Sallie Mae 2012 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Stock-Based Compensation Plans and Arrangements (Continued)

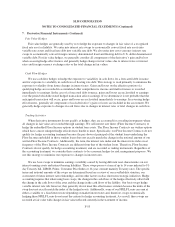

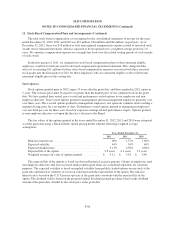

The fair values of the stock purchase rights of the ESPP offerings were calculated using a Black-Scholes

option pricing model with the following weighted average assumptions.

Years Ended December 31,

2012 2011 2010

Risk-free interest rate ...................................... .13% .27% .33%

Expected volatility ......................................... 29% 42% 61%

Expected dividend rate ..................................... 3.27% 1.87% 0.00%

Expected life of the option .................................. 1year 1 year 1 year

Weighted average fair value of stock purchase rights .............. $ 3.01 $ 3.63 $ 3.30

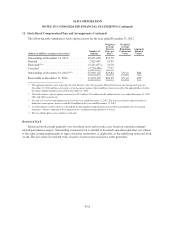

The expected volatility is based on implied volatility from publicly-traded options on our stock at the grant

date and historical volatility of our stock consistent with the expected life. The risk-free interest rate is based on

the U.S. Treasury spot rate at the grant date consistent with the expected life. The dividend yield is based on the

projected annual dividend payment per share based on the current dividend amount at the grant date divided by

the stock price at the grant date.

The fair values were amortized to compensation cost on a straight-line basis over a one-year vesting period.

As of December 31, 2012, there was $.1 million of unrecognized compensation cost related to the ESPP net of

estimated forfeitures, which is expected to be recognized in January 2013.

During the years ended December 31, 2012, 2011 and 2010, plan participants purchased 192,755 shares,

278,266 shares and 205,528 shares, respectively, of our common stock.

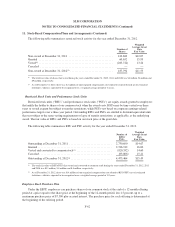

12. Restructuring Activities

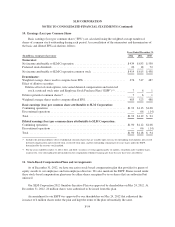

Restructuring expenses of $13 million, $9 million and $91 million were recorded in the years ended

December 31, 2012, 2011 and 2010, respectively. Of these amounts, $12 million, $9 million and $85 million was

recognized in continuing operations and $1 million, $0 and $6 million was recognized in discontinued operations,

respectively. The following details our restructuring efforts:

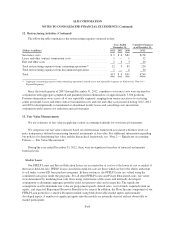

• On March 30, 2010, President Obama signed into law H.R. 4872, HCERA, which included the SAFRA

Act. Effective July 1, 2010, the legislation eliminated the authority to provide new loans under FFELP

and required all new federal loans to be made through the DSLP. The new law did not alter or affect

the terms and conditions of existing FFELP Loans. We have restructured our operations in response to

this change in law which resulted in a significant reduction of operating costs due to the elimination of

positions and facilities associated with the origination of FFELP Loans. Restructuring expenses

associated with this plan were $12 million, $9 million, and $84 million for the years ended

December 31, 2012, 2011, and 2010. Restructuring costs under this plan are substantially complete at

this time.

• In response to the College Cost Reduction and Access Act of 2007 (“CCRAA”) and challenges in the

capital markets, we initiated a restructuring plan in the fourth quarter of 2007. This plan focused on

conforming our lending activities to the economic environment, exiting certain customer relationships

and product lines, winding down or otherwise disposing of our debt Purchased Paper businesses, and

significantly reducing our operating expenses. This restructuring plan was essentially completed in the

fourth quarter of 2009. Under this plan, there were $1 million, $0 and $7 million of restructuring

expenses for the years ended December 31, 2012, 2011, and 2010.

F-63