Sallie Mae 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other

Our Other segment primarily consists of activities of our holding company, including the repurchase of

debt, the corporate liquidity portfolio and all overhead. We also include results from smaller wind-down and

discontinued operations within this segment.

Key Financial Measures

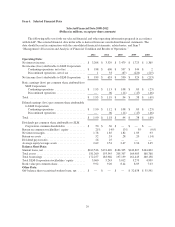

Our operating results are primarily driven by net interest income from our student loan portfolios (which

include financing costs), provision for loan losses, the revenues and expenses generated by our service

businesses, and gains and losses on loan sales and debt repurchases. We manage and assess the performance of

each business segment separately as each is focused on different customers and each derives its revenue from

different activities and services. A brief summary of our key financial measures are listed below.

Net Interest Income

The most significant portion of our earnings is generated by the spread earned between the interest income

we receive on assets in our student loan portfolios and the interest expense on debt funding these loans. We

report these earnings as net interest income. Net interest income in our Consumer Lending and FFELP Loans

segments are driven by significantly different factors.

Consumer Lending Segment

Net interest income in this segment is determined by the balance of Private Education Loans outstanding,

Private Education Loan asset yields (determined by interest rates we establish based upon the credit of the

customer and any cosigner) and the level of price competition in the Private Education Loan market less our cost

of funds. As of December 31, 2012, we had $36.9 billion of Private Education Loans outstanding. In 2012, we

originated $3.3 billion of Private Education Loans, up 22 percent from $2.7 billion in the prior year. The majority

of our Private Education Loans earn variable rate interest and are funded primarily with variable rate liabilities.

The Consumer Lending segment’s “Core Earnings” net interest margin was 4.13 percent in 2012 compared with

4.09 percent in 2011. Our cost of funds can be influenced by a number of factors including the quality of the

loans in our portfolio, our corporate credit rating, general economic conditions, investor demand for Private

Education Loan asset-backed securities (“ABS”) and corporate unsecured debt and competition in the deposit

market. At December 31, 2012, 52 percent of our Private Education Loan portfolio was funded to term with non-

recourse, long-term securitization debt.

FFELP Loans Segment

Net interest income will be the primary source of cash flow generated by this segment over the next 20 years

as this portfolio amortizes. Interest earned on our FFELP Loans is indexed to one-month LIBOR rates and our

cost of funds is primarily indexed to three-month LIBOR, creating the possibility of repricing risk related to these

assets. The FFELP Loans segment’s “Core Earnings” net interest margin was 0.84 percent in 2012 compared

with 0.98 percent in 2011.

The major source of variability in net interest income is expected to be Floor Income we earn on certain

FFELP Loans. Pursuant to the terms of the FFELP, certain FFELP Loans continue to earn interest at the stated

fixed rate of interest as underlying debt costs decrease. We refer to this additional spread income as “Floor

Income.” Floor Income can be volatile. We frequently hedge this volatility by selling Floor Income Contracts

which lock in the value of the Floor Income over the term of the contract.

At December 31, 2012, 82 percent of our FFELP Loan portfolio was funded to term with non-recourse,

long-term securitization debt.

31