, Becton Dickinson India Limited 1-May-09 Executive Director, ICICI Prudential Life Insurance Co. Limited 28-May-10 Director, Standard Chartered Bank 02-Aug-10 Head of Brokerage, Bank Muscat 4-Oct... -

Page 76

..., ICICI Prudential Life Insurance Co. Limited 18-Jul-05 Senior Manager, Union Bank of India 4-Jul-05 Senior Manager - HR, Novartis 4-May-98 03-Jan-11 Executive Director, Societe Generale Bank 24-Dec-01 Vice-President-Mutual Fund, CRISIL 2-Aug-99 GE Capital TFS Limited 2-Jul-01 General Manager... -

Page 77

...of Finance & Risk, AIB Govett (Asia) Limited Indicates part of the year. Nature of employment contractual, other employees are in the permanent employment of the Bank, governed by its rules and conditions of service. Designation/Nature of duties - Abbreviations Managing Director and Chief Executive... -

Page 78

financials -

Page 79

.... The balance sheet and profit and loss account are drawn up in conformity with Forms A and B (revised) of the Third Schedule to the Banking Regulation Act, 1949, read with Section 211 of the Companies Act, 1956. We did not audit the financial statements of Singapore, Bahrain and Hong Kong branches... -

Page 80

... Contingent liabilities ...Bills for collection ...Significant accounting policies and notes to accounts ... 12 9,231,216,140 85,300,273 7,270,840,587 64,749,539 17 & 18 The schedules referred to above form an integral part of the Balance Sheet. As per our Report of even date. FOR S.R. BATLIBOI... -

Page 81

... ...TOTAL EXPENDITURE ...PROFIT/(LOSS) Net profit for the year ...Profit brought forward...TOTAL PROFIT/(LOSS) ...APPROPRIATIONS/TRANSFERS Transfer to Statutory Reserve ...Transfer to Reserve Fund ...Transfer to Capital Reserve ...Transfer to/(from) Investment Reserve Account ...Transfer to General... -

Page 82

... and cash equivalents at end of the year ...Significant accounting policies and notes to accounts (refer schedule 17 & 18). The schedules referred to above form an integral part of the Balance Sheet. As per our Report of even date. FOR S.R. BATLIBOI & Co. Firm's Registration no.: 301003E Chartered... -

Page 83

... The Bank of Rajasthan Limited ...Less: 200 equity shares of the Bank, earlier held by erstwhile The Bank of Rajasthan Limited, extinguished on amalgamation ...Add: 2,743,137 equity shares of ` 10 each fully paid up (March 31, 2010: 1,594,672 equity shares) issued pursuant to exercise of employee... -

Page 84

... the year ...Closing balance ...IX. Balance in profit and loss account...TOTAL RESERVES AND SURPLUS 1. 2. 3. 4. 5. 6. Includes ` 1,391.3 million (March 31, 2010: ` 568.3 million) on exercise of employee stock options. Represents excess of paid up value of equity shares issued over the fair value of... -

Page 85

schedules forming part of the Balance Sheet (Contd.) At 31.03.2011 SCHEDULE 3 - DEPOSITS A. Demand deposits i) From banks ...ii) From others...II. Savings bank deposits ...III. Term deposits i) From banks ...ii) From others...TOTAL DEPOSITS ...B. I. Deposits of branches in India ...II. Deposits of ... -

Page 86

...,695 275,142,920 TOTAL CASH AND BALANCES WITH RESERVE BANK OF INDIA ...SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE I. In India i) Balances with banks a) In current accounts ... 4,996,213 39,418,419 9,595,803 36,076,344 b) In other deposit accounts ...ii) Money at call and... -

Page 87

... ...ii) Cash credits, overdrafts and loans repayable on demand ...iii) Term loans ...iv) Securitisation, finance lease and hire purchase receivables ...TOTAL ADVANCES ...B. i) Secured by tangible assets (includes advances against book debts) ...ii) Covered by bank/government guarantees ...iii... -

Page 88

... claims which are in the process of being transferred in the Bank's name. SCHEDULE 12 - CONTINGENT LIABILITIES I. Claims against the Bank not acknowledged as debts ...II. Liability for partly paid investments ...III. Liability on account of outstanding forward exchange contracts1 ...IV. Guarantees... -

Page 89

schedules forming part of the Profit and Loss Account Year ended 31.03.2011 SCHEDULE 13 - INTEREST EARNED I. Interest/discount on advances/bills ...II. III. IV. Income on investments...Interest on balances with Reserve Bank of India and other inter-bank funds ...Others1, 2 ...(` in '000s) Year ended... -

Page 90

... policies of ICICI Bank used in the preparation of these financial statements conform to Generally Accepted Accounting Principles in India (Indian GAAP), the guidelines issued by Reserve Bank of India (RBI) from time to time, the Accounting Standards (AS) issued by the Institute of Chartered... -

Page 91

... assets at rates prescribed by RBI. Loss assets and the unsecured portion of doubtful assets are provided/written off as per the extant RBI guidelines. For advances booked in overseas branches, provisions are made at the higher of the provision required at the overseas branch as per the host country... -

Page 92

.... The transferred loans are de-recognised and gains/losses are accounted for only if the Bank surrenders the rights to benefits specified in the underlying securitised loan contract. Recourse and servicing obligations are accounted for net of provisions. In accordance with the RBI guidelines for... -

Page 93

... Fund ICICI Bank contributes 15.0% of the total annual basic salary of certain employees to a superannuation fund for ICICI Bank employees. The employee gets an option on retirement or resignation to commute one-third of the total credit balance in his/her account and receive a monthly pension... -

Page 94

schedules forming part of the Accounts (Contd.) salary. For erstwhile Bank of Madura, erstwhile Sangli Bank and erstwhile Bank of Rajasthan employees in service, separate pension funds are managed in-house and the liability is funded as per actuarial valuation. The pension payments to retired ... -

Page 95

... network, communication including media costs, impairment of technology and fixed assets, conducting general meetings, payment of listing fees and other statutory and regulatory charges, travel in relation to the consolidation contemplated in the Scheme, valuation, due diligence, investment banking... -

Page 96

... of computing the ratio, assets represent average total assets as reported to RBI in Form X under Section 27 of the Banking Regulation Act, 1949. The number of employees includes sales executives, employees on fixed term contracts and interns. The average deposits and the average advances represent... -

Page 97

... the funds were received in March 2010 but were not considered for Tier-2 capital pending allotment. 5. Information about business and geographical segments Business Segments Pursuant to the guidelines issued by RBI on Accounting Standard 17 - (Segment Reporting) - Enhancement of Disclosures dated... -

Page 98

... Includes tax paid in advance/tax deducted at source (net) and deferred tax asset (net). Includes share capital and reserves and surplus. Geographical segments The Bank reports its operations under the following geographical segments. • Domestic operations comprise branches in India • Foreign... -

Page 99

...The Bank of Rajasthan Limited during the year ended March 31, 2011. 6. Maturity pattern • • a) In compiling the information of maturity pattern, certain estimates and assumptions have been made by the management. Assets and liabilities in foreign currency exclude off-balance sheet assets and... -

Page 100

...months from the date of grant. The options can be exercised within 10 years from the date of grant or five years from the date of vesting, whichever is later. As per the scheme, the exercise price of ICICI Bank's options is the last closing price on the stock exchange, which recorded highest trading... -

Page 101

...-09 dated May 11, 2009, ` 2.6 million (March 31, 2010: ` 10.4 million) representing outstanding credit balances of individual value less than US$ 2,500 or equivalent lying in nostro account, which were originated up to March 31, 2002, was transferred to profit and loss account during the year ended... -

Page 102

... a) In India ...b) Outside India...Net value of investments a) In India ...b) Outside India...Movement of provisions held towards depreciation on investments Opening balance ...Add: Provisions made during the year ...Less: Write-off/write back of excess provisions during the year ...Closing balance... -

Page 103

..., namely ICICI Bank UK PLC and ICICI Bank Canada. This also excludes investments in non-Indian government securities of ` 8,862.3 million made by overseas branches. Excludes equity shares, units of equity-oriented mutual fund and units of venture capital fund. Excludes equity shares, units... -

Page 104

... guidelines. The market making and the proprietary trading activities in derivatives are governed by the Investment Policy and the Derivative Policy of the Bank, which lay down the position limits, value at risk limits, stop loss limits as well as other risk limits. The Risk Management Group... -

Page 105

schedules forming part of the Accounts (Contd.) The following tables set forth the details of derivative positions at March 31, 2011. Sr. No. 1 Particulars Derivatives (Notional principal amount) a) For hedging ...b) For trading ...Marked to market positions3 a) Asset (+) ...b) Liability (-) ...... -

Page 106

...). The credit derivatives are marked to market by the Bank based on counter-party valuation quotes, or internal models using inputs from market sources such as Bloomberg/Reuters, counter-parties and FIMMDA. The Bank offers deposits to customers of its offshore branches with structured returns linked... -

Page 107

... in credit cards, the difference between the opening and closing balances (other than accounts written off during the year) is included in additions during the year. The previous year amounts have been reclassified accordingly. Includes NPAs acquired on account of amalgamation of Bank of Rajasthan... -

Page 108

... coverage ratio of the Bank at March 31, 2011 computed as per the RBI circular dated December 1, 2009 is 76.0% (March 31, 2010: 59.5%). 22. Farm loan waiver The Ministry of Finance, Government of India had issued guidelines for the implementation of the Agriculture debt waiver and relief scheme for... -

Page 109

schedules forming part of the Accounts (Contd.) 24. Financial assets transferred during the year to securitisation company (SC)/reconstruction company (RC) The Bank has transferred certain assets to Asset Reconstruction Companies (ARCs) in terms of the guidelines issued by RBI governing such ... -

Page 110

schedules forming part of the Accounts (Contd.) 26. Details of non-performing assets purchased/sold, excluding those sold to SC/RC The Bank has not purchased any non-performing assets in terms of the guidelines issued by the RBI circular no. DBOD.No.BP .BC.16/21.04.048/2005-06 dated July 13, 2005. ... -

Page 111

.... Excludes commercial business loans, developer financing and dealer funding. (III) Movement of NPAs Particulars Opening balance of gross NPAs1 ...Additions: fresh NPAs during the year2,3 ...Sub-total (A)...Less: ...i) Upgradations ...ii) Recoveries (excluding recoveries made from upgraded accounts... -

Page 112

...Bank in respect of primary issue of shares or convertible bonds or convertible debentures or units of equity oriented mutual funds ix) x) xi) Financing to stockbrokers for margin trading All exposures to Venture Capital Funds (both registered and unregistered) Others Total Exposure to Capital Market... -

Page 113

...of loans is from a real estate activity and exposures to mutual funds/venture capital funds/private equity funds investing primarily in the real estate companies. Excludes non-banking assets acquired in satisfaction of claims. 30. Risk category-wise country exposure As per the extant RBI guidelines... -

Page 114

schedules forming part of the Accounts (Contd.) with the approval of the Board of Directors can enhance exposure to a single borrower or borrower group by a further 5 percent of capital funds. During the year ended March 31, 2011, with the prior approval of the Board of Directors, the Bank exceeded ... -

Page 115

... a number of capital contracts. Capital contracts are job orders of a capital nature which have been committed. This item also includes the amount of Government securities bought/sold and remaining to be settled on the date of the financials statements. 2. 3. Liability for partly paid investments... -

Page 116

... profit of ` 2,029.0 million from this transaction, which is included in Schedule 14 - "Other income" for the year ended March 31, 2010. 38. Staff retirement benefits Pension The following tables set forth, for the periods indicated, reconciliation of opening and closing balance of the present value... -

Page 117

... service cost ...Exchange fluctuation loss/(gain) ...Losses/(Gains) on "Acquisition/Divestiture" ...Effect of the limit in para 59(b) ...Net cost ...Investment details of plan assets Majority of the plan assets are invested in Government securities and corporate bonds Assumptions ...Interest rate... -

Page 118

... provident funds which require employers to meet the interest shortfall are in effect defined benefit plans. The Bank's actuary has informed that it is not practicable to actuarially determine the interest shortfall obligation. 39. Movement in provision for credit card/debit card reward points The... -

Page 119

... as Financial Information Network & Operations Limited), TCW/ ICICI Investment Partners Limited (earlier known as TCW/ICICI Investment Partners LLC), I-Process Services (India) Private Limited, I-Solutions Providers (India) Private Limited, NIIT Institute of Finance, Banking and Insurance Training... -

Page 120

... ended March 31, 2011 was payment of insurance premium to ICICI Lombard General Insurance Company Limited amounting to ` 1,380.8 million (March 31, 2010: ` 1,057.3 million). During the year ended March 31, 2011, the Bank's insurance claims from the insurance subsidiaries amounted to ` 945.5 million... -

Page 121

... with ICICI Prudential Life Insurance Company Limited amounting to ` 3,074.9 million (March 31, 2010: ` 1,237.2 million). Investment in bonds and Certificate of Deposits (CDs) issued by ICICI Bank During the year ended March 31, 2011, subsidiaries have invested in bonds issued by the Bank amounting... -

Page 122

... 31, 2010: gain of ` 495.2 million) with ICICI Bank UK PLC, loss of ` 64.1 million (March 31, 2010: gain of ` 215.8 million) with ICICI Home Finance Company Limited, gain of ` 371.7 million (March 31, 2010: loss of ` 50.7 million) with ICICI Securities Primary Dealership Limited and loss of ` 248... -

Page 123

... and payment services, formed a merchant acquiring alliance and a new entity, 81% owned by First Data, was formed, which has acquired ICICI Bank's merchant acquiring operations through transfer of assets, primarily comprising fixed assets and receivables, and assumption of liabilities, for a total... -

Page 124

... with ICICI Bank ...Deposits of ICICI Bank ...Call/term money lent ...Call/term money borrowed ...Advances ...Investments of ICICI Bank ...Investments of related parties in ICICI Bank ...Receivables1...Payables1 ...Guarantees/ letter of credit ...Swaps/forward contracts (notional amount) ...Employee... -

Page 125

...year ended March 31, 2011. ` in million Total Items/ Related party Deposits with ICICI Bank ...Deposits of ICICI Bank ...Call/term money lent ...Call/term money borrowed ...Advances ...Investments of ICICI Bank ...Investments of related parties in ICICI Bank ...Receivables ...Payables ...Guarantees... -

Page 126

... party Deposits with ICICI Bank ...Deposits of ICICI Bank ...Call/term money lent ...Call/term money borrowed ...Advances ...Investments of ICICI Bank ...Investments of related parties in ICICI Bank ...Receivables ...Payables ...Guarantees/ letter of credit ...Swaps/forward contracts (notional... -

Page 127

... re-grouped to conform to the current year presentation. Signatures to Schedules 1 to 18 For and on behalf of the Board of Directors FOR S.R. BATLIBOI & Co. Firm's Registration no.: 301003E Chartered Accountants K. V. KAMATH Chairman SRIDAR IYENGAR Director CHANDA KOCHHAR Managing Director & CEO... -

Page 128

... Indian Rupees at the rate of 1 RUB = ` 1.50696. ICICI Prudential Pension Funds Management Company Limited, a wholly owned subsidiary of ICICI Prudential Life Insurance Company Limited, was incorporated on April 22, 2009. The information furnished for ICICI Bank Canada and ICICI Bank Eurasia Limited... -

Page 129

Consolidated financial statements of ICICI Bank Limited and its subsidiaries -

Page 130

...joint ventures (the 'ICICI Group'), as at March 31, 2011, and also the consolidated profit and loss account and the consolidated cash flow statement for the year ended on that date annexed thereto. These financial statements are the responsibility of the ICICI Bank Limited's management and have been... -

Page 131

... in India: (a) in the case of the consolidated balance sheet, of the state of affairs of the ICICI Group as at March 31, 2011; (b) in the case of the consolidated profit and loss account, of the profit for the year ended on that date; and (c) in the case of the consolidated cash flow statement, of... -

Page 132

...Contingent liabilities ...Bills for collection ...Significant accounting policies and notes to accounts ... 12 10,225,996,643 85,304,043 8,205,199,348 67,188,608 17 & 18 The schedules referred to above form an integral part of the Balance Sheet. As per our Report of even date. For S.R. BATLIBOI... -

Page 133

... note 18.2) Basic (`) ...Diluted (`) ...Face value per share (`) ... The schedules referred to above form an integral part of the Profit and Loss Account As per our Report of even date. For S.R. BATLIBOI & CO. Firm's Registration no.: 301003E Chartered Accountants SHRAWAN JALAN Partner Membership no... -

Page 134

... issue expense ...Net proceeds/(repayment) of bonds (including subordinated debt) ...Dividend and dividend tax paid ...Net cash generated from financing activities ...Effect of exchange fluctuation on translation reserve ...Net cash and cash equivalents taken over from The Bank of Rajasthan Limited... -

Page 135

... The Bank of Rajasthan Limited ...Less: 200 equity shares of the Bank, earlier held by erstwhile The Bank of Rajasthan Limited, extinguished on amalgamation ...Add: 2,743,137 equity shares of ` 10 each fully paid up (March 31, 2010: 1,594,672 equity shares) issued pursuant to exercise of employee... -

Page 136

... unrealised profit/(loss) pertaining to the investments of venture capital funds. Includes profit on sale of investments in HTM category, net of taxes and transfer to Statutory Reserve. Also includes profit on sale of land and buildings, net of taxes and transfer to Statutory Reserve, for the year... -

Page 137

...Opening minority interest ...Subsequent increase/(decrease) ...CLOSING MINORITY INTEREST ...SCHEDULE 3 - DEPOSITS A. I. Demand deposits i) From banks ...ii) From others ...II. Savings bank deposits ...III. Term deposits i) From banks ...ii) From others ...TOTAL DEPOSITS ...B. I. Deposits of branches... -

Page 138

...770 278,502,787 TOTAL CASH AND BALANCES WITH RESERVE BANK OF INDIA ... SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE I. In India i) Balances with banks a) b) ii) a) b) II. in current accounts ...in other deposit accounts ...with banks ...with other institutions ...5,864,648 55... -

Page 139

... and bonds ...v) Assets held to cover linked liabilities of life insurance business ...vi) Others (commercial paper, mutual fund units, pass through certificates, security receipts, certificate of deposits, Rural Infrastructure Development Fund deposits and other related investments etc.) ...TOTAL... -

Page 140

... The Bank of Rajasthan Limited for the year ended March 31, 2011. Includes assets amounting to Nil (March 31, 2010: ` 446.1 million) which are in the process of being sold. SCHEDULE 11 - OTHER ASSETS I. Inter-office adjustments (net debit) ...II. Interest accrued ...III. Tax paid in advance/tax... -

Page 141

schedules forming part of the Consolidated Profit and Loss Account Year ended 31.03.2011 SCHEDULE 13 - INTEREST EARNED I. Interest/discount on advances/bills ...II. Income on investments ...III. Interest on balances with Reserve Bank of India and other inter-bank funds ...IV. Others1,2 ...TOTAL ... -

Page 142

...in India (Indian GAAP), the guidelines issued by the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority (IRDA), National Housing Bank (NHB), the Accounting Standards (AS) issued by the Institute of Chartered Accountants of India... -

Page 143

... known as TCW/ICICI Investment Partners LLC) 26. Rainbow Fund3 27. Financial Inclusion Network & Operations Limited3 28. I-Process Services (India) Private Limited3 29. I-Solutions Providers (India) Private Limited3 30. NIIT Institute of Finance Banking and Insurance Training Limited3 31. Prize... -

Page 144

... Group are reported in Indian rupees (`), the national currency of India. Foreign currency income and expenditure items are translated as follows: • For domestic operations, at the exchange rates prevailing on the date of the transaction with the resultant gain or loss accounted for in the profit... -

Page 145

...on Black Scholes model. In the case of ICICI Prudential Life Insurance Company and ICICI Lombard General Insurance Company, the fair value of the shares is determined based on an external valuation report. The Group's venture capital subsidiary i.e. ICICI Venture Funds Management Company has settled... -

Page 146

...for one year renewable group term insurance. The unit liability in respect of linked business has been taken as the value of the units standing to the credit of policyholders, using the Net Asset Value (NAV) prevailing at the valuation date. The adequacy of charges under unit linked policies to meet... -

Page 147

... fund ICICI Bank contributes 15.00% of the total annual basic salary of certain employees to a superannuation fund for ICICI Bank employees. The employee gets an option on retirement or resignation to commute one-third of the total credit balance in his/ her account and receive a monthly pension... -

Page 148

.... Further, in the case of the Bank's United Kingdom and Canadian banking subsidiaries, unrealised gain/loss on investment in 'Held for Trading' category is accounted directly in the profit and loss account. In the case of life and general insurance businesses, investments are made in accordance... -

Page 149

... available net asset values of the respective fund. Unrealised gains/losses arising due to changes in the fair value of listed equity shares and mutual fund units are taken to 'Revenue and other reserves' in the balance sheet for life insurance business. In the case of general insurance business... -

Page 150

.... The transferred loans are de-recognised and gains/losses are accounted for only if the Bank surrenders the rights to benefits specified in the underlying securitised loan contract. Recourse and servicing obligations are accounted for net of provisions. In accordance with the RBI guidelines for... -

Page 151

... network, communication including media costs, impairment of technology and fixed assets, conducting general meetings, payment of listing fees and other statutory and regulatory charges, travel in relation to the consolidation contemplated in the Scheme, valuation, due diligence, investment banking... -

Page 152

... known as Financial Information Network & Operations Limited), I-Process Services (India) Private Limited, I-Solutions Providers (India) Private Limited, NIIT Institute of Finance Banking and Insurance Training Limited, Comm Trade Services Limited, Prize Petroleum Company Limited, ICICI Foundation... -

Page 153

schedules forming part of the Consolidated Accounts (Contd.) Insurance services During the year ended March 31, 2011, the Group received insurance premium from associates/other related entities amounting to ` 9.5 million (March 31, 2010: ` 52.5 million), from key management personnel amounting to ` ... -

Page 154

..., the balance payable to/receivable from its associates/other related entities. ` in million Items Deposits with the Group ...Advances ...Investments of the Group in related parties ...Investments of related parties in ICICI Bank ...Receivables ...Payables ...Guarantees issued by the Group ...At... -

Page 155

... balance payable to/receivable from relatives of key management personnel. ` in million Items Deposits ...Advances ...Investments ...4. Employee stock option scheme (ESOS) ICICI Bank: In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial year... -

Page 156

schedules forming part of the Consolidated Accounts (Contd.) In February 2011, the Bank granted 3,035,000 options to eligible employees and whole-time Directors of the Bank and certain of its subsidiaries at an exercise price of ` 967.00. Of these options granted 50.00% would vest on April 30, 2014 ... -

Page 157

... out of options (Number of shares) 13,565,154 Weighted average exercise price (` per share) 210.87 Weighted average remaining contractual life (Number of years) 6.11 30-400 ICICI General: ICICI Lombard General Insurance Company has formulated various ESOS schemes to their employees. There is no... -

Page 158

schedules forming part of the Consolidated Accounts (Contd.) The following table sets forth, for the periods indicated, a summary of the status of the stock option plan of ICICI Lombard General Insurance Company. `, except number of options Stock options outstanding Year ended March 31, 2011 Year ... -

Page 159

... periods indicated, the details of maturity profile of present value of finance lease receipts. ` in million Particulars Not later than one year ...Later than one year and not later than five years ...Later than five years ...Total ...7. Preference shares Certain government securities amounting to... -

Page 160

schedules forming part of the Consolidated Accounts (Contd.) 9. Staff retirement benefits Pension The following tables set forth, for the periods indicated, reconciliation of opening and closing balance of the present value of the defined benefit obligation for pension benefits. ` in million ... -

Page 161

schedules forming part of the Consolidated Accounts (Contd.) Gratuity The following tables set forth, for the periods indicated, reconciliation of opening and closing balance of the present value of the defined benefit obligation for gratuity benefits of the Group. ` in million Gratuity Year ended ... -

Page 162

...,555.8 4,712.6 86.5 4,799.1 85.4 24,842.1 Pursuant to the amalgamation of erstwhile Bank of Rajasthan with the Bank from the close of business at August 12, 2010, the Bank has recognised deferred tax asset of ` 827.3 million on eligible amount of timing difference on the date of amalgamation. F84 -

Page 163

... Banking segment, as per the RBI guidelines for the Bank. Treasury includes the entire investment portfolio of the Bank, ICICI Eco-net Internet and Technology Fund, ICICI Equity Fund, ICICI Emerging Sectors Fund, ICICI Strategic Investments Fund and ICICI Venture Value Fund. Other banking business... -

Page 164

... insurance segment adjustments Wholesale Treasury Life General Venture fund management Others InterTotal Sr. no. Particulars banking Other banking business 1 Revenue 159,734.9 2 Segment results (5,141.9) 3 Unallocated expenses 4 Income tax expenses (net)/(net deferred tax credit... -

Page 165

... Treasury Other banking business Life insurance General Venture fund insurance management Others Intersegment adjustments Total 1 Revenue 177,244.1 2 Segment results (13,335.1) 3 Unallocated expenses schedules 4 Income tax expenses (net)/(net deferred tax credit) 17,352.3 48... -

Page 166

schedules forming part of the Consolidated Accounts (Contd.) B. Geographical segments The Group has reported its operations under the following geographical segments. • Domestic operations comprise branches and subsidiaries/joint ventures in India. • Foreign operations comprise branches ... -

Page 167

...will be made once the review is completed. The impact of the same in the consolidated financial statements is presently not determinable. In view of above developments, IRDA has allowed increase in the rate of premium applicable to Motor Third Party Liability insurance business by 68.50% with effect... -

Page 168

... presentation. SIGNATURES TO SCHEDULES 1 TO 18 For and on behalf of the Board of Directors For S.R. BATLIBOI & CO. Firm's Registration no.: 301003E Chartered Accountants SHRAWAN JALAN Partner Membership no.: 102102 Place : Mumbai Date : April 28, 2011 SANDEEP BATRA Group Compliance Officer & Company... -

Page 169

...respectively. 4. Investments include securities held as stock in trade. 5. Dividend paid includes proposed dividend and dividend paid on preference shares. 6. The financial information of ICICI Bank UK PLC and ICICI International Limited have been translated into Indian Rupees at the closing rate on... -

Page 170

... Company Limited ICICI Home Finance Company Limited ICICI Trusteeship Services Limited ICICI Investment Management Company Limited ICICI International Limited ICICI Prudential Pension Funds Management Company Limited ICICI Eco-net Internet and Technology Fund1 ICICI Equity Fund 1 Nature of business... -

Page 171

.../ICICI Investment Partners LLC) Rainbow Fund 27 Financial Inclusion Network & Operations Limited 28 I-Process Services (India) Private Limited 29 I-Solutions Providers (India) Private Limited 30 NIIT Institute of Finance, Banking and Insurance Training Limited Prize Petroleum Company Limited... -

Page 172

... ICICI Lombard General Insurance Company Limited 1. Country of incorporation India India Ownership interest 73.88% 73.55% Book value of investment 35.94 13.481 Includes ` 2.52 billion held as share application money pending allotment of the shares. The quantitative impact on regulatory capital... -

Page 173

... on interest payment ranging up to 100 basis points. The lower Tier-2 bonds (subordinated debt) are cumulative and have an original maturity between 5 to 15 years. The interest on lower Tier-2 capital instruments is payable quarterly, semi-annually or annually. RBI vide its circular dated January 20... -

Page 174

... a. Capital management Objective The Bank actively manages its capital to meet regulatory norms and current and future business needs considering the risks in its businesses, expectation of rating agencies, shareholders and investors, and the available options of raising capital. Organisational set... -

Page 175

... of credit rating agencies, shareholders and investors; future strategy with regard to investments or divestments in subsidiaries; and evaluation of options to raise capital from domestic and overseas markets, as permitted by RBI from time to time. The Bank formulates its internal capital level... -

Page 176

... rate risk, liquidity risk, foreign exchange risk, operational and outsourcing risks and the limits framework, including stress test limits for various risks. The Risk Committee also reviews the risk profile of the overseas banking subsidiaries annually. Credit Committee reviews developments in key... -

Page 177

... 31, 2011 2. 3. Policies approved from time to time by the Board of Directors/Committees of the Board form the governing framework for each type of risk. The business activities are undertaken within this policy framework. Independent groups and sub-groups have been constituted across the Bank to... -

Page 178

... governed by Credit and Recovery Policy (Credit Policy). Credit Policy outlines the type of products that can be offered, customer categories, target customer profile, credit approval process and limits. The Credit Policy is approved by the Board of Directors. The delegation structure for approval... -

Page 179

...by executives on the basis of the product policies. Credit risk monitoring process For effective monitoring of credit facilities, a post-approval authorisation structure has been laid down. For corporate, small enterprises and rural and agriculture linked banking business, Credit Middle Office Group... -

Page 180

... the account for a continuous period of 90 days based on drawing power computed on the basis of stock statements that are more than three months old even though the unit may be working or the borrower's financial position is satisfactory; or e. the regular/ad hoc credit limits have not been reviewed... -

Page 181

... FMCG Venture capital funds Other industries Grand Total3 1. 2. 3. Includes home loans, automobile loans, commercial business loans, two wheeler loans, personal loans, and credit cards. Also includes dealer funding exposures and developer financing exposures. Includes balances with banks. Includes... -

Page 182

... Cash & balances with RBI Balances with banks & money at call and short notice 64.21 41.45 28.86 5.51 12.45 9.14 5.80 1.22 0.00 0.05 168.69 Investments Loans & advances Fixed assets Other assets Total Day 1 2 to 7 days 8 to 14 days 15 to 28 days 29 days to 3 months 3 to 6 months 6 months to 1 year... -

Page 183

... opening and closing balances (other than accounts written off during the year) of provisions on credit cards is included in provisions made during the year. Includes advances portfolio of the Bank and its banking subsidiaries and ICICI Home Finance Company. h. Amount of non-performing investments... -

Page 184

...CRISIL Limited, Credit Analysis & Research Limited, ICRA Limited and Fitch India and the international ECAI specified by RBI are Standard & Poor's, Moody's and Fitch. Further, the RBI's Basel II framework stipulates guidelines on the scope and eligibility of application of external ratings. The Bank... -

Page 185

... loans and current assets for working capital finance. For project finance, security of the assets of the borrower and assignment of the underlying project contracts is generally taken. In addition, in some cases, additional security such as pledge of shares, cash collateral, charge on receivables... -

Page 186

... policies with a declared surrender value issued by an insurance company which is regulated by the insurance sector regulator, certain debt securities, mutual fund units where daily net asset value is available in public domain and the mutual fund is limited to investing in the instruments listed... -

Page 187

... backed by financial assets originated by third parties for purposes of investment/trading/market-making with the aim of developing an active secondary market in securitised debt. • Structurer: structuring appropriately in a form and manner suitably tailored to meet investor requirements while... -

Page 188

...financings The Bank transfers commercial and consumer loans through securitisation transactions. The transferred loans are de-recognised and gains/losses are accounted for only if the Bank surrenders the rights to benefits specified in the underlying securitised loan contract. Recourse and servicing... -

Page 189

... 2011 d. Details of securitisation exposures in the banking book I. Total outstanding exposures securitised and the related unrecognised gains/(losses) (March 31, 2011) ` in billion Exposure type Vehicle/equipment loans Home and home equity loans Personal loans Corporate loans Mixed asset pool Total... -

Page 190

... in the trading book I. Aggregate amount of exposures securitised for which the Bank has retained some exposures subject to market risk (March 31, 2011) ` in billion Exposure type Vehicle/equipment loans Home and home equity loans Personal loans Corporate loans Mixed asset pool Total 1. The amounts... -

Page 191

... changes in the value of a financial instrument as a result of changes in market variables such as interest rates, exchange rates, credit spreads and other asset prices. The market risk for the Bank is managed in accordance with the Investment Policy and Derivatives Policy, which are approved by the... -

Page 192

... transactions. Structure and organisation of the market risk management function The Market Risk Management Group (MRMG), which is an independent function, reports to the Head - RMG. MRMG exercises independent control over the process of market risk management and recommends changes in policies... -

Page 193

... processes; and • Develop comprehensive operational risk loss database for effective mitigation. Operational risk management governance and framework In line with the RBI guidelines, an independent Operational Risk Management Group (ORMG) was set up in 2006. The Bank's operational risk management... -

Page 194

...control self-assessment, key indicators, scenario analysis and issues and action. The Bank is in the process of implementing economic capital system for operational risk during the financial year 2012. Operational risk management in international locations ORMG is responsible for design, development... -

Page 195

... of the markets. Risk measurement and reporting framework The Bank proactively manages impact of IRRBB as a part of its ALM activities. ALM policy defines the different types of interest rates risks that are to be monitored, measured and controlled. ALCO decides strategies for managing IRRBB at... -

Page 196

... for statutory liquid ratio maintenance purposes in these books, interest rate swaps, and any other derivatives, which have to be marked to market. The management of price risk of the trading book is detailed in the Investment Policy. Hedging policy Depending on the underlying asset or liability and... -

Page 197

..., ICICI Home Finance Company, ICICI Securities Primary Dealership Limited, ICICI Securities and its subsidiaries. 12. LIQUIDITY RISK Liquidity risk is the risk of inability to meet financial commitments as they fall due, through available cash flows or through sale of assets at fair market value... -

Page 198

...For the domestic operations, current accounts and savings deposits payable on demand form a significant part of the Bank's funding and the Bank is working with a concerted strategy to sustain and grow this segment of deposits along with retail term deposits. These deposits are augmented by wholesale... -

Page 199

... per guidelines issued by RBI/FIMMDA and other applicable regulatory agencies. 14. RISK MANAGEMENT FRAMEWORK OF ICICI HOME FINANCE COMPANY LIMITED The Board of Directors of the Company is responsible for the oversight and control of the functioning of the Company and approves all major policies and... -

Page 200

... defines product-wise approval limits for various underwriters. The Investment Policy lays down the asset allocation strategy to ensure financial liquidity, security and diversification. The Capital Adequacy and Liquidity Management Policy covers maintenance of adequate level of capital at all times... -

Page 201

... area of investments, the investment risk oversight reporting forms part of the RMC agenda. The company has in place various policies to manage operational risk such as the business continuity plan, information technology security policy, product and process approval guidelines), procedure manuals... -

Page 202

This page is left blank intentionally -

Page 203

On April 1, 2011, Ms. Chanda Kochhar, Managing Director & CEO was awarded the prestigious Padma Bhushan by the President of India -

Page 204

ICICI BANK LIMITED ICICI Bank Towers Bandra-Kurla Complex Mumbai 400 051 www.icicibank.com