Sallie Mae 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

securitizing these loans to term through securitization trusts. However, existing FFELP ABCP and FHLB-DM

Facility capacities, as well as additional capital markets funding sources may be needed to complete our

objectives on a timely basis.

Since December 31, 2010, we have refinanced approximately $9.4 billion in principal amount of our FFELP

Loans previously financed through the ED Conduit Program, most being funded to term through the use of

securitization trusts. As of December 31, 2012, we have $9.5 billion in principal amount of FFELP Loans

remaining in the ED Conduit Program. If we cannot obtain sufficient cost-effective funding to finance any or all

of the FFELP Loans remaining in the ED Conduit Program on or before the ED Maturity Date, any remaining

FFELP Loans still in the program must be put to ED at 97 percent of their principal balance which results in us

forfeiting three percent of the principal amount of those loans. In addition, we will also no longer collect future

servicing revenues or interest income on any loans put to ED.

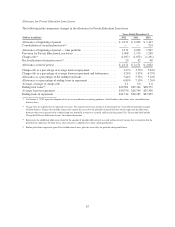

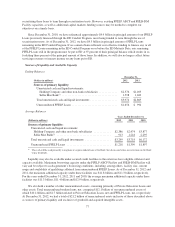

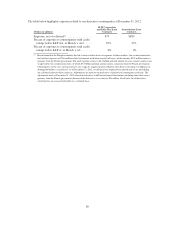

Sources of Liquidity and Available Capacity

Ending Balances

December 31,

(Dollars in millions) 2012 2011

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Holding Company and other non-bank subsidiaries ............. $2,376 $1,403

Sallie Mae Bank(1) ....................................... 1,598 1,462

Total unrestricted cash and liquid investments ................... $3,974 $2,865

Unencumbered FFELP Loans ................................ $1,656 $ 994

Average Balances

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Holding Company and other non-bank subsidiaries ............ $2,386 $2,474 $3,877

Sallie Mae Bank(1) ...................................... 913 1,244 2,295

Total unrestricted cash and liquid investments .................. $3,299 $3,718 $6,172

Unencumbered FFELP Loans ............................... $1,218 $1,399 $1,897

(1) This cash will be used primarily to originate or acquire student loans at the Bank. See discussion below on restrictions on the Bank

to pay dividends.

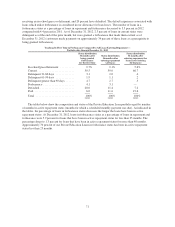

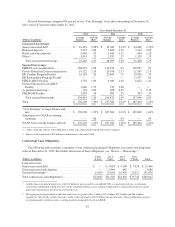

Liquidity may also be available under secured credit facilities to the extent we have eligible collateral and

capacity available. Maximum borrowing capacity under the FFELP ABCP Facility and FHLB-DM Facility will

vary and be subject to each agreement’s borrowing conditions, including, among others, facility size, current

usage and availability of qualifying collateral from unencumbered FFELP Loans. As of December 31, 2012 and

2011, the maximum additional capacity under these facilities was $11.8 billion and $11.3 billion, respectively.

For the years ended December 31, 2012, 2011 and 2010, the average maximum additional capacity under these

facilities was $11.3 billion, $11.4 billion and $12.9 billion, respectively.

We also hold a number of other unencumbered assets, consisting primarily of Private Education Loans and

other assets. Total unencumbered student loans, net, comprised $12.1 billion of our unencumbered assets of

which $10.4 billion and $1.7 billion related to Private Education Loans, net and FFELP Loans, net, respectively.

At December 31, 2012, we had a total of $21.2 billion of unencumbered assets inclusive of those described above

as sources of primary liquidity and exclusive of goodwill and acquired intangible assets.

77