Sallie Mae 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

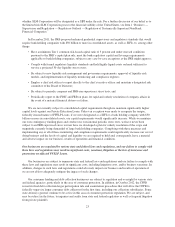

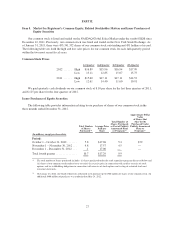

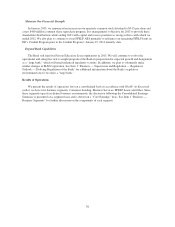

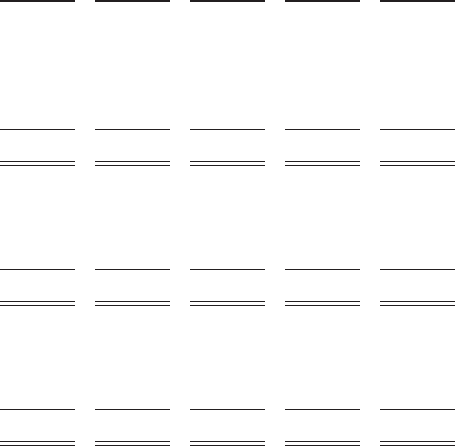

Item 6. Selected Financial Data

Selected Financial Data 2008-2012

(Dollars in millions, except per share amounts)

The following table sets forth our selected financial and other operating information prepared in accordance

with GAAP. The selected financial data in the table is derived from our consolidated financial statements. The

data should be read in conjunction with the consolidated financial statements, related notes, and Item 7

“Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

2012 2011 2010 2009 2008

Operating Data:

Net interest income ............................ $ 3,208 $ 3,529 $ 3,479 $ 1,723 $ 1,365

Net income (loss) attributable to SLM Corporation:

Continuing operations, net of tax ............. $ 938 $ 600 $ 597 $ 544 $ 2

Discontinued operations, net of tax ........... 1 33 (67) (220) (215)

Net income (loss) attributable to SLM Corporation . . $ 939 $ 633 $ 530 $ 324 $ (213)

Basic earnings (loss) per common share attributable to

SLM Corporation:

Continuing operations ..................... $ 1.93 $ 1.13 $ 1.08 $ .85 $ (.23)

Discontinued operations .................... — .06 (.14) (.47) (.46)

Total ....................................... $ 1.93 $ 1.19 $ .94 $ .38 $ (.69)

Diluted earnings (loss) per common share attributable

to SLM Corporation:

Continuing operations ..................... $ 1.90 $ 1.12 $ 1.08 $ .85 $ (.23)

Discontinued operations .................... — .06 (.14) (.47) (.46)

Total ....................................... $ 1.90 $ 1.18 $ .94 $ .38 $ (.69)

Dividends per common share attributable to SLM

Corporation common shareholders ............. $ .50 $ .30 $ — $ — $ —

Return on common stockholders’ equity ........... 21% 14% 13% 5% (9)%

Net interest margin ............................ 1.78 1.85 1.82 1.05 .93

Return on assets .............................. .52 .33 .28 .20 (.14)

Dividend payout ratio .......................... 26 25 — — —

Average equity/average assets ................... 2.69 2.54 2.47 2.96 3.45

Balance Sheet Data:

Student loans, net ............................. $162,546 $174,420 $184,305 $143,807 $144,802

Total assets .................................. 181,260 193,345 205,307 169,985 168,768

Total borrowings ............................. 172,257 183,966 197,159 161,443 160,158

Total SLM Corporation stockholders’ equity ....... 5,060 5,243 5,012 5,279 4,999

Book value per common share ................... 9.92 9.20 8.44 8.05 7.03

Other Data:

Off-balance sheet securitized student loans, net ..... $ — $ — $ — $ 32,638 $ 35,591

29