Sallie Mae 2012 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4. Allowance for Loan Losses (Continued)

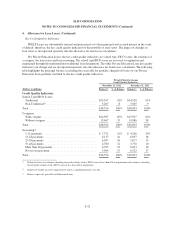

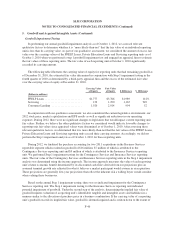

Key Credit Quality Indicators

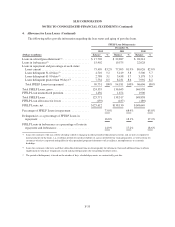

FFELP Loans are substantially insured and guaranteed as to their principal and accrued interest in the event

of default; therefore, the key credit quality indicator for this portfolio is loan status. The impact of changes in

loan status is incorporated quarterly into the allowance for loan losses calculation.

For Private Education Loans, the key credit quality indicators are school type, FICO scores, the existence of

a cosigner, the loan status and loan seasoning. The school type/FICO score are assessed at origination and

maintained through the traditional/non-traditional loan designation. The other Private Education Loan key quality

indicators can change and are incorporated quarterly into the allowance for loan losses calculation. The following

table highlights the principal balance (excluding the receivable for partially charged-off loans) of our Private

Education Loan portfolio stratified by the key credit quality indicators.

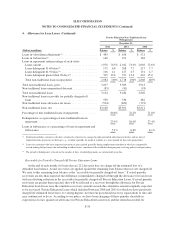

Private Education Loans

Credit Quality Indicators

December 31, 2012 December 31, 2011

(Dollars in millions) Balance(3) % of Balance Balance(3) % of Balance

Credit Quality Indicators

School Type/FICO Scores:

Traditional ........................................ $35,347 92% $34,528 91%

Non-Traditional(1) ................................... 3,207 8 3,565 9

Total ............................................... $38,554 100% $38,093 100%

Cosigners:

With cosigner ...................................... $24,907 65% $23,507 62%

Without cosigner ................................... 13,647 35 14,586 38

Total ............................................... $38,554 100% $38,093 100%

Seasoning(2):

1-12 payments ..................................... $ 7,371 19% $ 9,246 24%

13-24 payments .................................... 6,137 16 6,837 18

25-36 payments .................................... 6,037 16 5,677 15

37-48 payments .................................... 4,780 12 3,778 10

More than 48 payments .............................. 8,325 22 6,033 16

Not yet in repayment ................................ 5,904 15 6,522 17

Total ............................................... $38,554 100% $38,093 100%

(1) Defined as loans to customers attending for-profit schools (with a FICO score of less than 670 at origination) and customers attending

not-for-profit schools (with a FICO score of less than 640 at origination).

(2) Number of months in active repayment for which a scheduled payment was due.

(3) Balance represents gross Private Education Loans.

F-32