Sallie Mae 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• We recognize that, in some cases, loan modifications and other efforts may be insufficient. That is why

Sallie Mae continues to support bankruptcy reform that would permit the discharge of education loans —

both private and federal — after a required period of good faith attempts to repay and that is prospective

so as not to rewrite existing contracts. Any reform should recognize education loans have unique

characteristics and benefits as compared to other consumer loan classes. We do not believe bankruptcy

reform structured along these lines would be detrimental to our business model or future prospects.

Business Segments

We have three primary operating business segments — Consumer Lending, Business Services and FFELP

Loans. A fourth segment — Other, primarily consists of the financial results of our holding company, including

activities related to the repurchase of debt, the corporate liquidity portfolio and all overhead, as well as the results

from smaller wind-down and discontinued operations within this segment.

A summary of financial information for each of our business segments for each of the last three fiscal years

is included in “Note 16 — Segment Reporting” to the consolidated financial statements.

Consumer Lending Segment

In this segment, we originate, acquire, finance and service Private Education Loans. The Private Education

Loans we make are primarily to bridge the gap between the cost of higher education and the amount funded

through financial aid, federal loans or customers’ resources. We will continue to offer loan products to parents

and graduate students where we believe we are competitive with similar federal education loan products. In this

segment, we earn net interest income on the Private Education Loan portfolio (after provision for loan losses) as

well as servicing fees, consisting primarily of late fees. Operating expenses for this segment include costs

incurred to acquire and to service our loans.

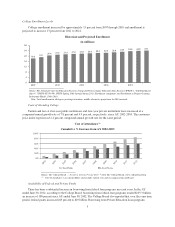

Managed growth of our Private Education Loan portfolio is central not only to our strategy for growing the

Consumer Lending segment but also for the future of Sallie Mae as a whole. In 2012 we originated $3.3 billion

of Private Education Loans, an increase of 22 percent and 45 percent from the years ended December 31, 2011

and 2010, respectively. As of December 31, 2012, 2011 and 2010, we had $36.9 billion, $36.3 billion, and $35.7

of Private Education Loans outstanding, respectively. See Item 7 “Management’s Discussion and Analysis of

Financial Condition and Results of Operations — Business Segment Earnings Summary — ‘Core Earnings’

Basis — Consumer Lending Segment” for a full discussion of our Consumer Lending business and related loan

portfolio.

Private Education Loans bear the full credit risk of the customer and cosigner. We manage this risk by

underwriting and pricing based upon customized credit scoring criteria and the addition of qualified cosigners.

For the year ended December 31, 2012, our annual charge-off rate for Private Education Loans (as a percentage

of loans in repayment) was 3.4 percent, as compared with 3.7 percent for the prior year.

Since the beginning of 2006, virtually all of our Private Education Loans have been originated and funded

by the Bank, a Utah industrial bank subsidiary regulated by the UDFI and the FDIC. At December 31, 2012, the

Bank had total assets of $9.1 billion including $5.5 billion in Private Education Loans. As of the same date, the

Bank had total deposits of $7.8 billion. The Bank relies on both retail and brokered deposits to fund its assets and

periodically sells originated Private Education Loans to affiliates for inclusion in securitization trusts or

collection. The Bank is also a key component of our Campus Solutions, Upromise Rewards and college-savings

product businesses. Sallie Mae and its affiliates provide services and technology support to the Bank through

various service agreements.

Our ability to obtain deposit funding and offer competitive interest rates on deposits will become more

important to sustain the continuing growth of our Private Education Loan portfolio. Our ability to obtain such

funding is also dependent in part on the capital level of the Bank and compliance with other regulatory

requirements applicable to the Bank. At the time of this filing, there are no restrictions on our ability to obtain

7