Sallie Mae 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207

|

|

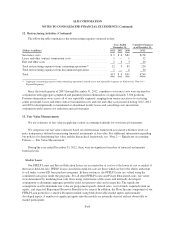

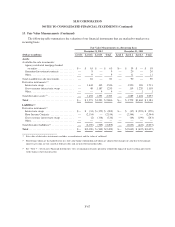

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

13. Fair Value Measurements (Continued)

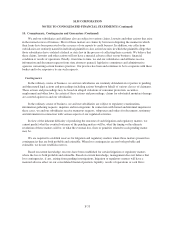

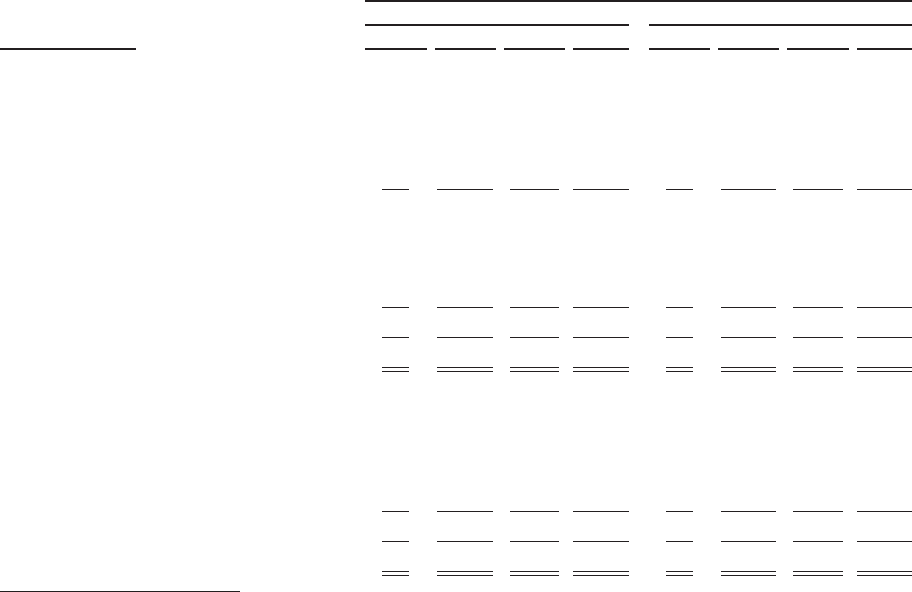

The following table summarizes the valuation of our financial instruments that are marked-to-market on a

recurring basis.

Fair Value Measurements on a Recurring Basis

December 31, 2012 December 31, 2011

(Dollars in millions) Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Assets

Available-for-sale investments:

Agency residential mortgage-backed

securities ............................ $— $ 63 $ — $ 63 $— $ 59 $ — $ 59

Guaranteed investment contracts ........... — 9 — 9 — 20 — 20

Other ................................. — 9 — 9 — 11 — 11

Total available-for-sale investments .......... — 81 — 81 — 90 — 90

Derivative instruments:(1)

Interest rate swaps ...................... — 1,444 102 1,546 — 1,550 183 1,733

Cross currency interest rate swaps .......... — 48 1,187 1,235 — 139 1,220 1,359

Other ................................. — — 4 4 — — 1 1

Total derivative assets(3) .................... — 1,492 1,293 2,785 — 1,689 1,404 3,093

Total ................................... $— $1,573 $1,293 $ 2,866 $— $ 1,779 $1,404 $ 3,183

Liabilities(2)

Derivative instruments(1)

Interest rate swaps ...................... $— $ (34) $ (175) $ (209) $— $ (47) $ (223) $ (270)

Floor Income Contracts .................. — (2,154) — (2,154) — (2,544) — (2,544)

Cross currency interest rate swaps .......... — (2) (134) (136) — (44) (199) (243)

Other ................................. — — — — — — — —

Total derivative liabilities(3) ................. — (2,190) (309) (2,499) — (2,635) (422) (3,057)

Total ................................... $— $(2,190) $ (309) $(2,499) $— $(2,635) $ (422) $(3,057)

(1) Fair value of derivative instruments excludes accrued interest and the value of collateral.

(2) Borrowings which are the hedged items in a fair value hedge relationship and which are adjusted for changes in value due to benchmark

interest rates only are not carried at full fair value and are not reflected in this table.

(3) See “Note 7 — Derivative Financial Instruments” for a reconciliation of gross positions without the impact of master netting agreements

to the balance sheet classification.

F-67