Sallie Mae 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

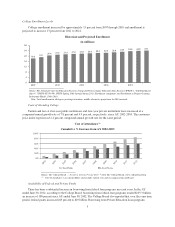

increased 7 percent in AY 2011-12 to an estimated $6.4 billion; an increase of 28 percent above AY 2001-2002

levels. We believe the drop in borrowing from Private Education Loan programs from the peak of $21 billion in AY

2007-2008 has been caused in large measure by increases in federal loan limits and the availability of federal funds,

as well as the strengthening of Private Education Loan underwriting standards.

Students and their families can borrow money directly from the federal government to pay for all or part of

college education costs under the Direct Student Loan Program (“DSLP”). The loans can be used to cover the

total cost of attendance. Currently, a dependent undergraduate student can borrow from $5,500 to

$7,500 annually, depending on their class level. An independent undergraduate student can borrow from

$9,500 to $12,500 annually, depending on their class level. Graduate students and parents of undergraduate

students can borrow up to the full cost of attendance. All federal education loans allow deferment of loan

payments while the student is in school. Rising enrollment levels, college costs and borrowing limits have caused

federal student loan programs to grow at a 10-year annual growth rate of 11 percent. The number of borrowers

using DSLP is further expected to increase three percent per year over the next three years.

Private Education Loans in Context

Private Education Loans help students and families fill the gap between their own resources, financial aid,

federal education loans, and the total cost of college. Historically, Private Education Loans have not replaced

federal aid and education loans. However, the interplay between federal and Private Education Loans, their

respective terms and conditions and interest rate structures has changed significantly over time. Most notably,

over time, federal education lending has expanded to include loans to graduate students and parents of

undergraduate students sufficient to cover the full cost of college and graduate school attendance. We believe the

evolution of our Private Education Loan products should allow us to effectively compete on interest rates and

terms with these particular federal education loan offerings.

On July 20, 2012, the Consumer Financial Protection Bureau (the “CFPB”) and ED released their joint report on

the Private Student Loan

(1)

industry (the “Report”) as required by the Dodd-Frank Wall Street Reform and Consumer

Protection Act of 2010 (the “Dodd-Frank Act”). While the Report criticized past practices in the private education

loan market, most notably in the timeframe prior to the 2008 global financial crisis, it also recognized the important

role Private Education Loans play in funding higher education as well as significant improvements in recent years in

the quality of underwriting, extensive protections provided by federal consumer protection laws and detailed,

required disclosures related to these loans. The Report compares federal education loans, which may be obtained

without regard to the borrowers’ creditworthiness and provide numerous adjustments for borrowers who have

difficulty making repayments, with underwritten Private Education Loans whose terms and conditions, such as

default status, are often specified by applicable consumer banking laws and regulations. We remain committed to

offer responsible Private Education Loan products to families and students. Since 2009, we have

• voluntarily required school certification of both the need for, and the amount of, all of our Private

Education Loans;

• introduced our Smart Option Student Loan product to emphasize payments while in school and to shorten

repayment terms based on loan amounts and class level;

• obtained cosigners on an average of 90 percent of all Private Education Loans originated; and

• offered through our rate reduction program, temporary relief to assist customers having difficulty making

payments on their Private Education Loans.

In addition, we provide many repayment options — reduced monthly payments, interest-only payments,

extended repayment schedules, temporary interest rate reductions and, if appropriate, forbearance — all scaled to

a customer’s individual circumstances and ability. These programs, much like the adjustments available to

customers under federal student loans, must be used wisely given their potential to significantly increase the

overall costs of education financing to customers.

(1) The Report addresses “Private Student Loans” as defined in Section 140 of the Truth in Lending Act

(15 USC§1650). Our Private Education Loans made for higher education purposes are within the Report’s scope.

4