Sallie Mae 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the net premiums received on the Floor Income Contracts for “Core Earnings” is reflected in student loan interest

income. Under GAAP accounting, the premiums received on the Floor Income Contracts are recorded as revenue

in the “gains (losses) on derivative and hedging activities, net” line item by the end of the contracts’ lives.

Basis swaps are used to convert floating rate debt from one floating interest rate index to another to better

match the interest rate characteristics of the assets financed by that debt. We primarily use basis swaps to hedge

our student loan assets that are primarily indexed to LIBOR, Prime or Treasury bill index (for $128 billion of our

FFELP assets as of April 1, 2012, we elected to change the index from commercial paper to LIBOR; see “FFELP

Loans Segment — FFELP Loans Net Interest Margin” for further discussion). In addition, we use basis swaps to

convert debt indexed to the Consumer Price Index to three-month LIBOR debt. The accounting for derivatives

requires that when using basis swaps, the change in the cash flows of the hedge effectively offset both the change

in the cash flows of the asset and the change in the cash flows of the liability. Our basis swaps hedge variable

interest rate risk; however, they generally do not meet this effectiveness test because the index of the swap does

not exactly match the index of the hedged assets as required for hedge accounting treatment. Additionally, some

of our FFELP Loans can earn at either a variable or a fixed interest rate depending on market interest rates and

therefore swaps economically hedging these FFELP Loans do not meet the criteria for hedge accounting

treatment. As a result, under GAAP, these swaps are recorded at fair value with changes in fair value reflected

currently in the income statement.

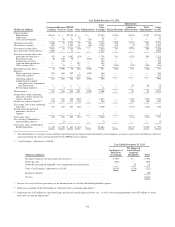

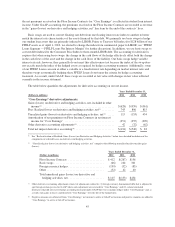

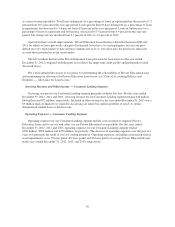

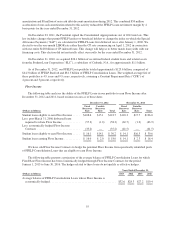

The table below quantifies the adjustments for derivative accounting on our net income.

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

“Core Earnings” derivative adjustments:

Gains (losses) on derivative and hedging activities, net, included in other

income(1) .................................................. $(628) $(959) $(361)

Plus: Realized losses on derivative and hedging activities, net(1) ......... 743 806 815

Unrealized gains (losses) on derivative and hedging activities, net(2) ..... 115 (153) 454

Amortization of net premiums on Floor Income Contracts in net interest

income for “Core Earnings” ................................... (351) (355) (309)

Other derivative accounting adjustments(3) .......................... 42 (32) (62)

Total net impact derivative accounting(4) ........................... $(194) $(540) $ 83

(1) See “Reclassification of Realized Gains (Losses) on Derivative and Hedging Activities” below for a detailed breakdown of the

components of realized losses on derivative and hedging activities.

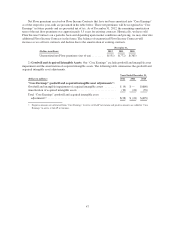

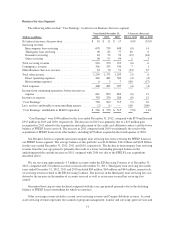

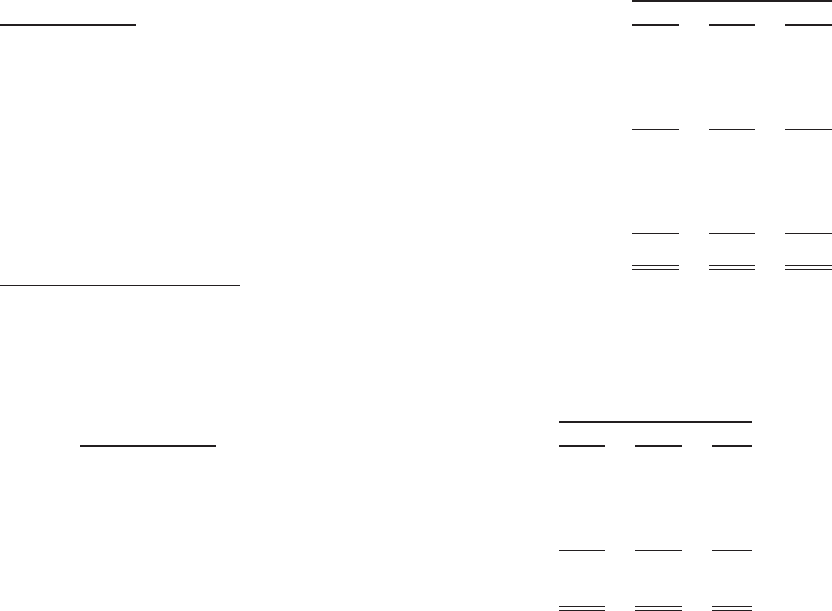

(2) “Unrealized gains (losses) on derivative and hedging activities, net” comprises the following unrealized mark-to-market gains

(losses):

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

Floor Income Contracts ......................... $412 $(267) $156

Basis swaps ................................... (66) 104 341

Foreign currency hedges ......................... (199) (32) (83)

Other ........................................ (32) 42 40

Total unrealized gains (losses) on derivative and

hedging activities, net ......................... $115 $(153) $454

(3) Other derivative accounting adjustments consist of adjustments related to: (1) foreign currency denominated debt that is adjusted to

spot foreign exchange rates for GAAP where such adjustment are reversed for “Core Earnings” and (2) certain terminated

deriviatves that did not receive hedge accounting treatment under GAAP but were economic hedges under “Core Earnings” and, as

a result, such gains or losses amortized into “Core Earnings” over the life of the hedged item.

(4) Negative amounts are subtracted from “Core Earnings” net income to arrive at GAAP net income and positive amounts are added to

“Core Earnings” to arrive at GAAP net income.

45