Sallie Mae 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

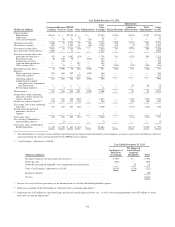

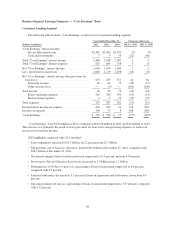

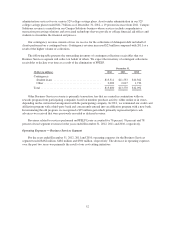

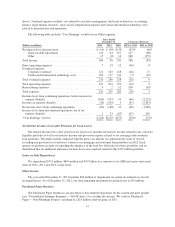

Business Segment Earnings Summary — “Core Earnings” Basis

Consumer Lending Segment

The following table includes “Core Earnings” results for our Consumer Lending segment.

Years Ended December 31, % Increase (Decrease)

(Dollars in millions) 2012 2011 2010 2012 vs. 2011 2011 vs. 2010

“Core Earnings” interest income:

Private Education Loans ...................... $2,481 $2,429 $2,353 2% 3%

Cash and investments ......................... 7 9 14 (22) (36)

Total “Core Earnings” interest income ............... 2,488 2,438 2,367 2 3

Total “Core Earnings” interest expense ............... 825 804 758 3 6

Net “Core Earnings” interest income ................. 1,663 1,634 1,609 2 2

Less: provision for loan losses ...................... 1,008 1,179 1,298 (15) (9)

Net “Core Earnings” interest income after provision for

loan losses ................................... 655 455 311 44 46

Servicing revenue ............................ 46 64 72 (28) (11)

Other income (loss) .......................... — (9) — (100) (100)

Total income .................................... 46 55 72 (16) (24)

Direct operating expenses ..................... 265 304 350 (13) (13)

Restructuring expenses ........................ 2 3 12 (33) (75)

Total expenses .................................. 267 307 362 (13) (15)

Income before income tax expense .................. 434 203 21 114 867

Income tax expense .............................. 156 75 8 108 838

“Core Earnings” ................................ $ 278 $ 128 $ 13 117% 885%

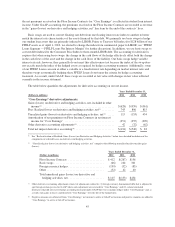

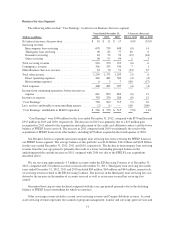

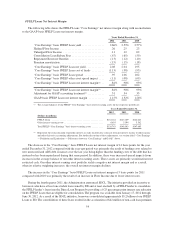

“Core Earnings” were $278 million in 2012, compared with $128 million in 2011 and $13 million in 2010.

This increase was primarily the result of lower provision for loan losses and operating expenses as well as an

increase in net interest income.

2012 highlights compared with 2011 included:

• Loan originations increased to $3.3 billion, up 22 percent from $2.7 billion.

• The portfolio, net of loan loss allowance, totaled $36.9 billion at December 31, 2012, compared with

$36.3 billion at December 31, 2011.

• Net interest margin, before loan loss provision, improved to 4.13 percent, up from 4.09 percent.

• Provision for Private Education Loan losses decreased to 1.0 billion from 1.2 billion.

• Delinquencies of 90 days or more (as a percentage of loans in repayment) improved to 4.6 percent,

compared with 4.9 percent.

• Loans in forbearance decreased to 3.5 percent of loans in repayment and forbearance, down from 4.4

percent.

• The annual charge-off rate (as a percentage of loans in repayment) improved to 3.37 percent, compared

with 3.72 percent.

48