Sallie Mae 2012 Annual Report Download - page 81

Download and view the complete annual report

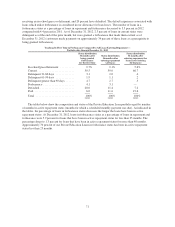

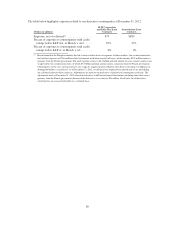

Please find page 81 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2012. During 2012, we repurchased 58.0 million shares for an aggregate purchase price of $900 million. In 2011,

we repurchased 19.1 million shares of common stock at an aggregate price of $300 million.

On February 5, 2013, we increased our quarterly dividend on our common stock from $0.125 per common

share to $0.15 per common share. The next quarterly dividend will be paid on March 15, 2013 to shareholders of

record at the close of business on March 1, 2013. The Board of Directors also authorized a $400 million share

repurchase program for our outstanding common stock. The program does not have an expiration date.

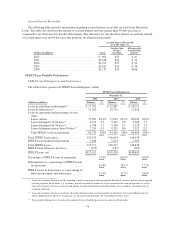

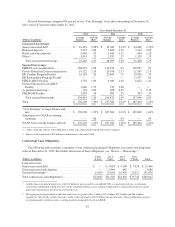

2013 Sale of FFELP Securitization Trust Residual Interest

We sold the Residual Interest in a FFELP Consolidation Loan securitization trust to a third party in February

2013. We will continue to service the student loans in the trust under existing agreements. The sale will remove

student loan assets of $3.8 billion and related liabilities of $3.7 billion from our balance sheet. A pre-tax gain of

approximately $55 million from the transaction will be recognized in the first quarter of 2013.

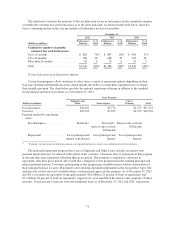

Counterparty Exposure

Counterparty exposure related to financial instruments arises from the risk that a lending, investment or

derivative counterparty will not be able to meet its obligations to us. Risks associated with our lending portfolio

are discussed in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of

Operations — Financial Condition — Consumer Lending Portfolio Performance” and “— FFELP Loan Portfolio

Performance.”

Our investment portfolio is composed of very short-term securities issued by a diversified group of highly

rated issuers, limiting our counterparty exposure. Additionally, our investing activity is governed by Board

approved limits on the amount that is allowed to be invested with any one issuer based on the credit rating of the

issuer, further minimizing our counterparty exposure. Counterparty credit risk is considered when valuing

investments and considering impairment.

Related to derivative transactions, protection against counterparty risk is generally provided by International

Swaps and Derivatives Association, Inc. (“ISDA”) Credit Support Annexes (“CSAs”). CSAs require a

counterparty to post collateral if a potential default would expose the other party to a loss. All derivative

contracts entered into by SLM Corporation and the Bank are covered under such agreements and require

collateral to be exchanged based on the net fair value of derivatives with each counterparty. Our securitization

trusts require collateral in all cases if the counterparty’s credit rating is withdrawn or downgraded below a certain

level. Additionally, securitizations involving foreign currency notes issued after November 2005 also require the

counterparty to post collateral to the trust based on the fair value of the derivative, regardless of credit rating. The

trusts are not required to post collateral to the counterparties. In all cases, our exposure is limited to the value of

the derivative contracts in a gain position net of any collateral we are holding. We consider counterparties’ credit

risk when determining the fair value of derivative positions on our exposure net of collateral.

We have liquidity exposure related to collateral movements between us and our derivative counterparties.

Movements in the value of the derivatives, which are primarily affected by changes in interest rate and foreign

exchange rates, may require us to return cash collateral held or may require us to access primary liquidity to post

collateral to counterparties. If our credit ratings are downgraded from current levels, we may be required to

segregate additional unrestricted cash collateral into restricted accounts.

79