Sallie Mae 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

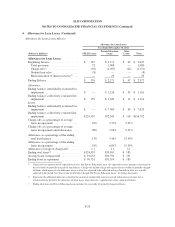

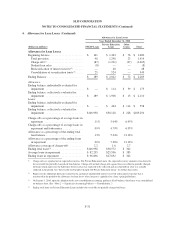

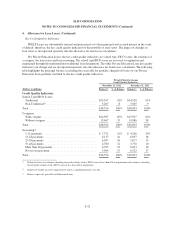

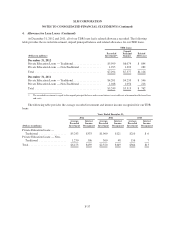

3. Student Loans (Continued)

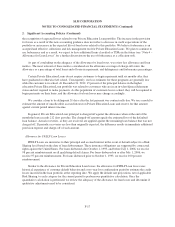

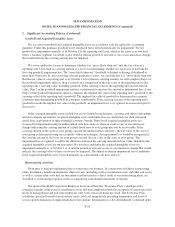

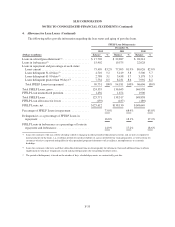

The estimated weighted average life of student loans in our portfolio was approximately 8.0 years and 7.6

years at December 31, 2012 and 2011, respectively. The following table reflects the distribution of our student

loan portfolio by program.

December 31,

2012

Year Ended

December 31, 2012

(Dollars in millions)

Ending

Balance

%of

Balance

Average

Balance

Average

Effective

Interest

Rate

FFELP Stafford and Other Student Loans, net(1) ................. $ 44,289 27% $ 47,629 1.98%

FFELP Consolidation Loans, net ............................. 81,323 50 84,495 2.73

Private Education Loans, net ................................ 36,934 23 37,691 6.58

Total student loans, net ..................................... $162,546 100% $169,815 3.38%

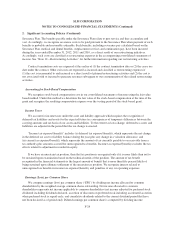

December 31,

2011

Year Ended

December 31, 2011

(Dollars in millions)

Ending

Balance

%of

Balance

Average

Balance

Average

Effective

Interest

Rate

FFELP Stafford and Other Student Loans, net(1) ................. $ 50,440 29% $ 53,163 1.92%

FFELP Consolidation Loans, net ............................. 87,690 50 89,946 2.71

Private Education Loans, net ................................ 36,290 21 36,955 6.57

Total student loans, net ..................................... $174,420 100% $180,064 3.27%

(1) The FFELP category is primarily Stafford Loans, but also includes federally guaranteed PLUS and HEAL Loans.

As of December 31, 2012 and 2011, 75 percent and 71 percent, respectively, of our student loan portfolio

was in repayment.

Loan Acquisitions and Sales

In 2010, we sold to ED approximately $20.4 billion face amount of loans as part of the Purchase Program.

These loan sales resulted in a $321 million gain. Outstanding debt of $20.3 billion has been paid down related to

the Participation Program in connection with these loan sales. See Note 6, “Borrowings” for a discussion of the

ED Purchase and Participation Programs.

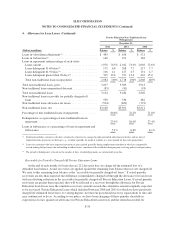

Certain Collection Tools — Private Education Loans

Forbearance involves granting the customer a temporary cessation of payments (or temporary acceptance of

smaller than scheduled payments) for a specified period of time. Using forbearance extends the original term of

the loan. Forbearance does not grant any reduction in the total repayment obligation (principal or interest). While

in forbearance status, interest continues to accrue and is capitalized to principal when the loan re-enters

repayment status. Our forbearance policies include limits on the number of forbearance months granted

consecutively and the total number of forbearance months granted over the life of the loan. In some instances, we

require good-faith payments before granting forbearance. Exceptions to forbearance policies are permitted when

such exceptions are judged to increase the likelihood of collection of the loan. Forbearance as a collection tool is

F-27