Sallie Mae 2012 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stafford Loan Program

For Stafford Loans, the HEA provided for:

• federal reimbursement of Stafford Loans made by eligible lenders to qualified students;

• federal interest subsidy payments on Subsidized Stafford Loans paid by ED to holders of the loans in lieu

of the borrowers’ making interest payments during in-school, grace and deferment periods; and

• Special Allowance Payments representing an additional subsidy paid by ED to the holders of eligible

Stafford Loans.

We refer to all three types of assistance as “federal assistance.”

The HEA also permits, and in some cases requires, “forbearance” periods from loan collection in some

circumstances. Interest that accrues during forbearance is never subsidized. Interest that accrues during

deferment periods may be subsidized.

PLUS and Supplemental Loans to Students (“SLS”) Loan Programs

The HEA authorizes PLUS Loans to be made to graduate or professional students (effective July 1, 2006) and

parents of eligible dependent students and previously authorized SLS Loans to be made to the categories of

students subsequently served by the Unsubsidized Stafford Loan program. Borrowers who have no adverse credit

history or who are able to secure an endorser without an adverse credit history are eligible for PLUS Loans, as

well as some borrowers with extenuating circumstances. The federal assistance applicable to PLUS and SLS

Loans are similar to those of Stafford Loans. However, interest subsidy payments are not available under the

PLUS and SLS programs and, in some instances, Special Allowance Payments are more restricted.

The annual and aggregate amounts of PLUS Loans were limited only to the difference between the cost of the

student’s education and other financial aid received, including scholarship, grants and other student loans.

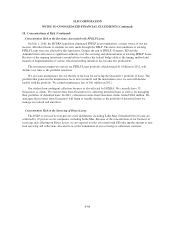

Consolidation Loan Program

The enactment of HCERA ended new originations under the FFELP consolidation program, effective July 1,

2010. Previously, the HEA authorized a program under which borrowers may consolidate one or more of their

student loans into a single FFELP Consolidation Loan that is insured and reinsured on a basis similar to Stafford

and PLUS Loans. FFELP Consolidation Loans were made in an amount sufficient to pay outstanding principal,

unpaid interest, late charges and collection costs on all federally reinsured student loans incurred under the

FFELP that the borrower selects for consolidation, as well as loans made under various other federal student loan

programs and loans made by different lenders. In general, a borrower’s eligibility to consolidate their federal

student loans ends upon receipt of a Consolidation Loan. With the end of new FFELP originations, borrowers

with multiple loans, including FFELP loans, may only consolidate their loans in the DSLP. For additional

information regarding the Consolidation Loan Program, see Appendix A to our 2010 Form 10-K.

Guaranty Agencies under the FFELP

Under the FFELP, guaranty agencies insured FFELP loans made by eligible lending institutions, paying claims

from “federal student loan reserve funds.” These loans are insured as to 100 percent of principal and accrued

interest against death or discharge. FFELP loans are also insured against default, with the percent insured

dependent on the date of the loans disbursement. For loans that were made before October 1, 1993, lenders are

insured for 100 percent of the principal and unpaid accrued interest. From October 1, 1993 to June 30, 2006,

lenders are insured for 98 percent of principal and all unpaid accrued interest. Insurance for loans made on or

after July 1, 2006 was reduced from 98 percent to 97 percent.

A-3