Sallie Mae 2012 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

F-59

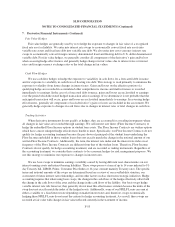

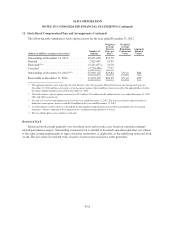

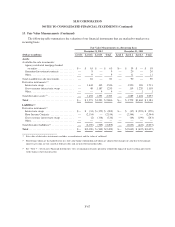

10. Earnings (Loss) per Common Share

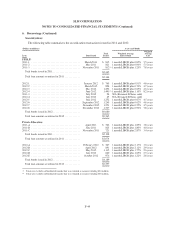

Basic earnings (loss) per common share (“EPS”) are calculated using the weighted average number of

shares of common stock outstanding during each period. A reconciliation of the numerators and denominators of

the basic and diluted EPS calculations follows.

Years Ended December 31,

(In millions, except per share data) 2012 2011 2010

Numerator:

Net income attributable to SLM Corporation ................................... $939 $633 $530

Preferred stock dividends ................................................... 20 18 72

Net income attributable to SLM Corporation common stock ....................... $919 $615 $458

Denominator:

Weighted average shares used to compute basic EPS ............................. 476 517 487

Effect of dilutive securities:

Dilutive effect of stock options, non-vested deferred compensation and restricted

stock, restricted stock units and Employee Stock Purchase Plan (“ESPP”)(1) .......761

Dilutive potential common shares(2) ...........................................761

Weighted average shares used to compute diluted EPS ............................ 483 523 488

Basic earnings (loss) per common share attributable to SLM Corporation:

Continuing operations ..................................................... $1.93 $1.13 $1.08

Discontinued operations .................................................... — .06 (.14)

Total ................................................................... $1.93 $1.19 $ .94

Diluted earnings (loss) per common share attributable to SLM Corporation:

Continuing operations ..................................................... $1.90 $1.12 $1.08

Discontinued operations .................................................... — .06 (.14)

Total ................................................................... $1.90 $1.18 $ .94

(1) Includes the potential dilutive effect of additional common shares that are issuable upon exercise of outstanding stock options, non-vested

deferred compensation and restricted stock, restricted stock units, and the outstanding commitment to issue shares under the ESPP,

determined by the treasury stock method.

(2) For the years ended December 31, 2012, 2011 and 2010, securities covering approximately 12 million, 16 million and 15 million shares,

respectively, were outstanding but not included in the computation of diluted earnings per share because they were anti-dilutive.

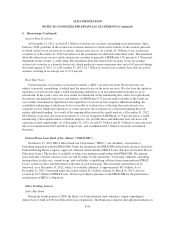

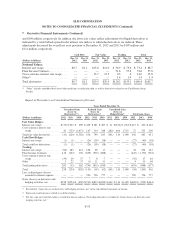

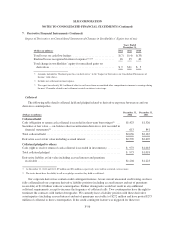

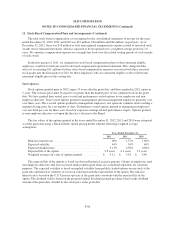

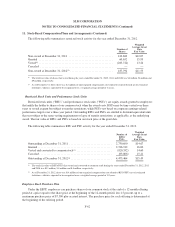

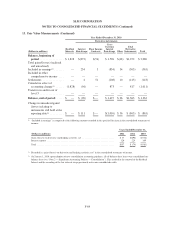

11. Stock-Based Compensation Plans and Arrangements

As of December 31, 2012, we have one active stock-based compensation plan that provides for grants of

equity awards to our employees and non-employee directors. We also maintain the ESPP. Shares issued under

these stock-based compensation plans may be either shares reacquired by us or shares that are authorized but

unissued.

Our SLM Corporation 2012 Omnibus Incentive Plan was approved by shareholders on May 24, 2012. At

December 31, 2012, 20 million shares were authorized to be issued from this plan.

An amendment to our ESPP was approved by our shareholders on May 24, 2012 that authorized the

issuance of 6 million shares under the plan and kept the terms of the plan substantially the same.