Sallie Mae 2012 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. Restructuring Activities (Continued)

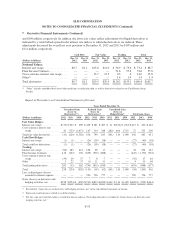

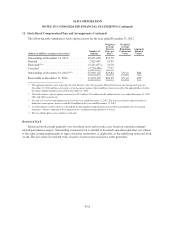

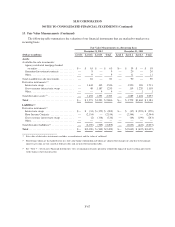

The following table summarizes the restructuring expenses incurred to date.

(Dollars in millions)

Years Ended

December 31,

Cumulative Expense

as of December 31,

2012 2011 2010 2012

Severance costs .............................................. $ 9 $ 6 $81 $178

Lease and other contract termination costs ......................... 1 — 1 12

Exit and other costs ........................................... 2 3 3 20

Total restructuring expenses from continuing operations(1) ............ 12 9 85 210

Total restructuring expenses from discontinued operations ............ 1 — 6 30

Total ....................................................... $13 $ 9 $91 $240

(1) Aggregate restructuring expenses from continuing operations incurred across our reportable segments are disclosed in “Note 16—

Segment Reporting.”

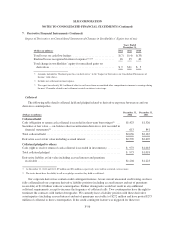

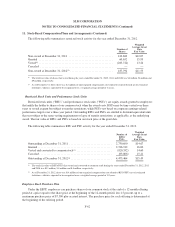

Since the fourth quarter of 2007 through December 31, 2012, cumulative severance costs were incurred in

conjunction with aggregate completed and planned position eliminations of approximately 5,500 positions.

Position eliminations were across all of our reportable segments, ranging from senior executives to servicing

center personnel. Lease and other contract termination costs and exit and other costs incurred during 2012, 2011

and 2010 related primarily to terminated or abandoned facility leases and consulting costs incurred in

conjunction with various cost reduction and exit strategies.

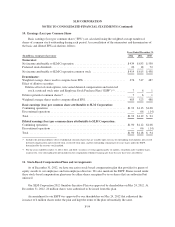

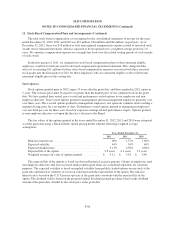

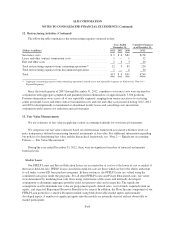

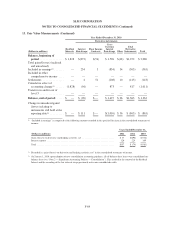

13. Fair Value Measurements

We use estimates of fair value in applying various accounting standards for our financial statements.

We categorize our fair value estimates based on a hierarchical framework associated with three levels of

price transparency utilized in measuring financial instruments at fair value. For additional information regarding

our policies for determining fair value and the hierarchical framework, see “Note 2 — Significant Accounting

Policies — Fair Value Measurement.”

During the year ended December 31, 2012, there were no significant transfers of financial instruments

between levels.

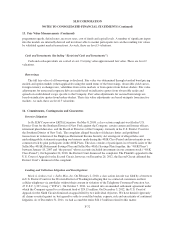

Student Loans

Our FFELP Loans and Private Education Loans are accounted for at cost or at the lower of cost or market if

the loan is held-for-sale. FFELP Loans classified as held-for-sale are those which we have the ability and intent

to sell under various ED loan purchase programs. In these instances, the FFELP Loans are valued using the

committed sales price under the programs. For all other FFELP Loans and Private Education Loans, fair values

were determined by modeling loan cash flows using stated terms of the assets and internally-developed

assumptions to determine aggregate portfolio yield, net present value and average life. The significant

assumptions used to determine fair value are prepayment speeds, default rates, cost of funds, required return on

equity, and expected Repayment Borrower Benefits to be earned. In addition, the Floor Income component of our

FFELP Loan portfolio is valued with option models using both observable market inputs and internally

developed inputs. A number of significant inputs into the models are internally derived and not observable to

market participants.

F-64