Sallie Mae 2012 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

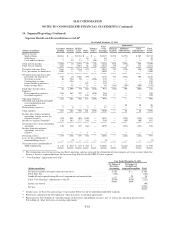

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

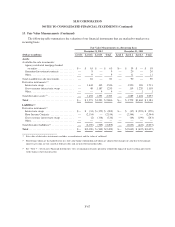

13. Fair Value Measurements (Continued)

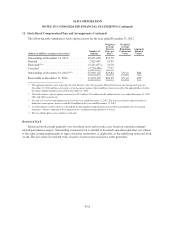

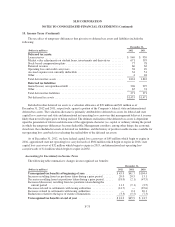

The following table summarizes the fair values of our financial assets and liabilities, including derivative

financial instruments.

December 31, 2012 December 31, 2011

(Dollars in millions)

Fair

Value

Carrying

Value Difference

Fair

Value

Carrying

Value Difference

Earning assets

FFELP Loans ....................... $125,042 $125,612 $ (570) $134,196 $138,130 $ (3,934)

Private Education Loans ............... 36,081 36,934 (853) 33,968 36,290 (2,322)

Cash and investments(1) ................ 9,994 9,994 — 9,789 9,789 —

Total earning assets ................... 171,117 172,540 (1,423) 177,953 184,209 (6,256)

Interest-bearing liabilities

Short-term borrowings ................ 19,861 19,856 (5) 29,547 29,573 26

Long-term borrowings ................ 146,210 152,401 6,191 141,605 154,393 12,788

Total interest-bearing liabilities ......... 166,071 172,257 6,186 171,152 183,966 12,814

Derivative financial instruments

Floor Income Contracts ............... (2,154) (2,154) — (2,544) (2,544) —

Interest rate swaps .................... 1,337 1,337 — 1,463 1,463 —

Cross currency interest rate swaps ....... 1,099 1,099 — 1,116 1,116 —

Other .............................. 4 4 — 1 1 —

Excess of net asset fair value over

carrying value .................... $4,763 $ 6,558

(1) “Cash and investments” includes available-for-sale investments that consist of investments that are primarily agency securities whose cost

basis is $78 million and $85 million at December 31, 2012 and 2011, respectively, versus a fair value of $81 million and $90 million at

December 31, 2012 and 2011, respectively.

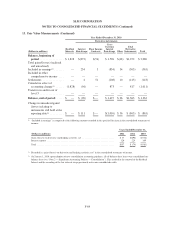

The following includes a discussion of financial instruments whose fair value is included for disclosure

purposes only in the table above along with their level in the fair value hierarchy.

Student Loans

FFELP Loans

Fair values for FFELP Loans were determined by modeling loan cash flows using stated terms of the loans

and internally-developed assumptions. The significant assumptions used to determine fair value are prepayment

speeds, default rates, cost of funds, capital levels, and expected Repayment Borrower Benefits to be earned. In

addition, the Floor Income component of our FFELP Loan portfolio is valued with option models using both

observable market inputs and internally developed inputs. A number of significant inputs into the models are

internally derived and not observable to market participants. While the resulting fair value can be validated

against market transactions where we are a participant, these markets are not considered active. As such, these

are level 3 valuations.

Private Education Loans

Fair values for Private Education Loans were determined by modeling loan cash flows using stated terms of

the loans and internally-developed assumptions. The significant assumptions used to determine fair value are

F-71