Sallie Mae 2012 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

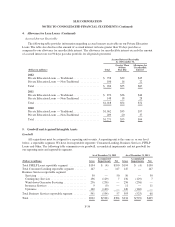

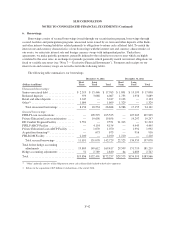

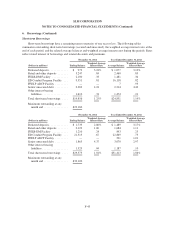

6. Borrowings (Continued)

Securitizations

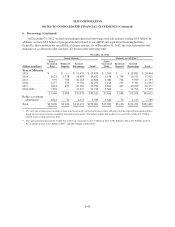

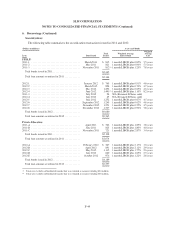

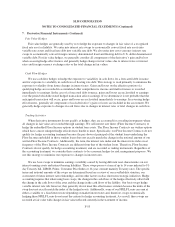

The following table summarizes the securitization transactions issued in 2011 and 2012.

(Dollars in millions) AAA-rated bonds

Issue Date Issued

Total

Issued

Weighted Average

Interest Rate

Weighted

Average

Life

FFELP:

2011-1 ...................................... March 2011 $ 812 1 month LIBOR plus 0.85% 5.5 years

2011-2 ...................................... May2011 821 1 month LIBOR plus 0.90% 5.5 years

2011-3 ...................................... November 2011 812(1) 1 month LIBOR plus 1.25% 7.8 years

Total bonds issued in 2011 ..................... $2,445

Total loan amount securitized in 2011 ............ $2,344

2012-1 ...................................... January 2012 $ 765 1 month LIBOR plus 0.91% 4.6 years

2012-2 ...................................... March 2012 824 1 month LIBOR plus 0.70% 4.7 years

2012-3 ...................................... May2012 1,252 1 month LIBOR plus 0.65% 4.6 years

2012-4 ...................................... June 2012 1,491(2) 1 month LIBOR plus 1.10% 8.2 years

2011-3 ...................................... July 2012 24 N/A (Retained B Notes sold)

2012-4 ...................................... July 2012 45 N/A (Retained B Notes sold)

2012-5 ...................................... July 2012 1,252 1 month LIBOR plus 0.67% 4.5 years

2012-6 ...................................... September 2012 1,249 1 month LIBOR plus 0.62% 4.6 years

2012-7 ...................................... November 2012 1,251 1 month LIBOR plus 0.55% 4.5 years

2012-8 ...................................... December 2012 1,527 1 month LIBOR plus 0.90% 7.8 years

Total bonds issued in 2012 ..................... $9,680

Total loan amount securitized in 2012 ............ $9,565

Private Education:

2011-A ...................................... April 2011 $ 562 1 month LIBOR plus 1.89% 3.8 years

2011-B ...................................... June 2011 825 1 month LIBOR plus 1.80% 4.0 years

2011-C ...................................... November 2011 721 1 month LIBOR plus 2.87% 3.4 years

Total bonds issued in 2011 ..................... $2,108

Total loan amount securitized in 2011 ............ $2,674

2012-A ...................................... February 2012 $ 547 1 month LIBOR plus 2.17% 3.0 years

2012-B ...................................... April 2012 891 1 month LIBOR plus 2.12% 2.9 years

2012-C ...................................... May2012 1,135 1 month LIBOR plus 1.77% 2.6 years

2012-D ...................................... July 2012 640 1 month LIBOR plus 1.69% 2.5 years

2012-E ...................................... October 2012 976 1 month LIBOR plus 1.22% 2.6 years

Total bonds issued in 2012 ..................... $4,189

Total loan amount securitized in 2012 ............ $5,557

(1) Total size excludes subordinated tranche that was retained at issuance totaling $24 million.

(2) Total size excludes subordinated tranche that was retained at issuance totaling $45 million.

F-49