Sallie Mae 2012 Annual Report Download - page 85

Download and view the complete annual report

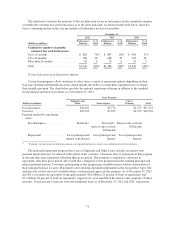

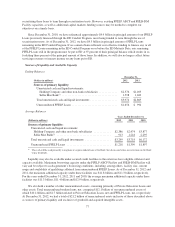

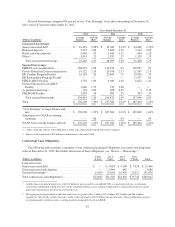

Please find page 85 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Unrecognized tax benefits were $33 million and $40 million for the years ended December 31, 2012 and

2011, respectively. For additional information, see “Note 15 — Income Taxes.”

Critical Accounting Policies and Estimates

Management’s Discussion and Analysis of Financial Condition and Results of Operations addresses our

consolidated financial statements, which have been prepared in accordance with generally accepted accounting

principles in the United States of America (“GAAP”). “Note 2 — Significant Accounting Policies” includes a

summary of the significant accounting policies and methods used in the preparation of our consolidated financial

statements. The preparation of these financial statements requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and the reported amounts of income and

expenses during the reporting periods. Actual results may differ from these estimates under varying assumptions

or conditions. On a quarterly basis, management evaluates its estimates, particularly those that include the most

difficult, subjective or complex judgments and are often about matters that are inherently uncertain. The most

significant judgments, estimates and assumptions relate to the following critical accounting policies that are

discussed in more detail below.

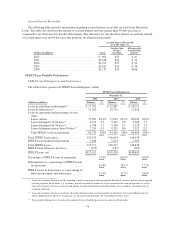

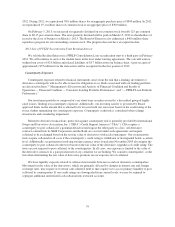

Allowance for Loan Losses

In determining the allowance for loan losses on our non-TDR portfolio, we estimate the principal amount of

loans that will default over the next two years (two years being the expected period between a loss event and

default) and how much we expect to recover over time related to the defaulted amount. Expected defaults less our

expected recoveries equal the allowance related to this portfolio. Our historical experience indicates that, on

average, the time between the date that a customer experiences a default causing event (i.e., the loss trigger

event) and the date that we charge off the unrecoverable portion of that loan is two years. Separately, for our

TDR portfolio, we estimate an allowance amount sufficient to cover life-of-loan expected losses through an

impairment calculation based on the difference between the loan’s basis and the present value of expected future

cash flows (which would include life-of-loan default and recovery assumptions) discounted at the loan’s original

effective interest rate (see “Allowance for Private Education Loan Losses” in “Note 2—Significant Accounting

Policies”). The separate allowance estimates for our TDR and non-TDR portfolios are combined into our total

allowance for Private Education Loan losses.

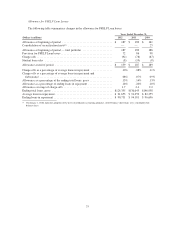

In estimating both the non-TDR and TDR allowance amounts, we start with historical experience of

customer default behavior. We make judgments about which historical period to start with and then make further

judgments about whether that historical experience is representative of future expectations and whether

additional adjustments may be needed to those historical default rates. We also take the economic environment

into consideration when calculating the allowance for loan losses. We analyze key economic statistics and the

effect we expect them to have on future defaults. Key economic statistics analyzed as part of the allowance for

loan losses are unemployment rates and other asset type delinquency rates. More judgment has been required

over the last several years, compared with years prior, in light of the recent downturn in the U.S. economy and

high levels of unemployment and its effect on our customers’ ability to pay their obligations.

Our allowance for loan losses is estimated using an analysis of delinquent and current accounts. Our model

is used to estimate the likelihood that a loan receivable may progress through the various delinquency stages and

ultimately charge off. The evaluation of the allowance for loan losses is inherently subjective, as it requires

material estimates that may be susceptible to significant changes. The estimate for the allowance for loan losses

is subject to a number of assumptions. If actual future performance in delinquency, charge-offs and recoveries

are significantly different than estimated, this could materially affect our estimate of the allowance for loan

losses and the related provision for loan losses on our income statement.

We determine the collectability of our Private Education Loan portfolio by evaluating certain risk

characteristics. We consider school type, credit score (FICO), existence of a cosigner, loan status and loan

seasoning as the key credit quality indicators because they have the most significant effect on our determination

of the adequacy of our allowance for loan losses. The type of school customers attend can have an impact on

83