Sallie Mae 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

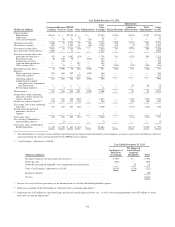

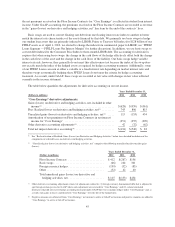

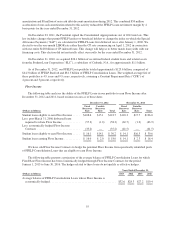

Reclassification of Realized Gains (Losses) on Derivative and Hedging Activities

Derivative accounting requires net settlement income/expense on derivatives and realized gains/losses

related to derivative dispositions (collectively referred to as “realized gains (losses) on derivative and hedging

activities”) that do not qualify as hedges to be recorded in a separate income statement line item below net

interest income. Under our “Core Earnings” presentation, these gains and losses are reclassified to the income

statement line item of the economically hedged item. For our “Core Earnings” net interest margin, this would

primarily include: (a) reclassifying the net settlement amounts related to our Floor Income Contracts to student

loan interest income and (b) reclassifying the net settlement amounts related to certain of our basis swaps to debt

interest expense. The table below summarizes the realized losses on derivative and hedging activities and the

associated reclassification on a “Core Earnings” basis.

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

Reclassification of realized gains (losses) on derivative and hedging activities:

Net settlement expense on Floor Income Contracts reclassified to net interest

income ............................................................ $(858) $(902) $(888)

Net settlement income on interest rate swaps reclassified to net interest income ..... 115 71 69

Foreign exchange derivative gains/(losses) reclassified to other income ........... — — —

Net realized gains (losses) on terminated derivative contracts reclassified to other

income ............................................................ — 25 4

Total reclassifications of realized losses on derivative and hedging activities ....... $(743) $(806) $(815)

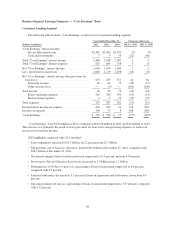

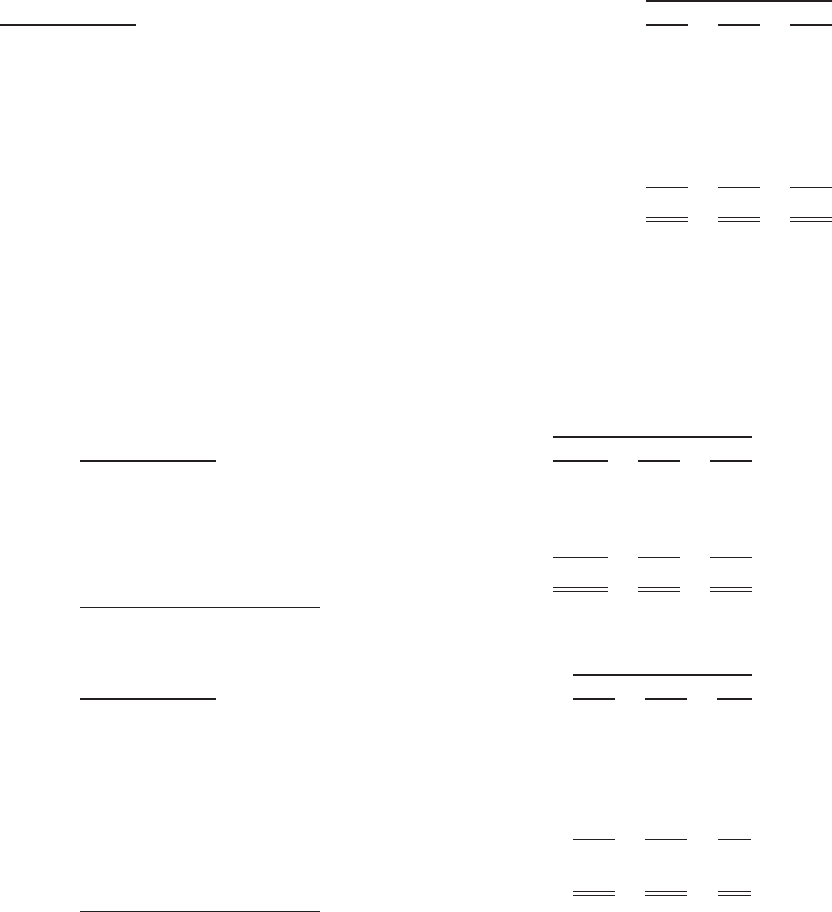

Cumulative Impact of Derivative Accounting under GAAP compared to “Core Earnings”

As of December 31, 2012, derivative accounting has reduced GAAP equity by approximately $1.1 billion as

a result of cumulative net unrealized net losses (after tax) recognized under GAAP, but not in “Core Earnings.”

The following table rolls forward the cumulative impact to GAAP equity due to these unrealized net losses

related to derivative accounting.

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

Beginning impact of derivative accounting on GAAP

equity .......................................... $ (977) $(676) $(737)

Net impact of net unrealized gains/(losses) under derivative

accounting(1) .................................... (103) (301) 61

Ending impact of derivative accounting on GAAP equity . . . $(1,080) $(977) $(676)

(1) Net impact of net unrealized gains (losses) under derivative accounting is composed of the following:

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

Total pre-tax net impact of derivative accounting recognized in

net income(a) ....................................... $(194) $(540) $ 83

Tax impact of derivative accounting adjustment recognized in

net income ........................................ 82 208 (27)

Change in unrealized gains on derivatives, net of tax recognized

in Other Comprehensive Income ....................... 9 31 5

Net impact of net unrealized gains (losses) under derivative

accounting ........................................ $(103) $(301) $ 61

(a) See “ ‘Core Earnings’ derivative adjustments” table above.

46