Sallie Mae 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I.

Item 1. Business

SLM Corporation, more commonly known as Sallie Mae, is the nation’s leading saving, planning and

paying for education company. For 40 years, Sallie Mae has made a difference in students’ and families’ lives,

helping more than 31 million Americans pay for college. We recognize there is no single way to achieve this

task, so we provide a range of products to help families whether college is a long way off or right around the

corner. Sallie Mae promotes responsible financial habits that help our customers dream, invest and succeed.

Our primary business is to originate, service and collect loans we make to students and their families to

finance the cost of their education. Since July 2010 we have originated only Private Education Loans. We use

“Private Education Loans” to mean education loans to students or their families that are non-federal loans and

loans not insured or guaranteed under the previously existing Federal Family Education Loan Program

(“FFELP”). The core of our marketing strategy is to generate student loan originations by promoting our products

on campus through the financial aid office and through direct marketing to students and their families. Since the

beginning of 2006, virtually all of our Private Education Loans have been originated and funded by Sallie Mae

Bank, a Utah industrial bank subsidiary (the “Bank”), regulated by the Utah Department of Financial Institutions

(“UDFI”) and the Federal Deposit Insurance Corporation (“FDIC”). We also provide servicing, loan default

aversion and defaulted loan collection services for loans owned by other institutions, including the U.S.

Department of Education (“ED”), as well as processing capabilities to educational institutions and 529 college-

savings plan programs. We also operate a consumer savings network that provides financial rewards on everyday

purchases to help families save for college.

In addition, we are the largest holder, servicer and collector of loans made under the previously existing

FFELP. The majority of our income continues to be derived, directly or indirectly, from our portfolio of FFELP

Loans and servicing we provide for FFELP Loans. In 2010, Congress passed legislation ending the origination of

education loans under the FFELP program. The terms and conditions of existing FFELP Loans were not affected

by this legislation. Our FFELP Loan portfolio will amortize over approximately 20 years. The fee income we

earn from providing servicing and contingent collections services on such loans will similarly decline over time.

For a full description of FFELP, see Appendix A “Federal Family Education Loan Program.”

At December 31, 2012, we had approximately 6,800 employees.

Private Education Loan Market

Key Drivers of Private Education Loan Market Growth

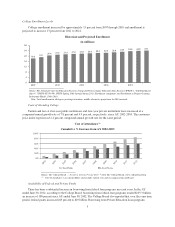

The size of the Private Education Loan market is based on three primary factors: college enrollment levels,

the costs of attending college and the availability of funds from the federal government to pay for a college

education. If the cost of education continues to increase at a pace that exceeds income and savings growth and

the availability of federal funds does not significantly increase, we expect more students and families to borrow

privately. We believe the credit market dislocation of 2008 and 2009 and the elimination of FFELP were largely

responsible for lenders exiting the Private Education Loan business. For Academic Year (“AY”) 2011-2012,

Private Education Loans were primarily originated by Sallie Mae, six of the country’s largest banks and

numerous credit unions.

2