Sallie Mae 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our Consolidated Financial

Statements and related Notes included elsewhere in this Annual Report on Form 10-K. This discussion and

analysis also contains forward-looking statements and should also be read in conjunction with the disclosures

and information contained in “Forward-Looking and Cautionary Statements” and Item 1A “Risk Factors” in

this Annual Report on Form 10-K.

Through this discussion and analysis, we intend to provide the reader with some narrative context for how

our management views our consolidated financial statements, additional context within which to assess our

operating results, and information on the quality and variability of our earnings, liquidity and cash flows.

Overview

Our primary business is to originate, service and collect loans we make to students and their families to

finance the cost of education. The core of our marketing strategy is to generate student loan originations by

promoting our products on campus through the financial aid office and through direct marketing to students and

their families. We also provide servicing, loan default aversion and defaulted loan collection services for loans

owned by other institutions, including ED, as well as providing processing capabilities to educational institutions,

529 college-savings plan program management services and a consumer savings network.

In addition we are the largest holder, servicer and collector of loans made under FFELP, a program that was

discontinued in 2010.

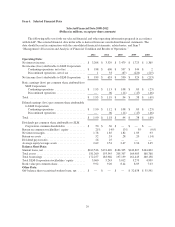

We monitor and assess our ongoing operations and results based on the following four reportable segments:

(1) Consumer Lending, (2) Business Services, (3) FFELP Loans and (4) Other.

Consumer Lending Segment

In this segment, we originate, acquire, finance and service Private Education Loans. The Private Education

Loans we make are primarily to bridge the gap between the cost of higher education and the amount funded

through financial aid, federal loans or customers’ resources. In this segment, we earn net interest income on the

Private Education Loan portfolio (after provision for loan losses) as well as servicing fees, primarily late fees.

Business Services Segment

Our Business Services segment generates the majority of its revenue from servicing our FFELP Loan

portfolio. We also provide servicing, loan default aversion and defaulted loan collection services for loans on

behalf of Guarantors of FFELP Loans and other institutions, including ED, as well as processing capabilities to

educational institutions and 529 college-savings plan programs. We also operate a consumer savings network

that provides financial rewards on everyday purchases to help families save for college.

FFELP Loans Segment

Our FFELP Loans segment consists of our $125.6 billion FFELP Loan portfolio and underlying debt and

capital funding these loans. Even though FFELP Loans are no longer originated we continue to seek to acquire

FFELP Loan portfolios to leverage our servicing scale to generate incremental earnings and cash flow. This

segment is expected to generate significant amounts of cash as the FFELP portfolio amortizes.

30