Sallie Mae 2012 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207

|

|

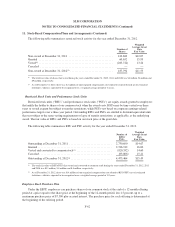

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

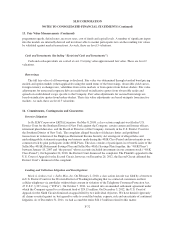

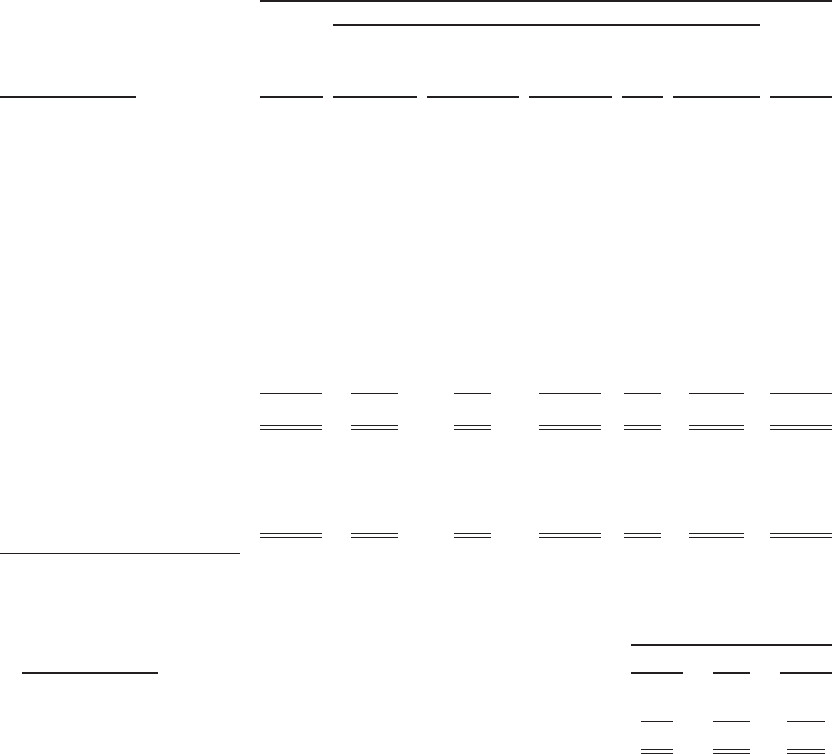

13. Fair Value Measurements (Continued)

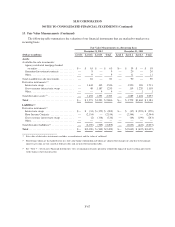

Year Ended December 31, 2010

Derivative instruments

(Dollars in millions)

Residual

Interests

Interest

Rate Swaps

Floor Income

Contracts

Cross

Currency

Interest

Rate Swaps Other

Total

Derivative

Instruments Total

Balance, beginning of

period ................. $1,828 $(272) $(54) $ 1,596 $(18) $1,252 $ 3,080

Total gains/(losses) (realized

and unrealized):

Included in earnings(1) ....... — 234 3 (834) 34 (563) (563)

Included in other

comprehensive income .... — — — — — — —

Settlements ............... — 4 51 (208) 10 (143) (143)

Cumulative effect of

accounting change(3 ) ...... (1,828) (56) — 873 — 817 (1,011)

Transfers in and/or out of

level 3 ................. — — — — — — —

Balance, end of period ..... $ — $ (90) $ — $ 1,427 $ 26 $1,363 $ 1,363

Change in unrealized gains/

(losses) relating to

instruments still held at the

reporting date(2) .......... $ — $111 $— $(1,010) $ 36 $ (863) $ (863)

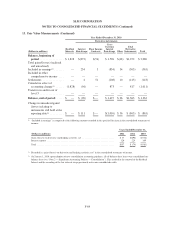

(1) “Included in earnings” is comprised of the following amounts recorded in the specified line item in the consolidated statements of

income:

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

Gains (losses) on derivative and hedging activities, net ............................ $ 37 $(298) $(732)

Interest expense ........................................................... 120 224 169

Total .................................................................... $157 $ (74) $(563)

(2) Recorded in “gains (losses) on derivative and hedging activities, net” in the consolidated statements of income.

(3) On January 1, 2010, upon adoption of new consolidation accounting guidance, all off-balance sheet loans were consolidated on-

balance sheet (see “Note 2 — Significant Accounting Policies — Consolidation”). This resulted in the removal of the Residual

Interest and the recording of the fair value of swaps previously not in our consolidated results.

F-69