Sallie Mae 2012 Annual Report Download - page 78

Download and view the complete annual report

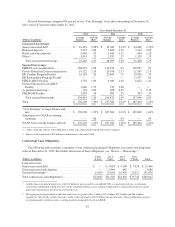

Please find page 78 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity and Capital Resources

Funding and Liquidity Risk Management

The following “Liquidity and Capital Resources” discussion concentrates on our Consumer Lending and

FFELP Loans segments. Our Business Services and Other segments require minimal capital and funding.

We define liquidity risk as the potential inability to meet our obligations when they become due without

incurring unacceptable losses, such as the ability to fund liability maturities and deposit withdrawals, or invest in

future asset growth and business operations at reasonable market rates, as well as the potential inability to fund

Private Education Loan originations. Our three primary liquidity needs include our ongoing ability to meet our

funding needs for our businesses throughout market cycles, including during periods of financial stress and to

avoid any mismatch between the maturity of assets and liabilities, our ongoing ability to fund originations of

Private Education Loans and servicing our indebtedness and bank deposits. To achieve these objectives we

analyze and monitor our liquidity needs, maintain excess liquidity and access diverse funding sources including

the issuance of unsecured debt, the issuance of secured debt primarily through asset backed securitizations and/or

other financing facilities and through deposits at the Bank.

We define liquidity as cash and high-quality liquid securities that we can use to meet our funding

requirements. Our primary liquidity risk relates to our ability to fund new originations and raise replacement

funding at a reasonable cost as our unsecured debt and bank deposits mature. In addition, we must continue to

obtain funding at reasonable rates to meet our other business obligations and to continue to grow our business.

Key risks associated with our liquidity relate to our ability to access the capital markets and bank deposits and

access them at reasonable rates. This ability may be affected by our credit ratings, as well as the overall

availability of funding sources in the marketplace. In addition, credit ratings may be important to customers or

counterparties when we compete in certain markets and when we seek to engage in certain transactions, including

over-the-counter derivatives.

Credit ratings and outlooks are opinions subject to ongoing review by the ratings agencies and may change

from time to time based on our financial performance, industry dynamics and other factors. Other factors that

influence our credit ratings include the ratings agencies’ assessment of the general operating environment, our

relative positions in the markets in which we compete, reputation, liquidity position, the level and volatility of

earnings, corporate governance and risk management policies, capital position and capital management practices. A

negative change in our credit rating could have a negative effect on our liquidity because it would raise the cost and

availability of funding and potentially require additional cash collateral or restrict cash currently held as collateral

on existing borrowings or derivative collateral arrangements. It is our objective to improve our credit ratings so that

we can continue to efficiently access the capital markets even in difficult economic and market conditions.

We expect to fund our ongoing liquidity needs, including the origination of new Private Education Loans

and the repayment of $2.3 billion of senior unsecured notes that mature in the next twelve months, primarily

through our current cash and investment portfolio, the issuance of additional bank deposits and unsecured debt,

the predictable operating cash flows provided by earnings, the repayment of principal on unencumbered student

loan assets and the distributions from our securitization trusts (including servicing fees which are priority

payments within the trusts). We may also draw down on our FFELP ABCP Facilities and the facility with the

Federal Home Loan Bank in Des Moines (the “FHLB-DM Facility”); and we may also issue term ABS.

Currently, new Private Education Loan originations are initially funded through deposits and subsequently

securitized to term. We have $1.6 billion of cash at the Bank as of December 31, 2012 available to fund future

originations. We no longer originate FFELP Loans and therefore no longer have liquidity requirements for new

FFELP Loan originations.

We will continue to opportunistically purchase FFELP Loan portfolios from others. Additionally, we still

expect to redeem all remaining FFELP Loans we currently finance in the ED Conduit Program on or before the

program’s anticipated January 19, 2014, maturity date (the “ED Maturity Date”). We plan to rely primarily on

76