Sallie Mae 2012 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

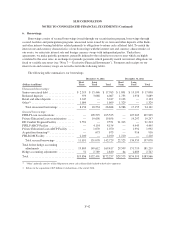

5. Goodwill and Acquired Intangible Assets (Continued)

the difference. In conjunction with the second step of the impairment analysis, the $9 million of goodwill

attributed to this reporting unit was fully impaired.

Continued weakness in the economy coupled with changes in legislation could adversely affect the

operating results of our reporting units. If the forecasted performance of our reporting units is not achieved, or if

our stock price declines to a depressed level resulting in deterioration in our total market capitalization, the fair

value of the FFELP Loans, Servicing, Private Education Loans and Contingency Services reporting units could

be significantly reduced, and we may be required to record a charge to our earnings, which could be material, for

an impairment of goodwill.

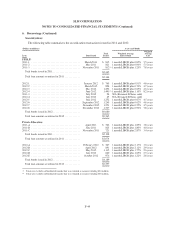

Acquired Intangible Assets

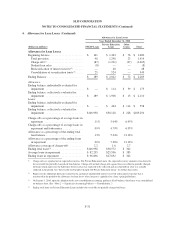

Acquired intangible assets include the following:

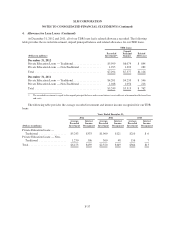

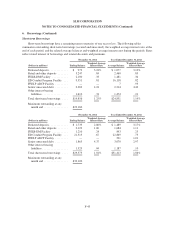

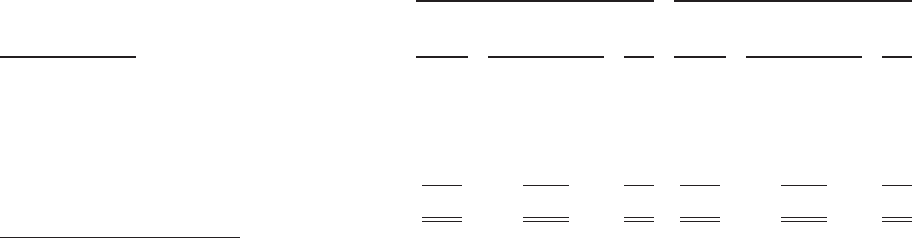

As of December 31, 2012 As of December 31, 2011

(Dollars in millions)

Cost

Basis(1)

Accumulated

Impairment and

Amortization(1) Net

Cost

Basis(1)

Accumulated

Impairment and

Amortization(1) Net

Intangible assets subject to amortization:

Customer, services and lending

relationships ......................... $303 $(270) $33 $303 $(253) $50

Software and technology ................. 93 (93) — 93 (93) —

Trade names and trademarks .............. 54 (34) 20 54 (31) 23

Total acquired intangible assets .............. $450 $(397) $53 $450 $(377) $73

(1) Accumulated impairment and amortization includes impairment amounts only if the acquired intangible asset has been deemed partially

impaired. When an acquired intangible asset is considered fully impaired, and no longer in use, the cost basis and any accumulated

amortization related to the asset is written off.

(2) Intangible assets not subject to amortization include tradenames and trademarks totaling $10 million, net of accumulated impairment and

amortization.

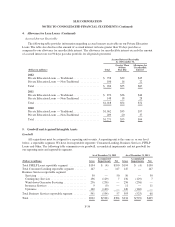

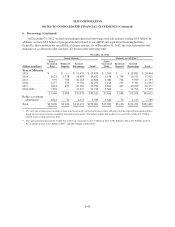

We recorded amortization of acquired intangible assets totaling $19 million, $24 million, and $39 million

for the years ended December 31, 2012, 2011 and 2010, respectively. We will continue to amortize our intangible

assets with definite useful lives over their remaining estimated useful lives. We estimate amortization expense

associated with these intangible assets will be $15 million, $12 million, $9 million, $5 million and $2 million for

the years ended December 31, 2013, 2014, 2015, 2016 and 2017, respectively.

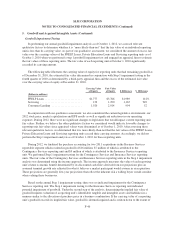

As discussed in “Note 2 — Significant Accounting Policies,” we test our indefinite life intangible assets

annually as of October 1 or during the course of the year if an event occurs or circumstances change which

indicate potential impairment of these assets. As of October 1, 2012, the fair values of the indefinite life

intangible assets exceed their carrying values. Accordingly, we recorded no impairment. We also assess whether

an event or circumstance has occurred which may indicate impairment of our definite life (amortizing) intangible

assets quarterly. During 2012, no such events or circumstances occurred that indicated our definite life intangible

assets may be impaired.

F-41