Sallie Mae 2012 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

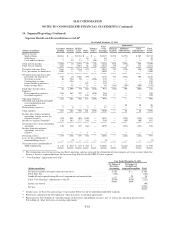

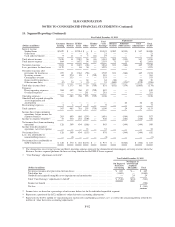

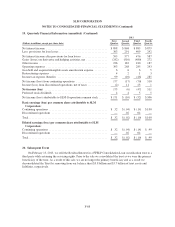

19. Quarterly Financial Information (unaudited) (Continued)

2011

(Dollars in millions, except per share data)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Net interest income ........................................... $898 $868 $885 $879

Less: provisions for loan losses .................................. 303 291 409 292

Net interest income after provisions for loan losses .................. 595 577 476 587

Gains (losses) on derivative and hedging activities, net ............... (242) (510) (480) 272

Other income ................................................ 236 182 180 187

Operating expenses ........................................... 303 268 285 243

Goodwill and acquired intangible assets amortization expense ......... 6 6 6 5

Restructuring expenses ........................................ 4 2 1 3

Income tax expense (benefit) ................................... 99 (10) (46) 285

Net income (loss) from continuing operations ...................... 177 (17) (70) 510

Income (loss) from discontinued operations, net of taxes .............. (2) 11 23 1

Net income (loss) ............................................ 175 (6) (47) 511

Preferred stock dividends ...................................... 4 4 5 5

Net income (loss) attributable to SLM Corporation common stock ...... $171 $ (10) $ (52) $ 506

Basic earnings (loss) per common share attributable to SLM

Corporation:

Continuing operations ......................................... $ .32 $(.04) $ (.14) $1.00

Discontinued operations ....................................... — .02 .04 —

Total ....................................................... $ .32 $(.02) $ (.10) $1.00

Diluted earnings (loss) per common share attributable to SLM

Corporation:

Continuing operations ......................................... $ .32 $(.04) $ (.14) $ .99

Discontinued operations ....................................... — .02 .04 —

Total ....................................................... $ .32 $(.02) $ (.10) $ .99

20. Subsequent Event

On February 13, 2013, we sold the Residual Interest in a FFELP Consolidation Loan securitization trust to a

third party while retaining the servicing rights. Prior to the sale we consolidated the trust as we were the primary

beneficiary of the trust. As a result of this sale, we are no longer the primary beneficiary and as a result we

deconsolidated the Trust by removing from our balance sheet $3.8 billion and $3.7 billion of trust assets and

liabilities, respectively.

F-88