Sallie Mae 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

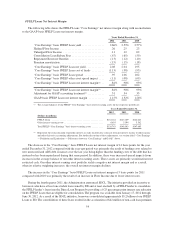

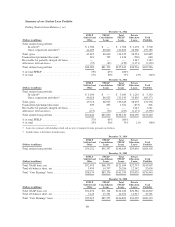

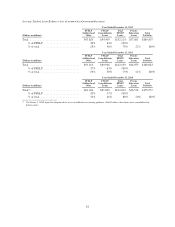

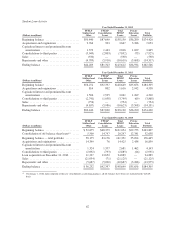

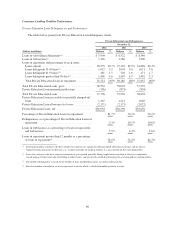

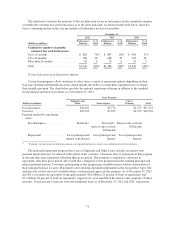

GAAP Basis

December 31, 2009 December 31, 2008

(Dollars in millions)

FFELP

Loans

Private

Education

Loans

Total

Portfolio

FFELP

Loans

Private

Education

Loans

Total

Portfolio

GAAP Basis:

Beginning balance ........................... $138 $1,308 $1,446 $ 89 $1,004 $1,093

Less:

Charge-offs(1) ............................. (79) (876) (955) (58) (320) (378)

Student loan sales .......................... (4) — (4) 1 — 1

Plus:

Provision for loan losses ..................... 106 967 1,073 106 586 692

Reclassification of interest reserve(2) ........... — 44 44 — 38 38

Ending balance .............................. $161 $1,443 $1,604 $138 $1,308 $1,446

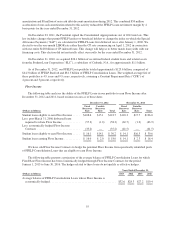

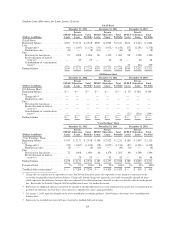

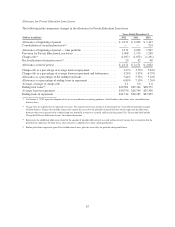

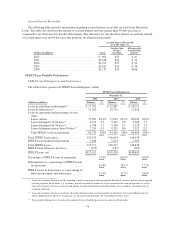

Off-Balance Sheet

December 31, 2009 December 31, 2008

(Dollars in millions)

FFELP

Loans

Private

Education

Loans

Total

Portfolio

FFELP

Loans

Private

Education

Loans

Total

Portfolio

Off-Balance Sheet:

Beginning balance ........................... $ 27 $505 $532 $ 29 $362 $391

Less:

Charge-offs(1) ............................. (15) (423) (438) (21) (153) (174)

Student loan sales .......................... — — — (2) — (2)

Plus:

Provision for loan losses ..................... 13 432 445 21 288 309

Reclassification of interest reserve(2) ........... — 10 10 — 8 8

Ending balance .............................. $ 25 $524 $549 $ 27 $505 $532

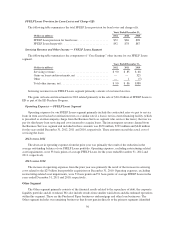

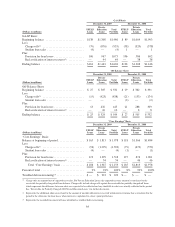

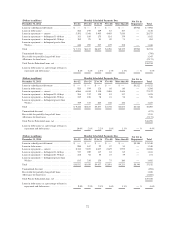

“Core Earnings” Basis

December 31, 2009 December 31, 2008

(Dollars in millions)

FFELP

Loans

Private

Education

Loans

Total

Portfolio

FFELP

Loans

Private

Education

Loans

Total

Portfolio

“Core Earnings” Basis:

Balance at beginning of period .................. $165 $1,813 $ 1,978 $ 118 $1,366 $1,484

Less:

Charge-offs(1) ............................. (94) (1,299) (1,393) (79) (473) (552)

Student loan sales .......................... (4) — (4) (1) — (1)

Plus:

Provision for loan losses ..................... 119 1,399 1,518 127 874 1,001

Reclassification of interest reserve(2) ........... — 54 54 — 46 46

Total “Core Earnings” basis ................ $186 $1,967 $ 2,153 $ 165 $1,813 $1,978

Percent of total .............................. 9% 91% 100% 8% 92% 100%

Troubled debt restructuring(3) ................... $— $ 223 $ 223 $— $ — $ —

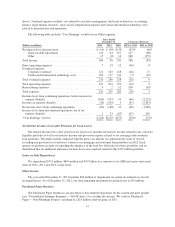

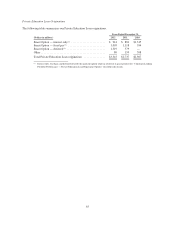

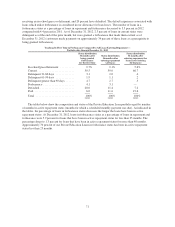

(1) Charge-offs are reported net of expected recoveries. For Private Education Loans, the expected recovery amount is transferred to the

receivable for partially charged-off loan balance. Charge-offs include charge-offs against the receivable for partially charged-off loans

which represents the difference between what was expected to be collected and any shortfalls in what was actually collected in the period.

See “Receivable for Partially Charged-Off Private Education Loans” for further discussion.

(2) Represents the additional allowance related to the amount of uncollectible interest reserved within interest income that is transferred in the

period to the allowance for loan losses when interest is capitalized to a loan’s principal balance.

(3) Represents the recorded investment of loans identified as troubled debt restructuring.

64