Sallie Mae 2012 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6. Borrowings (Continued)

the brokered Certificate of Deposit (“CD”) market and through direct retail deposit channels. As of December 31,

2012, bank deposits totaled $7.8 billion of which $4.1 billion were brokered term deposits, $3.2 billion were

retail and other deposits and $0.4 billion were deposits from affiliates that eliminate in our consolidated balance

sheet. Cash and liquid investments totaled $1.6 billion as of December 31, 2012.

In addition to its deposit base, the Bank has borrowing capacity with the Federal Reserve Bank (“FRB”)

through a collateralized lending facility. FRB is not obligated to lend; however, in general we can borrow as long

as the Bank is generally in sound financial condition. Borrowing capacity is limited by the availability of

acceptable collateral. As of December 31, 2012, borrowing capacity was approximately $945 million and there

were no outstanding borrowings.

Senior Unsecured Debt

We issued $2.7 billion, $2.0 billion and $1.5 billion of unsecured debt in the years ended December 31,

2012, 2011 and 2010, respectively.

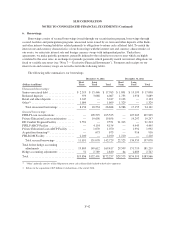

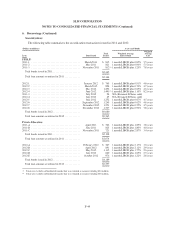

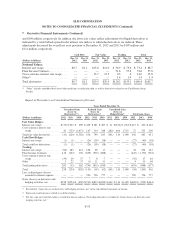

Debt Repurchases

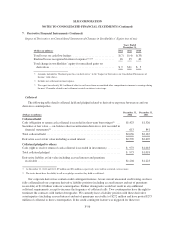

The following table summarizes activity related to our senior unsecured debt and ABS repurchases. “Gains

on debt repurchases” is shown net of hedging-related gains and losses.

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

Debt principal repurchased ....................................... $711 $894 $4,868

Gains on debt repurchases ....................................... 145 38 317

7. Derivative Financial Instruments

Risk Management Strategy

We maintain an overall interest rate risk management strategy that incorporates the use of derivative

instruments to minimize the economic effect of interest rate changes. Our goal is to manage interest rate

sensitivity by modifying the repricing frequency and underlying index characteristics of certain balance sheet

assets and liabilities so the net interest margin is not, on a material basis, adversely affected by movements in

interest rates. We do not use derivative instruments to hedge credit risk associated with debt we issued. As a

result of interest rate fluctuations, hedged assets and liabilities will appreciate or depreciate in market value.

Income or loss on the derivative instruments that are linked to the hedged assets and liabilities will generally

offset the effect of this unrealized appreciation or depreciation for the period the item is being hedged. We view

this strategy as a prudent management of interest rate sensitivity. In addition, we utilize derivative contracts to

minimize the economic impact of changes in foreign currency exchange rates on certain debt obligations that are

denominated in foreign currencies. As foreign currency exchange rates fluctuate, these liabilities will appreciate

and depreciate in value. These fluctuations, to the extent the hedge relationship is effective, are offset by changes

in the value of the cross-currency interest rate swaps executed to hedge these instruments. Management believes

certain derivative transactions entered into as hedges, primarily Floor Income Contracts, basis swaps and

Eurodollar futures contracts, are economically effective; however, those transactions generally do not qualify for

hedge accounting under GAAP (as discussed below) and thus may adversely impact earnings.

F-51