Sallie Mae 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Bank’s ability to pay dividends is subject to the laws of Utah and the regulations of the FDIC.

Generally, under Utah’s industrial bank laws and regulations as well as FDIC regulations, the Bank may pay

dividends from its net profits without regulatory approval if, following the payment of the dividend, the Bank’s

capital and surplus would not be impaired. While applicable Utah and FDIC regulations differ in approach as to

determinations of impairment of capital and surplus, neither method of determination has historically required

the Bank to obtain consent to the payment of dividends. For the years ended December 31, 2012, 2011 and 2010,

the Bank paid dividends of $420 million, $100 million and $400 million, respectively.

For further discussion of our various sources of liquidity, such as the ED Conduit Program, the Bank, our

continued access to the ABS market, our asset-backed financing facilities, the lending agreement we entered into

with the FHLB-DM and our issuance of unsecured debt, see “Note 6 — Borrowings.”

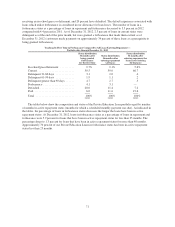

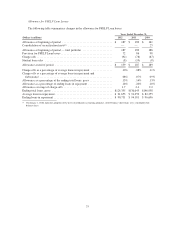

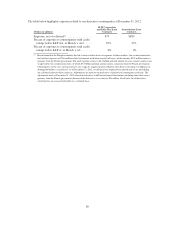

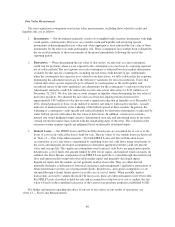

The following table reconciles encumbered and unencumbered assets and their net impact on total tangible

equity.

December 31,

(Dollars in billions) 2012 2011

Net assets of consolidated variable interest entities (encumbered assets)

— FFELP Loans ........................................... $ 6.6 $ 7.4

Net assets of consolidated variable interest entities (encumbered assets)

— Private Education Loans .................................. 6.6 5.5

Tangible unencumbered assets(1) ................................ 21.2 20.2

Unsecured debt .............................................. (26.7) (24.1)

Mark-to-market on unsecured hedged debt(2) ....................... (1.7) (1.9)

Other liabilities, net .......................................... (1.4) (2.3)

Total tangible equity ........................................ $ 4.6 $ 4.8

(1) Excludes goodwill and acquired intangible assets.

(2) At December 31, 2012 and 2011, there were $1.4 billion and $1.6 billion, respectively, of net gains on derivatives hedging

this debt in unencumbered assets, which partially offset these losses.

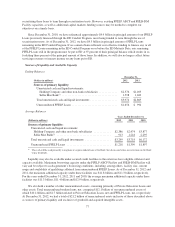

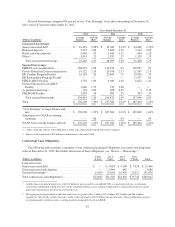

2012 Transactions

On January 13, 2012, the FFELP ABCP Facility was amended to increase the amount available to $7.5

billion, reflecting an increase of $2.5 billion over the previously scheduled facility reduction. In addition, the

amendment extends the final maturity date by one year to January 9, 2015 and increases the amount available at

future step-down dates.

In 2012, we issued $9.7 billion of FFELP ABS in eight separate transactions and $4.2 billion of Private

Education Loan ABS in five separate transactions.

Unsecured Financings:

• January 27, 2012 — issued $1.5 billion senior unsecured debt, consisting of a $750 million five-year term

bond and a $750 million ten-year term bond.

• June 18, 2012 — issued $350 million unsecured debt with an average life of 4.5 years.

• September 12, 2012 — issued an $800 million senior unsecured bond, consisting of a $300 million three-

year term bond and $500 million five-year term bond.

Shareholder Distributions

On January 26, 2012, we increased our quarterly dividend on our common stock to $0.125 per common

share. We paid our quarterly dividend on March 16, 2012, June 15, 2012, September 12, 2012 and December 21,

78